Stock Market, Gold Outlook for 2017

Stock-Markets / Financial Markets 2017 Jan 04, 2017 - 11:50 AM GMTBy: The_Gold_Report

Precious metals expert Michael Ballanger reflects on how events of 2016 affected the markets, and lays out his strategy for 2017, which includes diamonds and uranium.

Precious metals expert Michael Ballanger reflects on how events of 2016 affected the markets, and lays out his strategy for 2017, which includes diamonds and uranium.

One of the most bothersome peccadillos of the advisory community, be it emanations from home computer blogs or the Ivory Towers of Wall Street, is the annoying tendency to accentuate good calls and understate bad ones.

Confusion, diffusion, and illusion . . .

Take Dennis Gartman. The Zerohedge community is constantly laughing at his mistakes while ridiculing him for every single trading error and roasting his every slip-up by taking his trading comments out of context. Let us not forget that The Gartman Letter is a commodity trading letter and his subscribers are trained to look at a "long-term trade," as one that lasts as long as a) it is working, b) markets are open, or c) until one has to go to the men's room. So when he says that he is "getting very short of stocks," it means that he is already short and probably out either by way of stop-loss or by way of a decent "trade" going into the close.

And yet, as DG gets pilloried every time he opens his mouth, I find him extremely articulate and, in fact and fiction, quite entertaining as he adds a touch of wit and self-deprecation to the world of TV financial news coverage and is a far more ingratiating person to whom to listen rather than Canadian Shark Tank megalomaniac money guy Kevin O’Leary or the vast majority of the gold bugs.

In other words, it is all relative. When I listen to podcasts or interviews or commentaries from industry "experts," I always try to cut through those peccadillos that are derived from a facial feature or a method of speech or an overdone make-up job and instead focus on the actual message contained and in the same spirit, you should do the same with what I write as well. Being a "humorist" does not necessarily qualify me as a "guru" and nobody knows that better than me, my spouse, my banker, and my dog (should I ever be able to find him again).

Last year, when I wrote the 2016 Forecast Issue, I did so with an incredible sense of relief.

I was relieved that the most debilitating, depressing and dastardly bear market in the history of the precious metals markets was coming to an end and I wrote that in the Dec. 4 issue of "Gold and Gold Miners," where I pounded the table with both fists exclaiming to all that were (still) listening that "I am long the GDXJ (again—after being stopped out three times at great loss and anguish to Fido) and am delighted to see it creeping ahead."

On Jan. 5, I cancelled my 10% stop-loss and on Jan. 19 of this soon-to-be-ended year, I watched the GDXJ hit a new low, despite gold trading $30 higher than its Dec. 4 low. In a punctuative act of frustration and remorse, not only did I not jettison the GDXJ position, with ample fortification of painkillers and high-quality bourbon, I doubled down that very day and by the end of January, I was long the core from $19.32 and the margined stock from $17.38, and was sitting with an incredible Feb. 19 close of $23.44. Immediately resisting the temptation of doing the Kevin O’Leary victory lap, I elected to stay muted while watching all of the gold "gurus" climb back onto the Golden Bandwagon while claiming that they had "called the bottom."

The reason I resist the testosterone-enhancing lure of media adulation is that as much as it is a wonderful narcotic for the wounded soul, it is also very much like Frodo's "magic ring" in that, while saving his life on numerous occasion, it could easily have had the poor Hobbit to living his days out as a subterranean Gollum-ite addicted to the "Magic of the Ring," which, in our world, is tantamount to Joe Granville End Days.

So despite the fact that my actual gold portfolio, constructed in late 2015, has had a great year, it would have had an even better year if I’d taken my advice and hedged it in July with the Large Speculators at +340,000 contracts, versus Commercials short an equal amount. I did not follow my own trading advice and I took a few hits in the latter half of 2016—not big hits, but just enough to annoy me. The lesson I learned this year is just one of many I continue to learn after 40 years in the space: Trust the Commercials—they do not lose. (And listen to my own advice.)

Alas, here in very late 2016, it is not going to be easy to formulate a coherent investment plan for 2017 because of two very fundamental problems:

1. The issues surrounding intervention, manipulation and fraud have not been dealt with, and

2. Donald Trump

These two problems are actually anything but "mutually exclusive," because on the topic of Point 2, DJT and his Band of Merry Men, while certainly not archers and swordsmen, are most certainly billionaire "Swamp Creatures of the Black Lagoon" vintage.

If you were watching (as I was) the recent American election campaign, you would most certainly come away with the mistaken idea that with a mere twenty-five days until Inauguration, we might be seeing some "Swamp Drainers" arriving into the Donald's Cabinet. Well, we are not. What that means is that Point 1, covering "the issues surrounding intervention, manipulation, and fraud," are vulnerable to false hope and questionable intent and, to a greater degree, total collective losses of stock market advances and currency volatility.

When stocks wake up to the fact that all 2016 accomplished gains were the product of massive Wall Street interventions of the absolute highest order, based upon wishes of the elites, it is only then that we ignorant plebes can truly see the picture, unclouded by CNN or CNBC or BBC or CBC. All of the "information" we receive via the MSM ("MainStreamMedia") can only be therefore rendered moot. Or, more sadly, ineffectual. Or even more than sadly ineffectual—how about lame. . .

Applying bullet points to this 2017 Forecast Issue, I shall try to describe in detail the confusion, diffusion and illusion of the current state of global capital markets.

• Confusion: To state that "confusion reigns" over the world's money markets these days is an understatement taken to the point of hyperbole. With debt-GDP levels soaring around the world, managers have flocked en masse to stocks as a prudent replacement for bonds due to three factors: 1) Interest rate directional risk, 2) sovereign risk, and 3) geopolitical risk. In "Modern Portfolio Theory," all stock valuations are measured against the risk-free return, which is normally the U.S. three-month treasury bill (currently at .536%), so it cannot be that difficult to determine that with inflation at 1.7% (according to government figures), stocks with dividend yields in the 2% range appear to be a better proxy for fixed income portfolio allocations that would bills, or even the two-year at 1.28%.

Here is where the confusion starts: if stocks led by the financials (and primarily Goldman, the Vampire Squid for the Dow Jones Industrials) have decided to add 10% since the election against the 10-year yield, which has since doubled since early 2016, what is happening to stock valuations? If you are a purist, as am I, you have to believe that stocks are overvalued based upon simple modern portfolio theory. However, stocks continue to rise and this, for many, is confusing.

• Diffusion: This is defined as "the net movement of molecules or atoms from a region of high concentration to a region of low concentration," but I use the term in defining investor sentiment for stocks, gold and bonds.

In the beginning if 2016, there were a preponderance of gold bears and stock bulls, but as January progressed, global geopolitical events gradually diffused these concentrations. In July 2016, the gold market was saturated, with massive concentrations of gold bulls, but thanks to the efforts of commercial traders and the bullion bank behemoths, that bullishness underwent mass diffusion of sentiment. In November 2016, stock market "gurus" all pointed to financial Armageddon in the event of a Trump victory; by the wee hours of the morning on November 9, despite a Trump victory, the terror conveyed by an 800-point drop in the Dow and a $100 up-move in gold underwent an interventionalist-triggered diffusion of its own reversing all stock losses and gold gains. All of the collective wisdom of the Wall Street "strategists" was rendered completely and thoroughly useless when measured against the financial muscle of the elite-controlled banks, both Central and money-center, for whom there is no more important a process than. . .

• Illusion: "A deceptive appearance or impression" is precisely the tool used constantly by the powers that be to dumb-down the masses, which includes the majority of Wall Street analysts and money managers, into a state of total receptivity to subliminal messaging and suggestion. There is no better illustration of the Power of Illusion than in the weeks leading up to the U.S. elections.

In the chart above, you can see how the mainstream media joined in a chorus of negative outcome in the event of a DJT victory. This was the consistent message delivered by the financial news media in the same way that the UK financial media tried to frighten the voters into voting against Brexit.

However, in the U.S., the accumulation of stocks was done quietly and carefully during the period in which the Trump Machine began to close the gap as investors watching the polls had swallowed the illusion that a Trump victory was going to cause an immediate 10% crash in stocks. No better way to illustrate that point than to observe the action in gold and the S&P futures as the results began to arrive on the faces of horrified CNBC news anchors. Shortly after midnight, it was like the point in "Trading Places" where Eddie Murphy keeps asking Dan Aykroyd, "Now, Winthorpe? Now?" in reference to whether they should cover their OJ shorts after a huge spike down. The powers that be, after creating mass confusion through mass illusion, then lowered the boom on the gold and stock markets and the rest, as they say, is history.

Confuse them into action, diffuse sentiment through constant intervention and MSM "reporting," and finally, use illusion to create the "set-up." Brilliantly planned, masterfully played, and artfully executed, the money taken out of the Wall Street casino in late 2016 by the elites who control the banks (and therefore policy through the CBs) was hedonistic, criminal and obscene. Commercial traders run by the bullion banks and backstopped by central banks around the world sold over 36 million ounces of phony, synthetic gold by way of the Crimex, during which time the big players like Stanley Druckenmiller and Ray Dallio pledged allegiance to gold and sucked in the Large Specs including hedge, funds, technical funds and other generalist commodity funds, creating the large aggregate long position in Crimex history.

And just who are the investors in these funds? John Q. Public—perhaps not Joe Sixpack or Barney Fife, but it sure isn't Carl Icahn, who smugly remarked the morning after the election that he has bought the S&P futures the night before, followed by Stanley Druckenmiller, who confessed that he sold all of his gold position the night before.

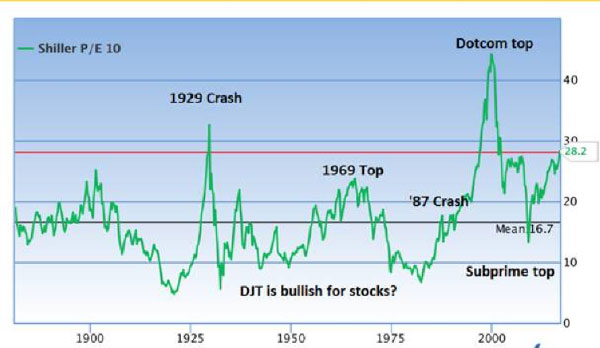

And then, one by one, all of the CNBC "guest commentators" were trotted out to take the television and YouTube pulpits to begin the "Sermon on the Trump," as to just how and why this massive swamp-draining exercise was bullish for the stock market, which currently resides at a Case-Shiller P/E of the historically-nosebleed level of 28.1.

You can decide for yourself whether or not you want to "get in the game, " and start enriching yourselves by listening to all of the Fast Money traders on CNBC boasting about how fast they reacted to the Trump victory and are now sailing ahead completely in-sync with the rally. But I guarantee that they are now completely at the diffusion point, as the last man standing at the Wall Street trough has now been encircled and entrapped. But enough of stocks and this travesty called Wall Street; if you own stocks in today's world, you are the patsy at the poker table.

As for gold and gold miners. . .

I look back at 2016 with a large dollop of mixed emotions. As mentioned earlier, my greatest regret was not sticking completely to my analytical guns and by listening to the gold and silver bugs that denounced my midyear concerns about the sharp rise in commercial shorting.

I recall one former client shouting, "Screw the Commercials!" in a violently capitalized email and thinking, "He will need a case of Prep H for Christmas." And sure enough, the silence from the gold perma-bull camp has become deafening. I write this not to gloat, but more to underscore the extreme difficulty of forecasting in today's world. To quote a phrase now legendary among the free-market thinkers like me, and coined by GATA cofounder Chris Powell, "There are no free markets anymore; there are only interventions."

Yet, despite that, my #1 pick for the year last year, the Junior Gold Miners ETF (GDXJ), looks poised to close out the year up over 60%, versus the S&P 500 up 11%. Gold bullion resides at the bottom of the chart with a 7.3% advance after being up 30% in July. Needless to say, I go into 2017 long the GDXJ through calls established in mid-November, which represent about 5% of my total maximum GDXJ dollar exposure at the peak in July. I will undoubtedly add in January, but I have a rule, and that is to wait until the 15th in order to see the lay of the land.

In 2017, I plan to diversify into more into the uranium names and to return to the world of gem-quality diamonds after a near-20-year absence. This decision is not to be construed as a waning of bullish conviction toward precious metals, but more of a need to avoid the massive drawdowns that can occur in gold and gold mining stocks due to the confusion, diffusion and illusion carried out so magnificently by the likes of Deutsche Bank, HSBC, Scotiabank and the rest of their porcine brethren.

How many years have I been chortling about the latent value in gold and silver ownership? It is the same number of years that I have been raging against the illicit behavior of the bullion banks. And yet every year—even this year—an absolutely perfect technical and fundamental set-up for enormous advances in gold and silver was flattened unmercifully by criminal collusion and deceit.

So, until the civil proceedings against DB blossom out into Federal prosecution and indictments, I am going to continue to follow the COT report and trade accordingly. Thanks to the great work of GATA and many other bloggers and newsletter writers, the jig for gold manipulation was up years ago. But since this is such a lucrative racket (as in RICO Statutes—hello?), the billion or so dollars taken out by the bullion banks in 2016 alone is enough to keep the status quo in place. And that alone, my friends, is ample reason to derisk but not abandon precious metals.

In many of the conversations I've had with friends and colleagues, the topic of the penny exploration issues and the TSX Venture Exchange inevitably arises because I earn a living consulting for a small few of these high-risk endeavors. Trust me when I tell you that it is getting increasingly difficult to operate in a hostile regulatory environment dominated more and more by the big banks that turn their noses up at "speculative investing." These Canadian banks comprise the power behind the regulatory regime, and if you recall the "illusion" word I used earlier, the banks tell their advisors to refrain from dealing in the penny miners because they are generally "unsuitable" for the bank's clients. As the magician flagrantly waves the right hand with the pink handkerchief in the air above his head while switching rabbits with his left hand, the banks have now become the dominant players in junior resource "penny" financing, having squeezed all but a handful of smaller boutiques out of the game.

Look at Canaccord Genuity, formerly the most dominant player in junior resource financings, which is now firmly pursuing the "wealth management" area of the business, which is an amazing transition and one that would make even Caitlyn Jenner envious. When you add in the roles of the ETFs that duplicate the penny explorers, once again the bank-controlled ETFs determine who gets included and who gets booted from inclusion in the "fund." This automatically sucks liquidity from the TSX.V, and since many portfolio mangers controlling large books demand and require liquidity, sparsely traded names with above-average projects are excluded from consideration.

The portfolio I put together at the end of April, referred to as the 357 Magnum (because like the weapon, it carried the potential to "change lives"), was a hit until the end of July and then it became a literal "hit" against my net worth as it plummeted from up 31% to down 16.6% in the last quarter of the year. I am making a couple of changes to the portfolio here at year-end, and in order to make room for additional uranium exposure, I am adding 10,000 Western Uranium Corp. (WUC:CNQ) at US$1.20 (CA$16,600), with the proceeds of sale of 100,000 Iconic Minerals Ltd. (ICM:TSX.V) at $0.12 ($12,000), plus $4,600 cash. I am adding a new recommendation to the mix in the form of 340,000 shares of Gem International Resources Inc. (GI;TSX.V) at $0.05 ($17,000), with the sale of 100,000 West Red Lake Gold Mines Inc. (RLG:CSNX) at $0.17 ($17,000). Stakeholder Gold Corp. (SRC:TSX.V), with $1,000,000 in working capital and only 19.3m shares issued, remains as one of two gold explorers, along with Canuc Resources Ltd. (CDA:TSX.V), our silver proxy for 2017 and one which should have completed the RTO with Santa Rosa Silver Mining Co. in early January. One of the hidden positives behind Canuc is gas production in Texas, which is not only increasing but, with natural gas up over $3.75/mcf, the cash flow accruals to CDA is more than enough to offset the monthly burn rate. And that, my friends, is a huge advantage.

Top Pick for 2017

Canuc Resources Ltd. (CDA:TSX.V) (CA0$.25):

My involvement in this company actually had as its genesis back in 2014, when I was introduced to the Santa Rosa Silver Mining Co., a private company based in Toronto with an intriguing asset in Mexico. I needed to plan for a silver component to the deal inventory, and since the Tinka Colquipucro silver asset had been shelved due to low silver prices and the smallish nature of the resource, I was looking for a replacement.

As Santa Rosa was a private company and had been financed at (much) higher levels back in 2011–2013, it was going to be quite a challenge, and since there were property payments coming up and no working capital to speak of, I decided to show it to a very competent geologist, SRC VP exploration John Nebocat. It didn’t take JN very long to arrive at an assessment, and by PDAC 2015, I felt that Santa Rosa was going to be a big, big winner. However, it was private and nobody wanted to tie up capital in a horrific bear market with little chance of success and no immediate exit strategy.

After sitting down with management and shareholders, I wanted to find a listed partner with a low share count, and hopefully some cash flow to offset the monthly burn, and see if this was a fit for both the Canuc shareholders and the Santa Rosa shareholders.

After struggling with it all through 2015 and the first half of 2016, we raised enough money for CDA and SRSMC to pay for all of the legal fees and exchange fees associated with a reverse takeover, whereby SRSMC with 44 million shares o/s (net 22m after rollback) effectively absorbs the 11m CDA share o/s and assumes control. After battling with the exchange for month after month, they finally received conditional approval in November, in advance of the final approval and closing in January.

Now, the last hurdle to overcome is the wraparound financing that will allow CDA to come out of the gate with a minimum $1.3M in working capital and positive cash flow from the gas production (as mentioned above), and around 38m shares o/s subject to revision based upon the financing size.

I am not going to discuss geology or share price potential at this time because it has passed mustard with John Nebocat and that is all I need. With the bad news being that it was halted a lot longer than I anticipated, the good news is that the halt allowed the company to bypass the brutal Q4/16 correction in the penny miners, with the 357 Magnum portfolio as evidence. Look for a trading resumption in January and we will take it from there.

Summary for 2017

My longer-term assessment for gold and silver prices has not changed since I wrote the Streetwise article in late February entitled: "Patiently Climbing Aboard the New Golden Bull," where the short-term outlook was mixed at $1,130, but solidly bullish for the intermediate and long-term trends.

I was in error in my cautiousness back in March, but still stayed fully invested, so while I refrained from buying more and missed another $250 of upside in the gold price, I captured all of my return in the GDXJ. As we close out 2016, my short-term outlook remains mixed, as the COT structure is still in the minus 134,000 range. The GDXJ is oversold beyond all recognition going into the end of the year, but I refrain from going "all-in" until the Commercials have lightened their shorts by at least another 100,000 contracts. If we get a market correction in January (which I think is a no-brainer), that could be the event that prompts the final regurgitation of the net long 105,000 contracts held by the Large Speculators.

Once we get this last flush out of the way, I believe that the intermediate and long-term trends will kick in, taking everything back into the upward vortex that we saw in February of this year. Of course, and sadly, until the regulatory regime clamps down on the price managers and bullion bank opportunists, I will have to continue to monitor the COT and make decisions as if I were residing in the minds of the Interventionalist criminals.

May you all have a prosperous and healthy New Year. . .

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Michael Ballanger: I, or members of my immediate household or family, own puts on the following companies mentioned in this article: Western Uranium Corp., Gem International Resources Inc., Stakeholder Gold Corp., Canuc Resources Ltd., Santa Rosa Silver Mining Co. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: Stakeholder Gold Corp. Santa Rosa Silver Mining Co./Canuc Resources Ltd., Gem International Resources Inc.. My company has a financial relationship with the following companies mentioned in this article: Stakeholder Gold Corp., Canuc Resources Ltd./SRSMC, Gem International Resources Inc., Western Uranium Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All charts and images courtesy of Michael Ballanger.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.