Stock Market Breakout or Breakdown?

Stock-Markets / Stock Market 2017 Feb 27, 2017 - 02:39 PM GMT Good Morning!

Good Morning!

SPX closed at the trading channel trendline on Friday without making a new high. In that context, it may be viewed as a possible wave (ii). However, it’s not over until it’s over. The SPX futures made a higher high in overnight trading. They are currently negative, but not so much as to proclaim victory for the bears. A decline beneath Friday’s low at 2352.87 would break the upward bias. Otherwise a breakout appears that it may be the final Wave c of (v) of [c].

ZeroHedge reports, “In a quiet night for markets, in which the top highlight was the Oscar's historic peddling of best picture "fake news" and where "millions" of Academy members seemingly voted illegally, European stocks were little changed after a selloff that pushed them to a two-week low, while the MSCI Asia index fells as Japan’s Topix dropped for third day. S&P futures were unchanged after hitting a a fresh all time high on Friday. Oil futures gained, with the dollar little changed against a basket of major currencies. Priceline, Albemarle and AES are among companies reporting earnings. Dallas Fed manufacturing activity, durable goods sales data due.”

ZeroHedge comments, “With The Dow Jones Industrial Average trading almost 50% higher than its 2007 peak, we thought it ironic that core Industrial durable goods orders remain well below the peak in 2008...

Probably nothing...”

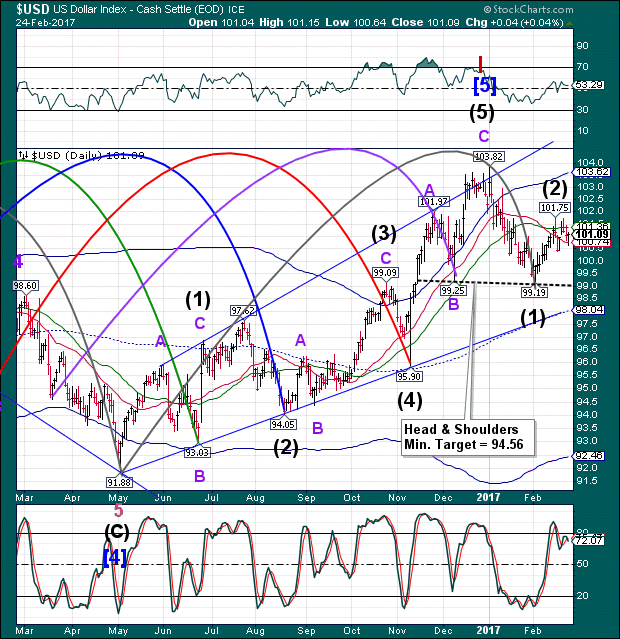

The direction of the markets may depend on the action in the USD futures. A decline beneath 100.64-100.74 puts USD on a sell signal, dragging treasury yields and the stock market with it.

USD/JPY is on a bounce this morning. It appears that the bounce may be over….or nearly so.

VIX futures are higher this morning, potentially putting it back on an aggressive buy signal. After all this back-and-forth in the past two weeks, it may be advisable to wait for the breakout above 12.52-12.86.

Of course, we will be scrutinizing the Hi-Lo index for a breakdown, as well.

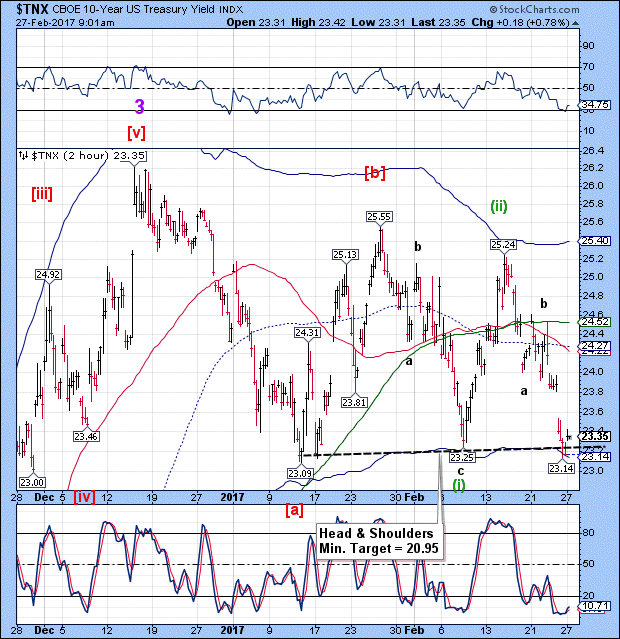

TNX is on a bounce after challenging its Head & Shoulders neckline. It is on a sell signal and the expectation is that it may continue its decline shortly. According to the Cycles Model, TNX may have another two weeks of decline left.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.