Physical Gold Market Will Trump Paper Gold

Commodities / Gold and Silver 2017 Jan 16, 2017 - 07:22 PM GMTBy: GoldCore

John Hathaway of Tocqueville Funds says the physical gold market will defeat the paper gold market leading to a much higher price for the monetary metal in the coming months and years in his Tocqueville Gold Strategy Investor Letter (Fourth Quarter 2016 Investor Letter):

Gold rose 8.5% for the year while gold-mining stocks (XAU – Philadelphia Gold and Silver Index stocks) rose 75%. On an annual basis, results were highly satisfactory. However, there was considerable drama beneath the surface that left precious metals investors in a state of anxiety by year-end. Precious metals and mining shares rose sharply through August, and then spent the rest of the year giving back much of the first-half gains. The second half downtrend accelerated into early December, following the unexpected victory by Trump and a hawkish statement after the December Federal Open Market Committee (FOMC) meeting.

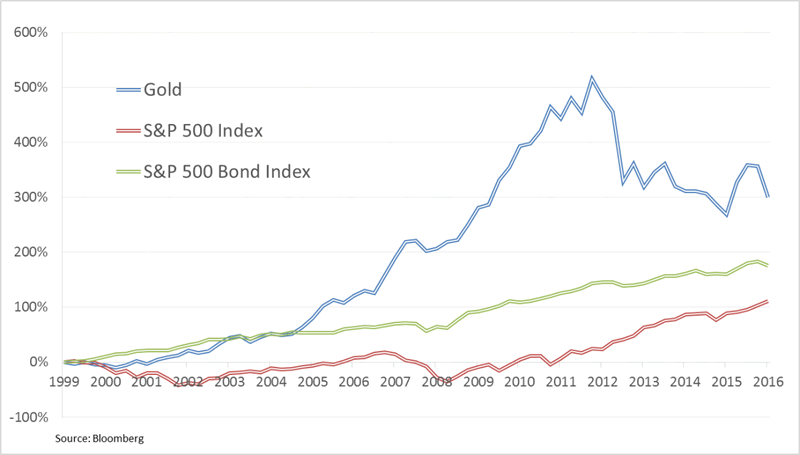

The question of the hour is whether the 2016 gains were merely a countertrend rally following a four-and-a-half-year decline from all-time highs in 2011, or the beginning of a new leg in the secular bull market that began in 1999, during which gold rose from less than $300/oz. to $1900 in August 2011. We judge the weight of current sentiment, mainstream media opinion, and technical analysis to be extremely bearish, comparable to year-end 2015 just prior to the dramatic gains that followed. We believe that, based on prevailing negativity, the next big change in the gold price will be substantially higher. If so, the 2016 second-half correction will have established a durable higher low from the advance that began at year-end 2015, and would be the precursor to the continuation of the secular advance that began in 2000.

Fundamentals of physical supply and demand remain positive, and are reinforced by the current extended regime of precious metals prices too low to justify expanded mine supply. Global mine output has plateaued; it now seems likely to decline through 2020 and perhaps into the middle of the next decade. As shown in the chart below, discoveries of new ore bodies are at a 25-year low, while the time required to bring new ore bodies into production continues to lengthen, and now stands at nearly 20 years.

Physical demand continues to show steady secular growth, primarily in Asia. Consumption by Turkey, India, China, and Russia alone have exceeded global mine supply since 2013, which means that inventories of physical metal held in Western vaults are being depleted to meet that demand.

Two recent developments (largely ignored by mainstream media) will, in our opinion, significantly strengthen the demand for and usage of physical metal. First, a new Shariah gold standard was approved in December 2016:

The AAOIFI [Accounting and Auditing Organization for Islamic Financial Institutions], in collaboration with the World Gold Council (WGC) and Amanie Advisors, has approved what will become known as the Shariah Gold Standard. This is a set of guidelines that will expand the variety and use of gold-based products in Islamic Finance. (Jan Skoyles, Goldcore Research, 12/16)

We believe that this will lead to the creation of investment products such as gold ETFs for the Islamic world (25% of global population), a market that has not been penetrated. While estimates of the potential market size vary wildly, and this development is in its early days, it seems to us that it is a major positive for future physical gold consumption …

This is an excerpt and the full letter can be accessed at the Tocqueville website here

KNOWLEDGE IS POWER

10 Important Points To Consider Before You Buy Gold

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Gold Prices (LBMA AM)

16 Jan: USD 1,202.75, GBP 997.56 & EUR 1,135.40 per ounce

13 Jan: USD 1,196.35, GBP 978.85 & EUR 1,123.25 per ounce

12 Jan: USD 1,206.65, GBP 984.39 & EUR 1,135.82 per ounce

11 Jan: USD 1,187.55, GBP 979.25 & EUR 1,128.41 per ounce

10 Jan: USD 1,183.20, GBP 974.60 & EUR 1,118.12 per ounce

09 Jan: USD 1,176.10, GBP 968.75 & EUR 1,118.59 per ounce

06 Jan: USD 1,178.00, GBP 951.35 & EUR 1,112.27 per ounce

05 Jan: USD 1,173.05, GBP 953.55 & EUR 1,116.16 per ounce

04 Jan: USD 1,165.90, GBP 949.98 & EUR 1,117.40 per ounce

Silver Prices (LBMA)

16 Jan: USD 16.82, GBP 13.94 & EUR 15.87 per ounce

13 Jan: USD 16.76, GBP 13.76 & EUR 15.74 per ounce

12 Jan: USD 16.91, GBP 13.77 & EUR 15.87 per ounce

11 Jan: USD 16.79, GBP 13.84 & EUR 15.96 per ounce

10 Jan: USD 16.66, GBP 13.73 & EUR 15.76 per ounce

09 Jan: USD 16.52, GBP 13.57 & EUR 15.69 per ounce

06 Jan: USD 16.45, GBP 13.30 & EUR 15.54 per ounce

05 Jan: USD 16.59, GBP 13.47 & EUR 15.80 per ounce

04 Jan: USD 16.42, GBP 13.36 & EUR 15.74 per ounce

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.