Major Funds Betting On Trump BioTech Sector

Companies / BioTech Feb 28, 2017 - 10:32 AM GMTBy: TLSReport

Donald Trump's presidency is a real nitro boost for the future of the biotech sector in the U.S., says Tom Beck, editor of Portfolio Wealth Global.

Donald Trump's presidency is a real nitro boost for the future of the biotech sector in the U.S., says Tom Beck, editor of Portfolio Wealth Global.

Donald Trump's presidency is a massive boost to all industries, and is a real nitro boost for the future of the biotech sector in the U.S.

With 80 million baby-boomers looking to stay young and vital for a very long time, you should be making your move, and market-beating returns will be occurring from the large-cap stocks and in the small-cap sector even more so.

While Democratic nominee Hillary Clinton took an anti-biotech stance since the beginning of her deeply flawed presidential campaign, Trump's win was a welcome relief to investors who were worried about another four years of anti-business rhetoric, attacks, high taxes, damaging and flawed regulatory practices—specifically increased price controls under a possible Clinton administration. The U.S. is already struggling with a central bank that prints money like there are no repercussions to its actions.

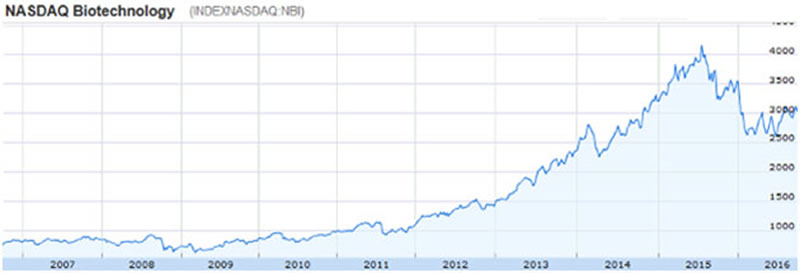

See how the mid-2016 recover of biotech stocks has gained pace ever since the election results came out on Nov. 8, 2016.

images.angelpub.com/2016/40/40360/biotech-index-chart-nbi.png

A lot of biotech investors sold off their stocks in anticipation of a Clinton presidency.

Now that Trump has won the White House, it's a magnificent time for investors to re-evaluate their association with this high-growth sector and several other high-priority sectors that are set to erupt to the upside. Let's take a closer look at what a Trump administration means for the biotech industry.

Trump was a lot more supportive of the biotech industry than Clinton and Portfolio Wealth Global has become bullish on this sector in our portfolio, as well as researching this one particular Trump Stock.

He was consistent in his support of Medicare re-importation and negotiation, but has largely maintained silence on the issue of drug pricing. When governments impose price controls on business, the free market suffers, as in the case of Cuba.

The baby boomers are now retiring in droves and new babies are being conceived daily—companies that are lined up to cater for health care needs will see tremendous inflows of cash-flow.

However, hope comes in the form of Trump's pro-business stance. This means he is going to be less of a headwind or a detriment on the biotech industry's profits. What this indicates is that biotech stocks are set to perform better under Trump's leadership than anticipated.

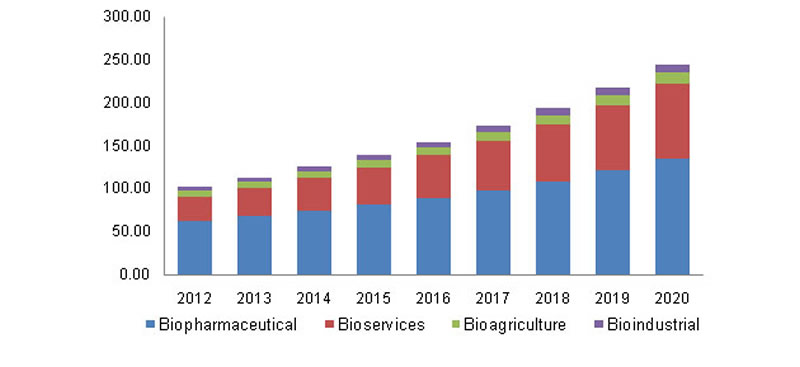

Notice what industry analysts predict in terms of biotech industry growth until 2020.

www.grandviewresearch.com/static/img/research/biotechnology-market.png

Future Prospects

One of the most significant policy positions of Trump's campaign trail was the repealing of Obamacare. If he keeps his word on the dismantling the Affordable Care Act or unaffordable care act which has already begun, it will have major repercussions on biotech stocks.

For starters, Obamacare used to levy burdensome taxes on the drug industry (and everything else), and this drastically lowered profitability, which means fewer drugs for terrible diseases are pursued.

The Branded Prescription Drug Fee especially levied a tax on drug manufacturers that was equivalent to their market share. Trump will be blasting all these regulations out of the park.

A specific tax target is established on an annual basis, and this needs to be collected from the drug industry. In 2017, this target is set to cross the $4 billion mark, up from $3 billion last year.

Instead of draconian taxes, these newly-profitable companies would be able to bid for Small-Cap Cutting Edgers, making Portfolio Wealth Global members the clear winners.

Already our 2016 picks are up big double-digits, but in 2017, we are already building a Watch List of high-potential stocks from biotechnology, Nanotechnology, Marijuana, Natural Resources and High-Tech patents.

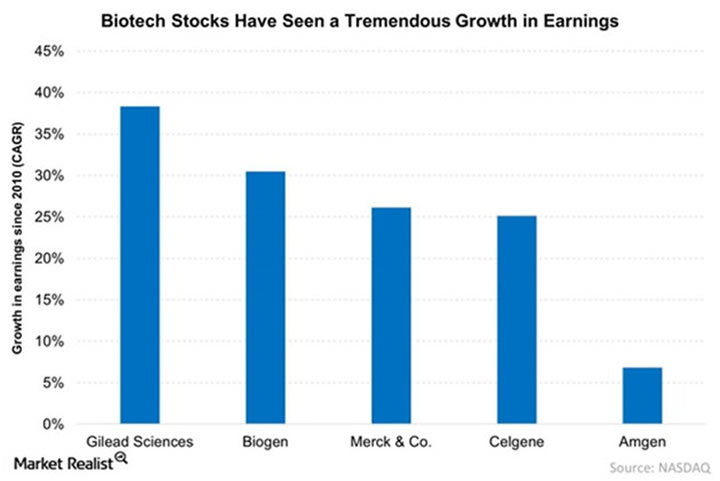

Biotech stocks that have consistently performed well are poised to reap the maximum benefits; some examples are shown in the bar graph below. We will soon publish our highest-ranked picks from the sector.

marketrealist.imgix.net/uploads/2015/05/Biotech-Stocks-Have-Witnessed-a-Tremendous-Growth-in-Earnings

Expected Tax Plan

The tax plan suggested by Trump means to cut down the business tax rate from 35% to 15%. This would signal that the tax burden on profit-generating, large-cap biotechnology firms will certainly drop significantly.

Moreover, Trump has indicated a one-time discount on the taxes owed by corporations which repatriate cash held abroad.

Under the plans made by Trump, large-cap stocks in the biotech industry that have cash overseas have the potential to "bring in" as much money as they can while paying only 10% tax on it. Theoretically, this money may be used for buying back stocks that boost income per share, drug research, acquisitions and mergers and dividends.

All signs point to the fact that his election will be bullish for biotech stock investors, specifically those who focus on Small-Cap biotechnology stocks.

Tom Beck is senior editor of Portfolio Wealth Global. Known as one of the first millennial millionaires in the United States, Beck is a relentless idea machine. After retiring two years ago at age 33, he's officially come out of retirement to head up Portfolio Wealth Global. He brings a vision of setting a new record for millionaires with his seven-year plan to accelerate any subscribers' net worth who will commit to the income lifestyle. Beck delivers new ideas on the marketplace that were once only available to the rich. Traveling the world, he's invested in over a dozen countries, including real estate.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Tom Beck and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. The author was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview/article until after it publishes.

All charts provided by author.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.