USD rebound cut short. SPX Flat

Stock-Markets / Stock Market 2017 Jan 27, 2017 - 02:28 PM GMT Good Morning!

Good Morning!

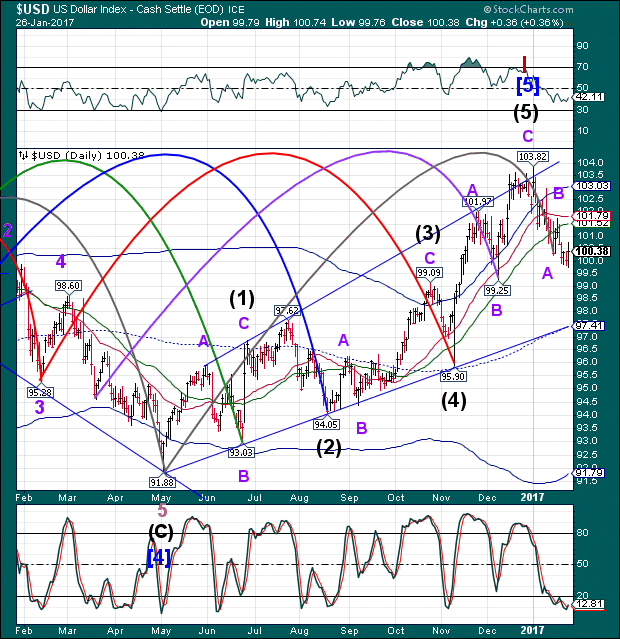

The overnight bounce in USD futures was stymied by the Durable Goods hard data that crushed the hopes of a rebound. A Wave [iii] may have begun.

Q4 GDP also missed as exports tumbled. ZeroHedge reports, “It appears that Deutsche Bank's warning that the global economy is about to roll over was spot on, because moments ago the Bureau of Economic Analysis reported that GDP in Q4 rose only 1.9%, barely above the lowest forecast of 1.7%, and below both the consensus estimate of 2.2% and the whisper estimate of 2.5%-2.6%. The reason for the big miss, and nearly 50% drop from the 3.5% print in Q3: a collapse in contribution to GDP from trade (net exports and imports) which subtracted a whopping 1.7% from the headline number. So much for that bumper soybean boost to the US economy.”

The positive overnight action in the SPX futures is now over. We still need a decline beneath the Cycle Top at 2289.64 in the 2-hour chart (2291.61 in the daily chart). For an aggressive short. The assumption is that the SPX may retest that area as a new resistance after the decline beneath it.

Today is an interesting day, because it offers a Primary Cycle turn, which is one of the strongest indicators of a probable change in trend. It may be that SPX could still rally to its “natural” target (where Wave (C) equals Wave (A) before the reversal takes place. We must be ready for a variety of possible actions before the actual reversal.

VIX is flat-lined this morning. More to come later.

The Hi-Lo made a wide move yesterday, but closed above its 50-day Moving Average and mid-Cycle support/resistance at 123.18.

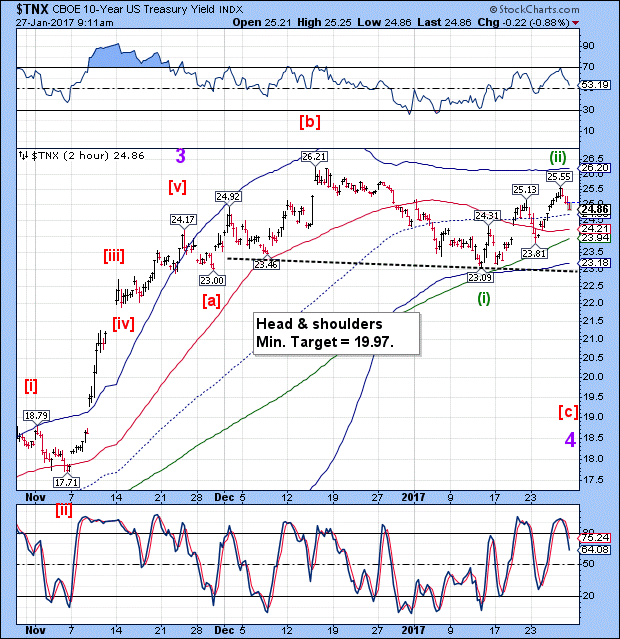

TNX is tentatively moving lower this morning after yesterday’s well-attended auction. It appears that money flows are now risk-adverse.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.