Gold Surges Over 30% in GBP In 2016 After Brexit

Commodities / Gold and Silver 2017 Jan 06, 2017 - 04:27 PM GMTBy: GoldCore

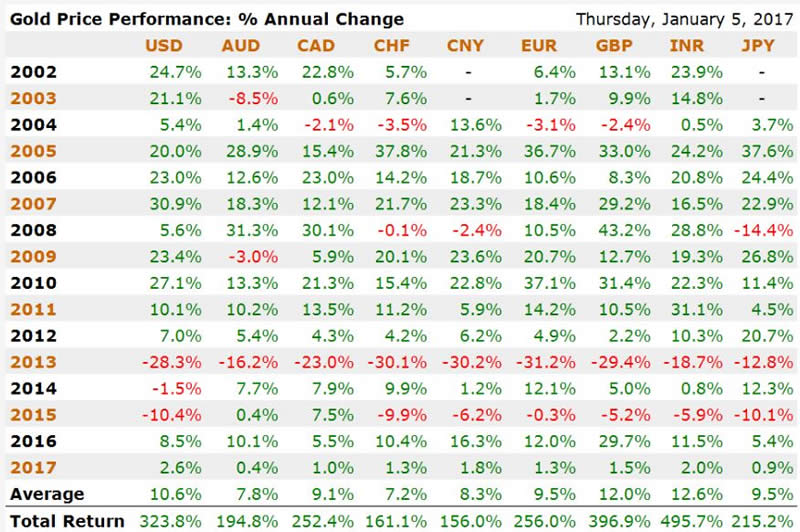

– Gold gains in USD, GBP, EUR, CAD, AUD, NZD, JPY

– Gold gains in USD, GBP, EUR, CAD, AUD, NZD, JPY

– Gold gains in CNY, INR & most emerging market currencies

– Gold surges 31.5% in British pounds after Brexit shock

– Gold acted as hedge and safe haven in 2016 … for those who need safe haven

– Further signs of market having bottomed and bodes well for 2017

– What drivers will gold respond to in 2017?

– EU elections and contagion risk, Geo-politics, terrorism, war and cyber war

– Outlook for gold good during Trump Presidency (2017 to 2020)

Source: GoldPrice.org

Gold was the best performing currency in 2016, rising as it did in all major currencies. It again performed the function as a hedge against currency devaluation and this was seen particularly in sterling terms with gold rising 31.5% in British pounds after the Brexit shock.

Gold in USD in 2016

Gold prices closed 2016 at USD 1,159.10, EUR 1,098.36 and GBP 942.58 per ounce.

Gold prices closed 2015 at USD 1,062.25, EUR 974.32 and GBP 716.36 per ounce.

(Gold AM fixes on December 30th 2016 and December 31st 2015 respectively)

UK investors and savers who had an allocation to gold protected their wealth from the Brexit debacle and the sharp falls in sterling seen in its aftermath. Gold rose over £220 per ounce and acted as a classic safe haven for investors exposed to the pound, and markets and assets denominated in British pounds.

The gains in euro terms were more modest but robust. The gains seen are likely due to the continuing massive ECB money printing and debt monetisation programme and heightened risk of contagion in the Eurozone.

Brexit and the elections in France, Germany and Holland will support gold in euro terms in 2017 and there is the possibility of sharp gains in euro terms should the Eurozone debt crisis return.

Gold in EUR in 2016

What drivers will gold respond to in 2017?

- Italian, Greek, Irish, Spanish and other banks and risk of bail-ins

- Dutch, German, French elections … Eurozone contagion

- Continuing ultra loose monetary policies by Fed, BOE, BOJ and especially ECB

- Trump policies and tweets …

- Geo-politics, cyber war & terrorism, conventional war & terrorism

President Trump has already shown himself as a man who likes to tweet and knows the power of the short sound bite and the medium that is Twitter. His skill in this regard was one of the factors which helped him become President.

However, this asset may become a liability for him and for markets when he becomes President. The art of diplomacy will become more important and 140 characters of unfiltered Trump is likely to create tensions with America’s largest trading partners such as China. This has been seen with China recently and his accusation that China “stole” the U.S. drone on Twitter.

It has already impacted markets as seen when he tweeted about Boeing and Boeing shares fell sharply.

Should he continue in this vein, it could lead to jitters in markets and a safe haven bid for gold in the event of ‘inflammatory’, tension creating and damaging tweets. His capacity to comment without fully understanding all the facts may be his ‘Achilles heal’ in this regard.

Overnight Trump’s tweet regarding Toyota saw the Japanese car maker lose $1.2 billion in value in five minutes. Shares plummeted after the president-elect vowed in a tweet to stop the car manufacturer from moving abroad.

Stocks, bonds and property markets have performed very well in recent years. However, there gains are artificial and are based on near zero percent interest rate policies and from being bloated by monetary stimulus on a scale that the world has never seen before.

These bubble like conditions look increasingly vulnerable and will likely burst – the question is when rather than if.

Indeed, the turmoil that we have seen on international markets in 2016 appears a foretaste of a very volatile 2017. We continue to see conditions akin to those seen in 2007 and 2008. Many leading experts have echoed these concerns.

Geopolitical risk intensified in 2016 with Brexit, the Italian referendum and of course the election of Trump. The risk of terrorism and war remain ever present and gold will continue to act as an important hedge against geopolitical risk.

The risk of contagion in the EU – both political and financial and monetary now looms large. Today there is the added risk of bail-ins and deposit confiscation which will be see savings and capital confiscated from savers and companies in the next financial crisis.

Conclusion

It is worth remembering – as many seem to have forgotten – that gold was one of the few assets to rise in the financial crash of 2008 and in the debt crisis in the 2007 to 2012 period. It has under performed since as stocks and bonds roared to artificially induced record highs.

The strong performance of gold in all currencies including the very strong dollar in 2016 bodes well for 2017.

It is due a period of out performance and we believe it will outperform other assets in the coming Trump Presidency years from 2017 to 2020.

KNOWLEDGE IS POWER

For your perusal, below are in order of downloads our most popular guides in 2016:

10 Important Points To Consider Before You Buy Gold

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Thank you and wishing you a healthy and fulfilling 2017.

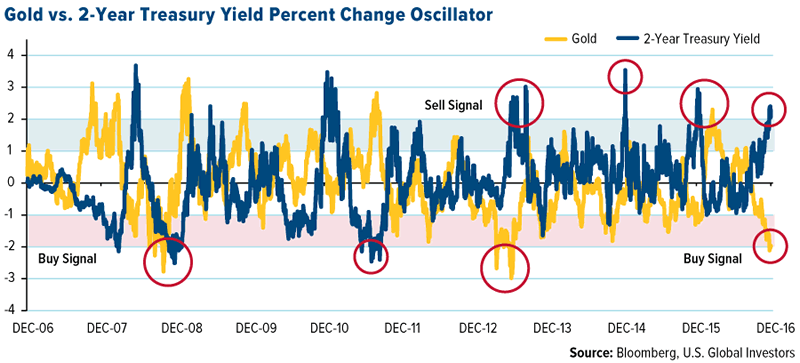

Source: US Funds

Gold Prices (LBMA AM)

06 Jan: USD 1,178.00, GBP 951.35 & EUR 1,112.27 per ounce

05 Jan: USD 1,173.05, GBP 953.55 & EUR 1,116.16 per ounce

04 Jan: USD 1,165.90, GBP 949.98 & EUR 1,117.40 per ounce

03 Jan: USD 1,148.65, GBP 935.12 & EUR 1,103.28 per ounce

30 Dec: USD 1,159.10, GBP 942.58 & EUR 1,098.36 per ounce

29 Dec: USD 1,146.80, GBP 935.56 & EUR 1,094.85 per ounce

28 Dec: USD 1,139.75, GBP 931.29 & EUR 1,091.88 per ounce

Silver Prices (LBMA)

06 Jan: USD 16.45, GBP 13.30 & EUR 15.54 per ounce

05 Jan: USD 16.59, GBP 13.47 & EUR 15.80 per ounce

04 Jan: USD 16.42, GBP 13.36 & EUR 15.74 per ounce

03 Jan: USD 15.95, GBP 12.97 & EUR 15.34 per ounce

30 Dec: USD 16.24, GBP 13.20 & EUR 15.38 per ounce

29 Dec: USD 16.06, GBP 13.10 & EUR 15.36 per ounce

28 Dec: USD 15.85, GBP 12.96 & EUR 15.22 per ounce

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.