Gold Continues to Consolidate

Commodities / Gold & Silver Aug 07, 2008 - 07:28 AM GMTBy: Mark_OByrne

Gold finished trading in New York yesterday at $874.40, down $4.50 and silver was down 11 cents to $16.46. Gold has again recovered somewhat in Asian and early European trading and is trading at $883.00/883.40 per ounce (1058 GMT).

Gold finished trading in New York yesterday at $874.40, down $4.50 and silver was down 11 cents to $16.46. Gold has again recovered somewhat in Asian and early European trading and is trading at $883.00/883.40 per ounce (1058 GMT).

The credit crisis continues as evidenced in the world's largest insurer, American International Group, reporting a quarterly loss of $5.36bn with profits wiped out by further mortgage related writedowns. In the UK house prices fell a further 1.7% in July as the decline in availability of mortgages, rising inflation and general economic uncertainty led to further falls in property prices. Not to mention the worryingly poor results from Freddie Mac yesterday.

Economic and financial conditions are unlikely to improve anytime soon – Freddie Mac's Chief Executive Officer, Richard Syron, sees no end in sight to the worst housing slump since the Great Depression. Some have warned that Freddie and Fannie look set to be insolvent in the coming months due to the extent of home loan defaults.

The credit crisis is degenerating into an insolvency and systemic crisis . Alan Greenspan has called the current credit crisis, an “insolvency crisis” and has said that will not end until home prices in the United States begin to stabilise. "This crisis is different -- a once or twice a century event deeply rooted in fears of insolvency of major financial institutions," Greenspan wrote. Huge bailouts will be required for banks, brokerages and now there is even talk of bailouts for the ‘big three' car makers.

All these bailouts will lead to the dollar coming under further pressure in the coming months which should see gold reach $1,200/oz in the coming months.

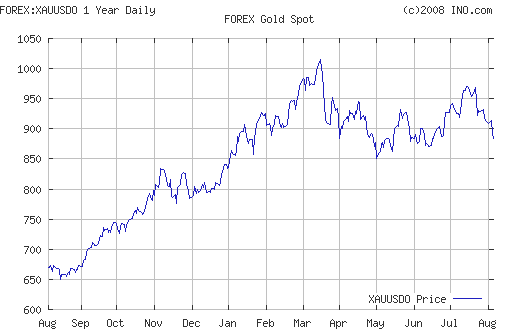

The credit crisis is one year old and as can be seen in the chart below and the table above, gold is up by more than 30% and has vastly outperformed most other asset classes and will likely continue to do so.

An example of gold's historic role as a safe haven asset in times of economic uncertainty is seen in the following data. The industry performance of Physical Gold Versus the S&P 500 during eleven stock market declines of 15% or more in the Post-War period (since 1946).

| Correction Date | S & P 500 | Physical Gold | Gold Mining Shares |

| May 46 - May 47 | -23 |

0 |

-28 |

| June 48 - June 49 | -17 |

0 |

+3 |

| July 57 - Oct 57 | -15 |

0 |

-18 |

| Dec 61 - June 62 | -22 |

0 |

-3 |

| Feb 66 - Oct 66 | -17 |

0 |

-10 |

| Nov 68 - May 70 | -28 |

+4.11 |

-35 |

| Jan 73 - Oct 74 | -41 |

+142.87 |

+144 |

| Sept 76 - Mar 78 | -16 |

+60.72 |

+43 |

| Aug 87 - Dec 87 | -27 |

+7.90 |

-22 |

| July 90 - Oct 90 | -15 |

+2.54 |

-8 |

| Source: Sam Stovall, Chief Investment Strategist at Standard & Poor's, featured in 'The Bear Book - Survive and Profit in Ferocious Markets' by John Rothchild. Note: Gold price was "fixed" and the US dollar was backed by gold during the first few episodes, hence physical gold was cash and registered no gains and no losses. Gold and Silver Investments Ltd - www.goldassets.co.uk |

|||

Gold and Silver

Gold is trading at $885.20/885.70 per ounce (1045GMT).

Silver is trading at $16.61/16.65 per ounce (1045 GMT).

PGMs

Platinum is trading at $1595/1605 per ounce (1045 GMT).

Palladium is trading at $353/358 per ounce (1045 GMT).

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold and Silver Investments Limited No. 1 Cornhill London, EC3V 3ND United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.