US Dollar and Stocks Olympics Rally Despite Recession

Stock-Markets / Financial Markets Aug 10, 2008 - 01:12 PM GMT The Olympic Games kicked off at 8:08:08 pm on Friday night, the eighth day of the eighth month of 2008. Coincidence? Not at all. The number eight is considered lucky by the Chinese, because in Cantonese (the language of South China) the word for prosperity is “fa”, which sounds like “ba” (eight).

The Olympic Games kicked off at 8:08:08 pm on Friday night, the eighth day of the eighth month of 2008. Coincidence? Not at all. The number eight is considered lucky by the Chinese, because in Cantonese (the language of South China) the word for prosperity is “fa”, which sounds like “ba” (eight).

Let the gains begin. Fortune also smiled upon stock markets, with the S&P 500 Index scoring its first back-to-back weekly gain since April as the US dollar rallied strongly and oil and commodities plummeted. The S&P 500's gain since the low of July 15 has been 6.7%, with the Financial SPDR up by 27.8%.

Hat tip: Phil's Stock World

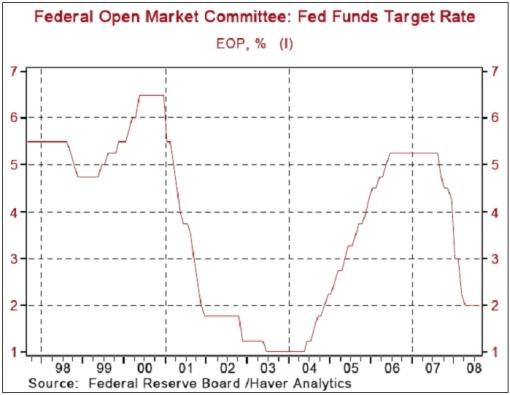

As expected, the Federal Open Market Committee held the Fed funds target rate steady at 2.0%. This is the second straight meeting with no change in the rate. The committee's statement discussed high inflation; although the FOMC expected inflation to decline in the months ahead, the members said “the inflation outlook remains highly uncertain”. The statement acknowledged both downside risks to growth and upside risks to inflation, indicating no near-term change in monetary policy. Click here for a comparison of the content of last week's communiqué with that of the previous one (June 25), courtesy of Bill King ( The King Report ).

Casting light on the market situation, David Fuller ( The King Report ) said: “The obvious beneficiaries of weaker oil and a firmer US dollar are global stock markets. As the US has been The Rocky Horror Show in terms of concerns, it is now one of the more obvious candidates for a relief (short covering?) rally.”

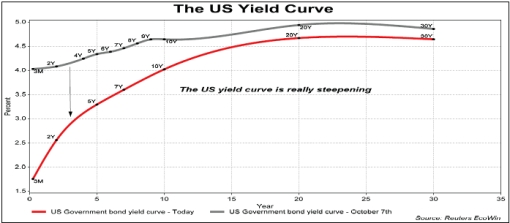

To which GaveKal added: “Policy responses to the credit crunch have helped. To successfully get out of a financial squeeze you need three things: 1) a cheap currency, 2) a positive yield curve, and 3) the recapitalization of bank balance sheets. With surprising speed, all three of these conditions are now being met in the US.”

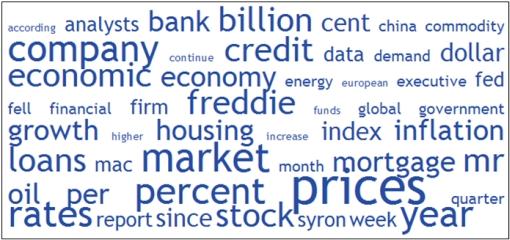

Next, a tag cloud of the text of all the articles I have read during the past week. This is a way of visualizing word frequencies at a glance. “Prices”, understandably, remained a key concern of commentators.

I believe there is still no confirmation that stock markets have bottomed and maintain that the convalescence period will be an extended affair. From a short-term perspective, however, I would give the upside the benefit of the doubt unless the lows established on 1) July 28 and 2) July 15 are broken.

Interestingly, assets in US money market funds have increased by 1.8% to $3.56 trillion since the mid-July stock market lows. Mulling through my head are the words of the late Sir John Templeton: “Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.” It's best to keep an open mind about matters.

Before highlighting some thought-provoking news items and quotes from market commentators, let's briefly review the financial markets' movements on the basis of economic statistics and a performance round-up.

Economy

“Global business sentiment remains weak and fragile,” according to the Survey of Business Confidence of the World conducted by Moody's Economy.com . The survey results suggest that the global economy is skirting recession, but just barely.

Economic reports released in the US during the past week were mixed and included the following:

• Personal income inched up 0.1% in June after soaring 1.8% in May. Excluding the tax rebate effect, personal income rose by 0.3% in June, up from 0.4% in May. Spending growth slipped to 0.6% from 0.8% the prior month. Real spending fell by 0.2% as prices soared. The core PCE deflator rose by 0.3%, the fastest since September, while the top-line deflator jumped 0.8%.

• The ISM non-manufacturing index came in slightly better than expected in July. However, a decline in new orders and new export orders signaled weaker activity in the non-manufacturing economy in the months ahead.

• Initial claims for unemployment insurance benefits increased 7,000 to 455,000 for the week ended August 2. Although expectations had been for claims to remain high, this figure exceeded them.

• Friday's productivity and costs numbers came in worse than expected on the productivity side but better than expected on the cost side.

On Thursday, the European Central Bank (ECB) left interest rates on hold at 4.25% and stated that risks to economic growth were starting to materialize. Victoria Marklew ( Northern Trust ) commented: “Eurozone GDP almost certainly contracted in Q2 – Eurostat will release its flash estimate on August 14, the same day that Germany and France release their own first estimates. If the numbers surprise on the downside, the markets will start anticipating a rate cut by the ECB on September 4.”

“Europe has moved further along the road towards a recession than the US. The economic data of the past two weeks make that conclusion hard to avoid,” reported John Authers in the Financial Times .

In line with market expectations, the Bank of England also decided to keep its key repo rate steady at 5.0% at its August monetary policy meeting last week. August marks the fifth consecutive month with no change in the repo rate. UK house prices fell by almost 11% in the year to July – one of the biggest year-on-year falls recorded in the UK – prompting BCA Research to say: “The BoE will cut aggressively before year end.”

Further afield, according to the Financial Times , the Japanese government conceded on Wednesday that the country's longest postwar period of economic expansion might be over as it reported a drop in its key measure of underlying economic conditions for June.

WEEK'S ECONOMIC REPORTS

| Date | Time (ET) | Statistic | For | Actual | Briefing Forecast | Market Expects | Prior |

| Aug 4 | 8:30 AM | Personal Income | Jun | 0.1% | 0.0% | -0.2% | 1.8% |

| Aug 4 | 8:30 AM | Personal Spending | Jun | 0.6% | 0.4% | 0.4% | 0.8% |

| Aug 4 | 10:00 AM | Factory Orders | Jun | 1.7% | 0.5% | 0.7% | 0.9% |

| Aug 5 | 10:00 AM | ISM Services | Jul | 49.5 | 51.0 | 48.7 | 48.2 |

| Aug 5 | 2:15 PM | FOMC Policy Statement | - | - | - | - | - |

| Aug 6 | 10:35 AM | Crude Inventories | 08/02 | 1614K | NA | NA | -81K |

| Aug 6 | 3:00 PM | Consumer Credit | Jun | - | $7.0B | $6.0B | $7.8B |

| Aug 7 | 8:30 AM | Initial Claims | 08/02 | 455K | 420K | 420K | 448K |

| Aug 7 | 10:00 AM | Pending Home Sales | Jun | 5.3% | - | -1.0% | -4.9% |

| Aug 7 | 3:00 PM | Consumer Credit | Jun | $14.3B | $7.0B | $6.4B | $7.8B |

| Aug 8 | 8:30 AM | Productivity -Prel | Q2 | 2.2% | 2.5% | 2.5% | 2.6% |

| Aug 8 | 10:00 AM | Wholesale Inventories | Jun | 1.1% | 0.6% | 0.6% | 0.9% |

Source: Yahoo Finance , August 8, 2008.

Next week's economic highlights in the US, courtesy of Northern Trust , include the following:

1. International Trade (August 12): The trade deficit is predicted to have widened to $61.5 billion in June from $59.7 billion in May, with the oil import bill showing a noticeable increase. Consensus : $59.5 billion.

2. Retail Sales (August 13): Auto sales fell sharply to 12.55 million units in July. Non-auto retail sales were soft. The decline in gasoline prices in July should trim back the headline reading. Consensus : 0.0% versus 0.1% in June; non-auto retail sales: 0.5% versus 0.8% in June.

3. Consumer Price Index (August 14): A 0.4% increase in the CPI is predicted for July after a 1.1% jump in June. The core CPI is expected to have moved up 0.2% versus a 0.3% increase in June. Consensus : +0.3%; core CPI +0.2%.

4. Industrial production (August 15): The 0.1% drop in the manufacturing man-hours index in July points to a drop in industrial production. The operating rate is projected to have declined to 79.8% in July, the lowest since September 2005, excluding the 79.6% rate in May 2008. Factory production had declined for three straight quarters, with the 3.7% annualized drop in the second quarter the largest since the fourth quarter of 2001. Consensus : -0.1%; Capacity Utilization 79.8% versus 79.9% in June.

5. Other reports : NFIB Survey (August 12), Inventories (August 13), Consumer Sentiment Index (August 15).

Click here for a summary of Merrill Lynch 's US economic and interest rate forecasts.

A summary of the release dates of economic reports in the UK, Eurozone, Japan and China is provided here . It is important to keep an eye on growth trends in these economies for clues on, among others, which way the US dollar is going to move and how strongly.

Markets

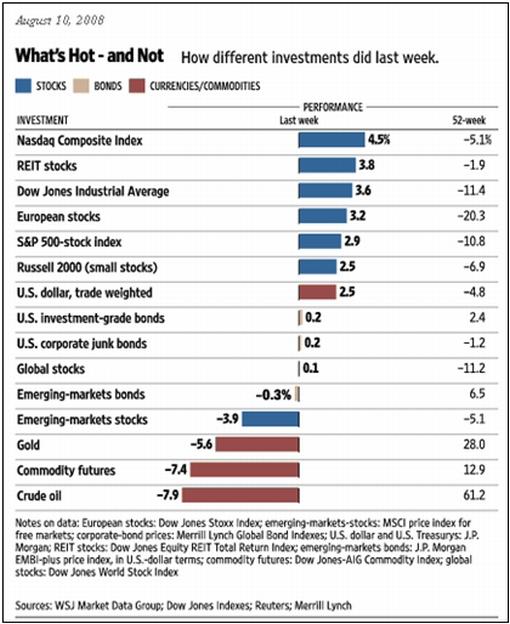

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online , August 10, 2008.

Equities

Developed stock markets, in general, soared during the past week, with gains in excess of 2.5% being the order of the day. As was the case during the previous week, the Japanese Nikkei 225 Average was the worst performer among mature markets, rising by a relatively modest 0.6%.

The emerging markets category, as a group, underperformed developed markets, with Russia (-11.3%), China (-7.0% – a 19-month low) Turkey ( 4.7%) and Hong Kong (-4.32%) leading the declines. On the other side of the scale, the Indian BSE 30 Sensex Index (+3.5%) scored a fifth successive weekly gain. The Philippines (+4.2%) and Taiwan (+3.0%) also delivered solid returns.

Interestingly, the MSCI World Index has been outperforming the MSCI Emerging Markets Index since the stock market peaks of the middle of May, gaining 4.0% in relative performance on the back of perceived increased risks in developing markets.

The US stock markets moved strongly higher, especially on Wednesday and Friday when the Dow Jones Industrial Index recorded gains in excess of 300 points. The major index movements were: Dow Jones +3.6% (YTD -11.5%), S&P 500 Index +2.9% (YTD -11.7%), Nasdaq Composite Index +4.5% (YTD 9.0%) and Russell 2000 Index +2.5% (YTD -4.1%).

It is noteworthy that the Dow Jones, Nasdaq Composite and Russell 2000 have all crept back to above their 50-day moving averages, with the S&P 500 closing the week a mere 1 point below. The Russell 2000 also managed to penetrate the key 200-day line – often used as an indicator of the primary trend.

Click here or on the thumbnail below for a market map, courtesy of Finviz.com , providing a quick overview of the performance of the various segments of the S&P 500 Index over the week.

The apparel & accessory group outperformed last week, gaining 16%. Polo Ralph Lauren (RL) and Jones Apparel (JNY) reported earnings that handsomely beat the consensus estimates. Coach (COH), the largest member of the group, rose by 20% on the back of Coach's CEO increasing his holdings in the company's stock.

The casino & gaming group (+14%) was also among the top performers. Its single member, International Game Technology (IGT), reported that it had repurchased 3% of the company's outstanding shares since the end of June.

Stocks related to the energy sector (-4.6%) and materials sector (-3.0%) were at the bottom end of the week's performance table.

The thrifts & mortgage finance group was the worst-performing group for the week, down by 12%. The two largest members of the group, Fannie Mae (FNM) and Freddie Mac (FRE), both reported losses in excess of the analyst consensus estimates as they continue to be negatively affected by the housing decline and mortgage-related credit problems.

In other corporate news, Citigroup (C) and UBS (UBS) agreed to settle allegations of misrepresentation in the marketing of auction-rate securities. Separately, Moody's indicated that it had placed American Express' (AXP) A1 rating on review for a downgrade.

Fixed-interest instruments

UK, Eurozone and Japanese government bond yields declined during the past week as the economic outlook for those parts of the world worsened.

The UK ten-year Gilt yield declined by 17 basis points to 4.68%, the German ten-year Bund yield by 7 basis points to 4.26% and the Japanese ten-year bond yield by 4 basis points to 1.47%. The ten-year US Treasury Note, however, was almost unchanged at 1 basis point higher, closing at 3.95%.

US mortgage rates rose, with the 15-year fixed rate and the 5-year ARM both 7 basis points higher at 6.08% and 6.06% respectively.

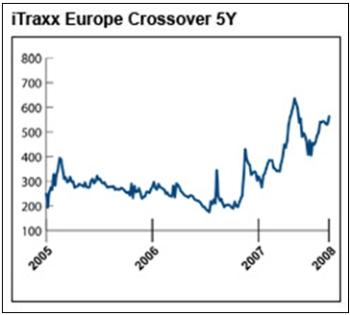

Credit market stress was almost unchanged in the US, but worsened in Europe as reflected by the spread of the Markit iTraxx Europe Crossover Index widening from 531 to 563.

Source: Markit/Creditex

Currencies

The US dollar surged following an acknowledgment of weakening growth in the Eurozone by ECB President Trichet, prompting traders to think the ECB would not be hiking rates further to fight inflation.

The US Dollar Index now trades above its 50-day and 200-day moving averages, signaling a breakout from its five-month trading range.

The greenback rose against the euro (+3.2% – a five-month high), the British pound (+2.9% – a 20-month peak), the Swiss franc (+3.0%), the Japanese yen (+2.2%) and the Canadian dollar (+3.7%).

The Australian dollar (-3.9%) and New Zealand dollar (-3.1%) also lost badly against their US namesake as a result of slowing economic growth pointing to interest rate cuts.

Commodities

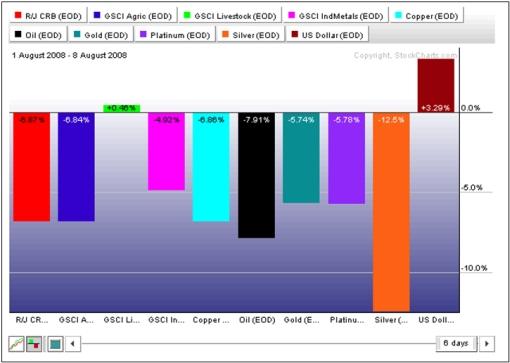

The dollar's rally and growing concerns of slowing demand knocked down dollar-denominated commodity prices as seen in the Reuters/Jeffries CRB Index plunging by 7.4%.

Crude oil, understandably, received the most attention in the commodity sell-off given its strong link to the economy. The price of West Texas Intermediate crude dropped by 7.9% for the week to $115.20 a barrel, i.e. a decline of 20.9% since its high on July 11.

Precious metals remained out of favor, with silver down 12.5%, platinum 5.9% and gold bullion 5.6%. The yellow metal dropped to a three-month low, falling below its 200-day moving average. Among base metals, copper declined by 6.9%.

As far as agricultural commodities were concerned, an expected reassurance from the US Department of Agriculture on the outlook for this year's harvest caused corn to nosedive 11.8%, soyabeans 12.0% and wheat 2.8%.

The chart below shows the past week's damage for the various commodities.

Source: StockCharts.com

Now for a few news items and some words and charts from the investment wise that will hopefully assist with our preparation to achieve investment success. It is a prerequisite for success at the Beijing Olympics that athletes be extraordinarily well prepared. Likewise with managing our investments.

Source: Slate

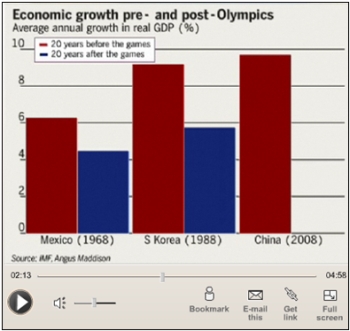

Financial Times: Beijing Olympics in perspective

John Authers discusses the market implications of the Beijing Olympics.

Source: John Authers, Financial Times , August 8, 2008.

Financial Times: A year in a tin hat – one-year anniversary of the credit crunch

FT Alphaville's Paul Murphy narrates a short guide to the 12 months of the credit crunch.

Source: Financial Times , August 5, 2008.

CNBC: Faber says US economy in recession; “long” on dollar

“Investor Marc Faber, publisher of the Gloom, Boom & Doom Report, talks with Bloomberg about the euro's performance against the US dollar, the commodities market and the global economy. The euro fell the most in almost eight years against the dollar as traders pared bets the European Central Bank will raise interest rates as the economy slows.”

Source: CNBC , August 8, 2008.

CNBC: Hugh Hendry (Eclectica Asset Management) – the state of the market and opportunities

Source: CNBC , August 1, 2008.

GaveKal: Investment environment is starting to improve

“… is this simply a bounce from the extreme levels that we highlighted three weeks ago? Or is the investment environment starting to improve? … we argue the following:

• Oil prices are rolling over. From their highs in July, crude prices are now down more than -18%. As we see it, this is a sign that the ongoing demand destruction is finally impacting price movements. Most importantly, the short-term pressures of Chinese demand – the biggest driver of the oil rally – are now rapidly abating.

• Policy responses to the credit crunch have helped. To successfully get out of a financial squeeze you need three things: 1) a cheap currency, 2) a positive yield curve, and 3) the recapitalization of bank balance sheets. With surprising speed, all three of these conditions are now being met in the US. Yesterday, the Fed decided to keep rates at 2%, giving no outright signal for imminent hikes. As such, the yield curve is poised to stay positive, giving banks more time to rebuild their balance sheets. While we believe the Fed's next move will be a hike, this will not happen for a while.

• OECD inflationary pressures are abating. Given that a) the Fed has kept monetary aggregates in check, b) banks have severely curtailed their lending, and c) the US current account deficit – an important source of global liquidity is now narrowing, rising inflationary pressures around the world seem unlikely.

• Parts of the US economy are being boosted by the weak US$. Even though the US$ has gained some footing in recent weeks, it is still down some -12% since December 31, 2006. As can be expected, this has sparked record exports, which, in turn, have boosted US manufacturing activity. This development is likely to keep the US from falling into a recession.

“So the investment environment is not that dire. In fact, away from the massive volatility prevalent in the financials and commodity space (which together seem to account for almost 50% or more of most indices, and volumes traded), other sectors (technology, healthcare, staples …) are holding their own. At this juncture, we reiterate our belief that it makes more sense to focus on these forgotten parts of the market and resist the urges to call tops, or bottoms, in the overcrowded financial and commodity spaces.”

Source: GaveKal – Checking the Boxes , August 6, 2008.

Bloomberg: Global economy “close” to recession in 2009, UBS says

“The world economy is ‘precariously close' to a recession in 2009, UBS said as it cut next year's global growth forecast due to a US slowdown.

“Global gross domestic product will expand 2.9% next year, from an earlier prediction of 3.1%, UBS chief economist Larry Hatheway wrote in a report published yesterday. UBS considers a 2.5% global growth rate as one that is consistent with a recession.

“A global recession would be the first since 2001-2002, and may ease inflation that's already projected by the International Monetary Fund to be the fastest in nine years.

“‘Softer global economic activity for longer suggests peaking and then declining inflation,' Hatheway said. ‘A sustainable recovery of ‘risk' assets probably requires policy recognition that the primary macroeconomic challenge remains weak growth, not temporarily high inflation.'

“The Fed will cut interest rates by a further half percentage point this year, from the current 2% rate, UBS predicts. The ECB and the Bank of England will probably lower borrowing costs next year, Hatheway said.”

Source: Shamim Adam, Bloomberg , August 7, 2008.

Financial Times: UBS's George Magnus – downturn could hit developing countries

“George Magnus, senior economic advisor of UBS, talks about the impact of the credit crunch on companies and nations. He believes there will be low growth up to and beyond 2010 and the slowdown will hit emerging markets as well as rich nations.”

Source: Financial Times , August 8, 2008.

CNBC: The frugal future

Thoughts on the future of the economy, with David Rosenberg, Merrill Lynch North American economist.

Source: CNBC , August 6, 2008.

Bloomberg: Mobius says Fed should cut rates to 1% to boost economy

Mark Mobius, executive chairman of Templeton Asset Management, talks with Bloomberg about Federal Reserve monetary policy, oil prices and investment opportunities in emerging markets.

Source: Bloomberg , August 5, 2008.

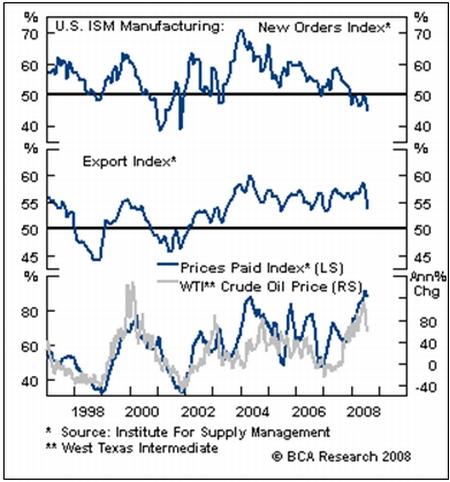

BCA Research: US Manufacturing – global weakness adds to domestic drag

“The July ISM manufacturing survey showed further softening in already weak domestic demand, while a slowing in overseas growth presents a new headwind.

“Global leading economic indicators have rolled over, implying that slower overseas growth will diminish one of the key sources of support for US manufacturers. The July ISM manufacturing survey reported a drop in export orders (albeit the index is still well above its boom/bust line). A slowdown in exports is worrisome because this sector had been the primary source of growth for manufacturers in the past year, as the domestic economy is mired in recession.

“The only silver lining is that energy prices have finally begun to recede. Although oil prices will have to move substantially lower before having a significant economic impact, energy price relief will help to ease pressure on profit margins and lower inflation expectations.

“Bottom line: The overall manufacturing sector will continue to grow at a sub-par pace, and the risks will stay on the downside until the consumer retrenchment is further advanced and/or much more relief from commodity prices arrives.”

Source: BCA Research , August 6, 2008.

Asha Bangalore (Northern Trust): Fed policy statement is marginally dovish

“The Fed left the Federal funds rate unchanged at 2.0%, no surprises here. President Fisher dissented; he would have preferred a higher Federal funds rate. The committee included one new member, Governor Elizabeth Duke, who voted in favor of holding the federal funds rate unchanged.

“The Fed retained most of the June 25 statement but rearranged the order of sentences and made subtle but important changes. First, the phrase ‘downside risks to economic growth remain but they appear to have diminished somewhat' is missing. Also, in place of ‘economic activity continues to expand,' the latest statement notes that ‘economic activity expanded in the second quarter'. These changes with regard to growth suggest that the FOMC is less optimistic about economic growth.

“Second, the more hawkish part of the June 25 statement – ‘the upside risks to inflation and inflation expectations have increased' is eliminated entirely. The recent reduction in energy and commodity prices is captured by the phrase ‘earlier increases in prices of energy and some other commodities' as opposed to ‘continued increases in prices of energy and some other commodities', which suggest that the FOMC views recent downward movements in energy prices as meaningful.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , August 5, 2008.

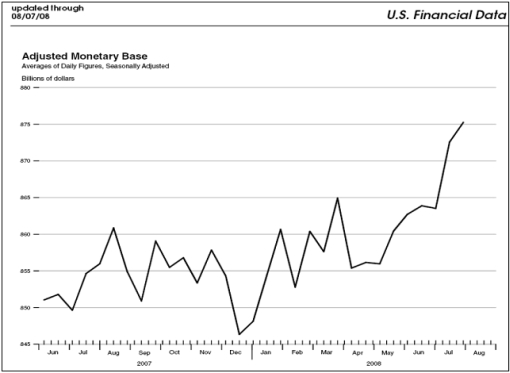

Bill King (The King Report): Adjusted Monetary Base continues surge

“The ‘Adjusted Monetary Base' as calculated by the St. Louis Fed continues its near-vertical surge.”

Source: Bill King, The King Report , August 8, 2008.

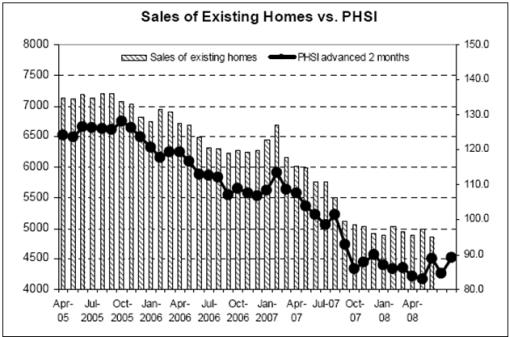

Asha Bangalore (Northern Trust): Pending Home Sales Index moves up

“The Pending Home Sales Index (PHSI) of the National Association of Realtors increased 5.3 points to 89.0 in June. According to the National Association of Realtors, the PHSI leads sales of existing home sales by one or two months. Based on this, sales of existing homes should show gains in the July-August period.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , August 7, 2008.

Asha Bangalore (Northern Trust): Credit crunch and weak employment conditions continue to weigh on housing market

“The Mortgage Bankers Association's Mortgage Purchase Index rose to 315.2 during the week ended August 2 from 309.5 in the prior week. According to the Mortgage Bankers Association, FHA loans accounted for a large part of the increase in the index, while applications for conventional mortgage loans declined.

“Sales reports of existing and new home for June contained faint signs of a housing market mending but additional support from a pickup in hiring and willingness of banks to lend money will be necessary for stability in the housing market.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , August 6, 2008.

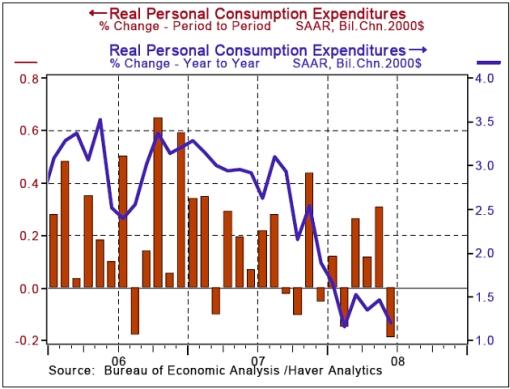

Asha Bangalore (Northern Trust): Outlook for consumer spending remains gloomy

“Nominal consumer spending increased 0.6% in June, following a 0.8% jump in May. These headlines overstate the strength in consumer spending. After adjusting for inflation, consumer spending fell 0.2% in June after a 0.3% increase in May. On a year-to-year basis, consumer spending showed to a 1.2% increase in June, the smallest gain since October 2002.

“Given the weakness in labor market conditions and the absence of the one-off tax rebate check, consumer spending will most likely decline in the third quarter.

“Personal income increased 0.1% in June after a 1.8% gain in May. The difference in growth of personal income reflects the impact of the Economic Stimulus Act of 2008. Excluding the impact of tax rebates, personal income increased 0.3% in June, following a 0.4% jump in May.

“The overall personal consumption expenditure price index moved up 0.8% in June, putting the year-to-year increase at 4.1%.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , August 4, 2008.

CNBC: Freddie's forecast seems a little too bright

“I came away from the Freddie Mac conference call feeling a little, shall we say nicely, confused.

“The CEO, Richard Syron, warned of the troubled times in housing, even revised his forecast for home price drops, peak to trough, from 15% to 18-20%. He said we're only halfway through the correction.

“But then one of his underlings went on to assure everyone that Freddie would be able to withstand $40 billion worth of credit pain through 2009 (if it finishes raising that $5.5 billion it promised). He also talked about how they may reverse some of the previously estimated losses as the portfolio does better than expected.

“Here's the issue: write-downs. Unless you've been trapped under something heavy for the past year, you probably know that this is the crux of the credit crash. Wall Street has been writing down the value of all these mortgage-backed securities, as foreclosures and defaults rise on home loans and prices continue to fall. That has taken billions and billions of dollars off the nation's corporate balance sheets and caused the collapse of the likes of Bear Stearns and many many others.

“Freddie, in the second quarter, wrote down the value of its subprime and Alt-A portfolio by $1 billion. Freddie is claiming that they can hold these securities to maturity and not have to take a loss, because over time, the dire predictions of defaults on these loans just won't come to pass. Freddie's subprime and Alt-A portfolio is about $130 billion. Think of that. Just $1 billion in writedowns.

“I think Armando Falcon, a former head of OFHEO, said it best when I interviewed him yesterday:

“‘They've only written them down by let's say five or 6% total over the past few quarters. If those were sold on the market they would get maybe 50 cents on the dollar for these securities. At some point they can't delay the inevitable about having to mark these assets down to their true market value. They are now holding them close to book value, based on the theory that these are temporary impairments. As the market continues to decline into next year, it will be clear that these aren't just temporary impairments. Then the government will not be able to allow this forbearance on recognizing losses much longer.'”

Source: Diana Olick, CNBC , August 6, 2008.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.