The Great Rotation - Monetary to Fiscal, Major Cycles Turning Down

Stock-Markets / Financial Markets 2017 Feb 01, 2017 - 12:29 PM GMTBy: Gordon_T_Long

Democratic Senator Chuck Schumer dejectedly quipped during Fed Chairman Ben Bernanke's Humphrey-Hawkins testimony before congress in July of 2012:

Democratic Senator Chuck Schumer dejectedly quipped during Fed Chairman Ben Bernanke's Humphrey-Hawkins testimony before congress in July of 2012:

"I'm afraid the Fed's the only game in town!"

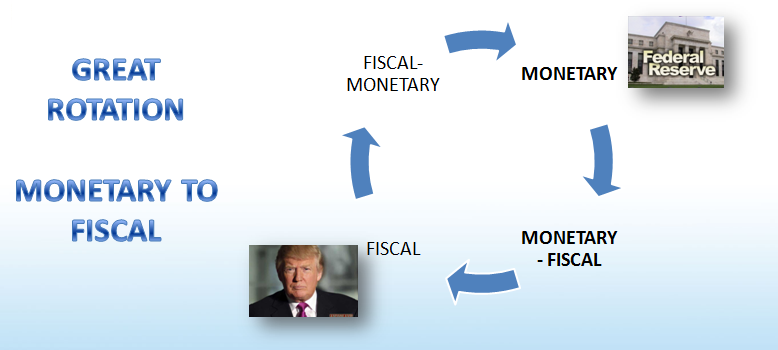

Now nearly five years later things may be about to change! The other two policy pillars of Fiscal and Public Policy may be reasserting themselves with a change in the White House and congressional leadership. Suddenly just the promise of potential fiscal stimulus, tax policy and claw backs of regulatory over-reach have become the lead stories on the nightly news.

With it we have witnessed the DOW explode through 20,000. We believe this is not simply an endorsement of Donald Trump, but rather a statement of how desperate the country is to remove Congressional grid lock, a dysfunctional Washington apparatus and maybe most importantly, Monetary Policy as the prime driver of economic policy.

The "Dis-Integrative" Winter

Even an initially somewhat surprised Donald Trump referred to his shocking win as "a movement that the world has never seen before".

This statement has in it a fair degree of Trump's famous hyperbole, but nevertheless it is true that it is about a dramatic change in the electorate.

Whether trump recognized it and capitalized on it, or he simply got expectantly pushed along with it, what is important to understand this is happening in many countries with different names, different rallying calls and different populist frustrations.

The commonality is that it is about "Anti-Establishment, Anti Status Quo and in many cases Anti-Globalization.

To us this is a confirmation that we are well into the Kondratieff Long-Wave "Winter"

Cycles Turning Down

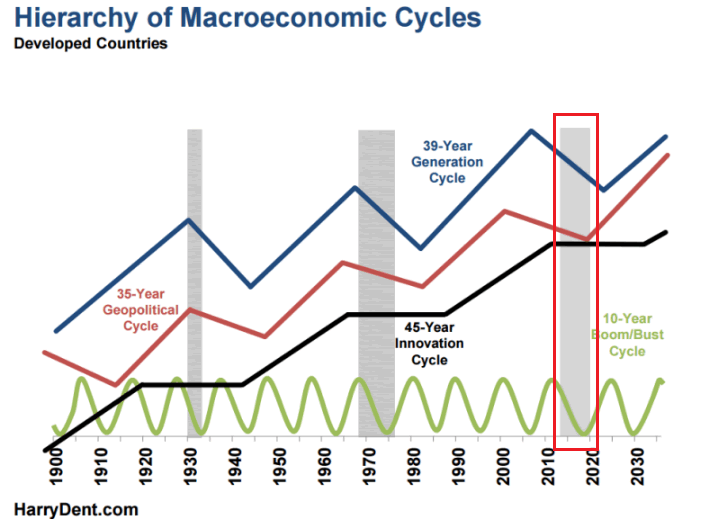

All the Cycles we study, including the well followed Kondratieff Cycle are now turning down, irrelevant of their individual long term frequencies. None of the cycles we studied show a reversal until early 2020 as Donald Trump's first term comes to an end. Coincidence?

What it really says is that who ever was elected US President during this period was going to face serious and unprecedented historical challenges.

It's About Social Trend

All the Cycles are fundamentally reflecting how social trends, beliefs and value systems continuously change in a cyclical fashion. Financial excesses get corrected, Social inequalities become more of a concern and Economic imbalances become less tolerable between nations. All of these normally occur within a country, but when they become globally wide spread they are a exponentially more serious.

The central issue is that the unwritten "Social Contract" between the elected and the electors has broken down.

Even corrupt governments can stay in power if the social contract is maintained. The social contract is the unspoken,unwritten expectations that opportunities for improvement of a families quality of life are available for those who are willing to strive for it. The system which elected politicians are elected to maintain, continues to deliver this opportunity.

"The system is not working for me!" - A Bernie Sanders rally supporter

When people feel it is not available, then social unrest and revolutions can be expected to occur. Donald Trump's labeling of it as "a movement" should be more apply described as a predictable shift in cultural expectations.

Listen to this 30 minute video discussion with supporting slides between Charles Hugh Smith and Gordon T Long as they outline what they see is occurring and why.

For more articles signup for GordonTLong.com releases of MATASII Research

Gordon T. Long

Publisher - LONGWave

Signup for notification of the next MACRO INSIGHTS

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Copyright © 2010-2017 Gordon T. Long

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.