The Future of Pharma In The Age Of Trump

Companies / Healthcare Sector Jan 24, 2017 - 12:05 PM GMTBy: John_Mauldin

BY PATRICK COX : Last week, Donald Trump complained about drug prices in a press conference. Drug companies, he said, are “getting away with murder.” During that presser, pharma and biotech stocks lost over $20 billion in value.

BY PATRICK COX : Last week, Donald Trump complained about drug prices in a press conference. Drug companies, he said, are “getting away with murder.” During that presser, pharma and biotech stocks lost over $20 billion in value.

Investors should have learned an important lesson. They probably didn’t.

Trump’s targeting of drug sellers was not a fluke. Hillary Clinton's "price gouging" tweet last September had the same type of impact on markets.

For those who understand the big picture, these two events offer clues about the future of the drug business.

The real problem isn’t drug pricing

The big picture is pretty simple. Healthcare costs will continue to rise even if drug prices go down. At most, medicines account for about 15% of the national medical bill. They’re not the reason that costs are rising. But, they are easier to attack than hospitals and doctors.

Here’s the real problem: America is broke. Worse than broke, actually. This is because of healthcare costs. These costs are the number one driver of federal spending (as well as the deficit and debt). As President Obama learned, those costs are hardcoded into the system.

Healthcare costs are rising not because of greed or inefficiency (though there are plenty of both). They're rising for demographic reasons. And they’re rising faster than we can repay the trillions we’ve already borrowed. The unfunded liabilities for future healthcare are even more of a problem.

As a result, our fiscal policy choices will be increasingly limited and ineffectual. Politicians and the public will demand that “something be done.” And that “something” will mean greater government involvement in drug pricing.

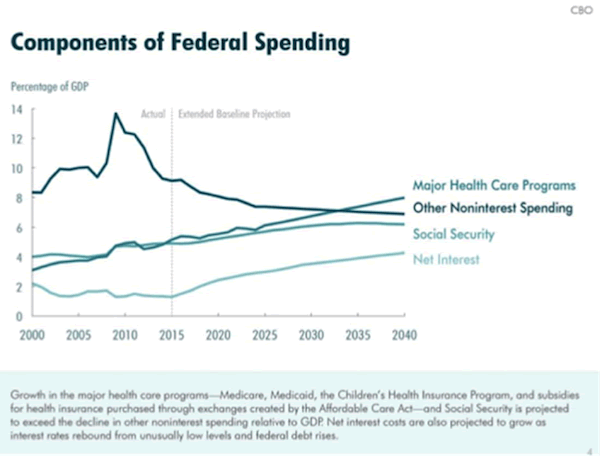

Let me explain why this is inevitable. As the Congressional Budget Office has pointed out, age-related healthcare costs and the associated debt service are the only part of the federal budget that’s growing in proportion to the whole. (Increases of approximately 9% in these programs are mandatory and automatic.)

Source: CBO

The graph above is quite sobering, but you should read the CBO’s statement below it. Note that “growth in the major health care programs… and Social Security is projected to exceed the decline in other noninterest spending relative to GDP.”

Here’s why healthcare costs are rising

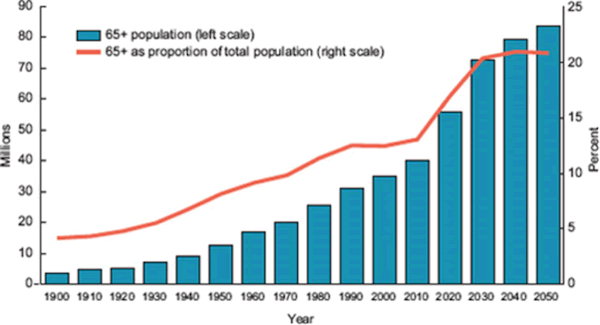

The CBO clearly points to age-related disease as the culprit. Simply put, we are living longer. Healthcare costs rise exponentially with age, and the percentage of the population that is older is growing. This is simple math, but our leaders seem to be in denial over this macroeconomic reality.

This graph, based on data from the HHS Administration on Aging, makes the trend clear.

Source: CBO

This aging of the population is only one half of a bigger change… often called the flipping of the demographic pyramid. It’s taking place throughout the world. But the trend is growing fastest in the West.

The effect of the baby bust

In the past, when birthrates were higher, longer life spans and a larger aged population wouldn’t have been a problem. Today though, birthrates are too low to provide the younger workers that we need to pay for our increased medical costs.

In fact, CDC data show that the US fertility rate fell last year to its lowest since 1909 (when tracking began). This puts our fertility rate at about 1.8 births per woman. At least 2.1 births are required to replace the existing population and maintain the old-age dependency ratio (OADR).

In other words, the pool of younger workers (contributors) is shrinking… while the aged population (dependents) is growing. Our already untenable OADR is getting worse.

Optimists say that the birthrate will rise when the economy improves. It may to some degree, but US birthrates have been well below replacement rate since 1972. This is true even among immigrants. This interactive chart by the WHO shows just how dire the picture is.

Even if by some miracle, we could return to 1950s birthrates, it wouldn’t help. Why not? Babies born now won’t become working contributors for decades. Likewise, most immigrants don’t become net contributors for decades either.

The issue is that we don’t have that long to fix the problem.

The politics of the demographic shift

The political consequences of this change are huge and are not widely recognized. We can’t afford to pay the rising cost of healthcare for the aged. Nor is it possible (politically) to reduce their level of care.

In the news, we’ve heard a lot of talk about the changes in political demographics. But most reports make the mistake of focusing on ethnicities. As such, they ignore the biggest demographic change in history—the growth of the most powerful of all political blocs… the aged.

This proverbial third rail will not go quietly into the night. So politicians will try anything to put off the day of reckoning.

Most investors and politicians don’t get it. Many are in full denial. But it’s time to face facts; we're entering the Trumpian age of the deal. Big pharma’s ability to set prices will give way to political pressures.

The future outlook for pharma

There are ways to deal with this situation… and even profit from it.

One is to shift from big pharma, ETFs, and companies that sell older existing drugs and invest in biotech startups. Big pharma will claim that reduced profits on widely used drugs will limit their ability to acquire new drugs. But it may, in fact, incentivize drug discovery.

Pharma tends to be slow to replace very profitable drugs with something newer and better. The Trump Administration could make new drug development more attractive by following through on its promise to reduce regulatory hurdles.

New and better drugs can reduce total healthcare spending, not just drug costs. A significantly superior cancer drug, for example, would cut hospital and physician costs.

Even more exciting is the work in geroprotectors. These are drugs that could prevent (rather than treat) cancers and other age-related diseases. But these drugs are difficult to approve because prevention may take decades to prove with finality.

If I were Trump, I would reach out directly to the aged community. He could enlist their help to move the most promising and safest geroprotectors into the market. There are compounds, currently stalled by regulators, that have shown tremendous efficacy in animals. I think they could effectively rejuvenate older individuals and return some degree of health and vigor. Since most people are forced to retire due to their or their spouse’s health, this could repair the dependency ratio.

A more immediate solution has ironically come from the company that inspired the fateful Clinton tweet, KaloBio. You may recall that “pharma bro” Martin Shkreli took over the company and then increased the price of KaloBio’s older antibiotic Daraprim by more than 5,000%. (Daraprim is a life saver for a few thousand Americans who suffer from the parasitic disease toxoplasmosis.)

After Shkreli destroyed the company, investors looked for help. They chose industry veteran Cameron Durrant PhD, a well-known critic of big pharma. Despite his initial hesitance, Durrant has since turned the company around via regulatory jiu-jitsu.

Exploiting the bad press surrounding KaloBio and the biotech industry, he announced a bold new approach to drug pricing. Called the Responsible Pricing Model, it is a transparent process that involves the help and advice of those who want affordable drugs. This includes regulators, insurers, researchers, and patients. In return, KaloBio has lower costs and risks.

This approach can shift traditionally risky biotech stocks into more bond-like instruments that could outperform ETFs. Bigger pharma players, like Allergan, are now emulating Durrant's model.

Clearly, the industry is starting to see the writing on the wall. Investors should as well.

Stay in the Loop on Life-Extending Research with Tech Digest

Read about the latest breakthroughs–as well as the innovative companies that work on them. Get Tech Digest free in your inbox every Monday. John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.