Gold and Silver Off To Shining Start to 2017

Commodities / Gold and Silver 2017 Jan 13, 2017 - 02:21 PM GMTBy: Jeff_Berwick

Bitcoin stole the headlines in the first week of 2017, rising nearly $200 in the first two days of the year before swiftly giving back those gains and more since.

Bitcoin stole the headlines in the first week of 2017, rising nearly $200 in the first two days of the year before swiftly giving back those gains and more since.

Quietly, however, gold and silver have gotten off to an excellent start to the year.

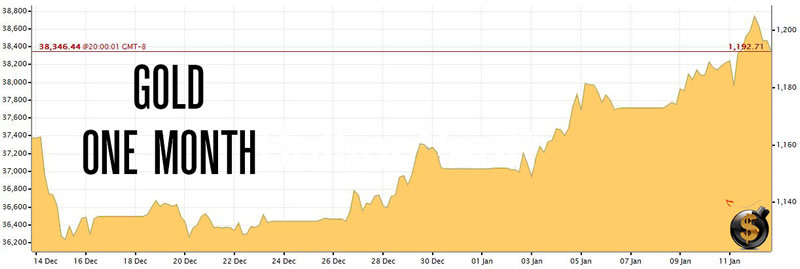

Gold began the year at $1,154 and has rarely looked back, rising to over $1,200 on Thursday.

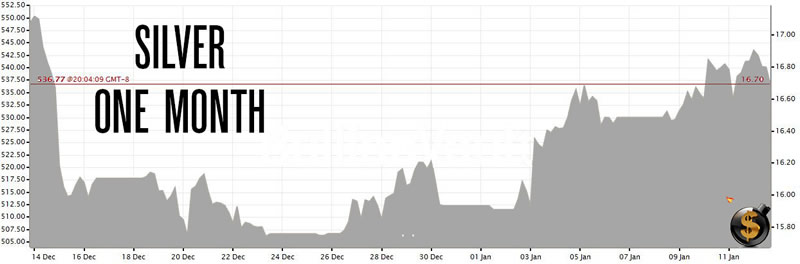

Silver has been similar. It started the year at $15.93 and has gone nowhere but up since and came close to hitting $17 on Thursday.

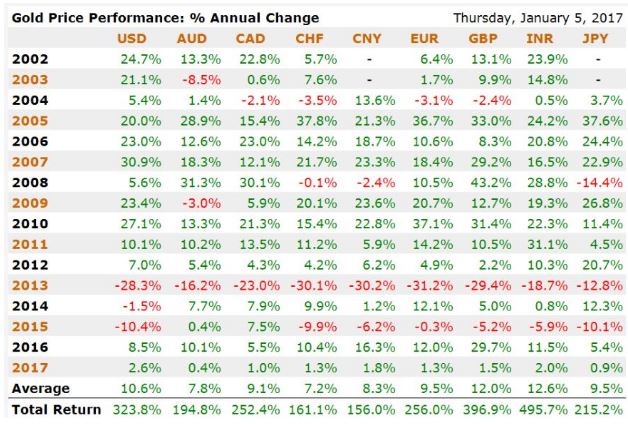

And all of this comes after gold rose against all fiat currencies in 2016, rising 9% against the US dollar, 13% against the euro and 31.5% against the British pound.

And continued its massive bull run since 2002 with only two down years in the last 15.

What is interesting about gold and silver’s rise so far in 2017 is how it correlates to their rise in 2016.

From the very first day of 2016 gold and silver rocketed higher.

And gold didn’t stop rising until it hit nearly $1,400 in July.

But then, for the second half of the year it was almost all downhill.

Gold stocks followed the same pattern.

Gold stocks nearly tripled, as a whole, from January until August of last year and then fell until the end of the year again.

This is what makes the rise of silver and gold so sharply at the beginning of this year so interesting. If they go on to repeat a similar performance in 2017 it will mean massive gains in the gold stocks.

It is even possible that the downturn gold experienced in the last half of the year may not occur this time. It is certainly possible that gold could remain relatively stationary or even continue to rise. There are certainly reasons why gold could continue to rise, especially if the dollar erodes.

TDV Premium subscribers made massive gains in the first half of last year. And TDV’s Senior Analyst, Ed Bugos, advises on which gold stocks have the most potential.

And, on January 24th, in a live webinar, Ed will be divulging his top mining stock pick for 2017. It’s an incredibly special situation that has the potential to gain 1,000% or more in the coming years.

You can get access to this limited live Webinar on January 24th by registering for free here.

And make sure to mark your calendar for February 24th for the TDV Internationalization & Investment Summit with many of the world’s top experts on precious metals, cryptocurrencies and finance including Ed Bugos, G. Edward Griffin, David Morgan, Bix Weir and Bill Murphy of GATA.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2016 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.