Stocks are higher, but the Fed trumps Trump

Stock-Markets / Stock Market 2017 Mar 01, 2017 - 03:39 PM GMT Good Morning!

Good Morning!

President Trump’s speech appeared to be his most “presidential,” but was short on details.

The surging dollar and rising SPX futures give some indication that Trump is still getting the benefit of the doubt.

SPX futures have broken out to a higher level this morning. This morning’s ramp appears to be a sub-Micro Wave [3]. Waves [4] and [5] should take the rest of the day. Given this (new) scenario, Wave (v) equals Wave (i) at 2385.06.

Global stocks ramped higher overnight. ZeroHedge comments, “While many Wall Street traders expecting Trump to unveil details of his economic plan went to bed empty handed last night, that was not enough to halt the market rally with the narrative shifting to Trump's "measured", "presidential" tone in which he offered an olive branch to both Democrats and Republicans in Congress while promising to make concessions and providing another round of grand visions for the US. Trump urged Americans to abandon conflict and help him remake the fabric of the country, a moment he hopes will turn the page on his administration’s chaotic beginning and bring clarity to his policy agenda. He offered few new proposals and made no suggestions on how he would pay for his plans, including a replacement of Obamacare, a tax overhaul including cuts for the middle class, $1 trillion in infrastructure investment and a large increase in defense spending.”

USD futures ramped to a high of 101.89, extending its retracement to 58.3% in overnight trading. That may not be the full extent of the retracement. A 61.8% retrace would take the USD to 102.05, for example.

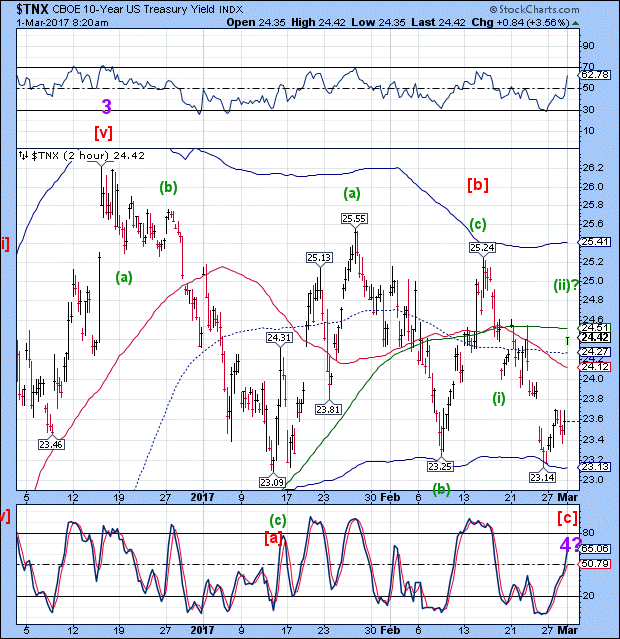

The Federal Reserve policymakers took center stage, raising the odds of a rate hike from 50% to 80%. As a result, the TNX futures surged to challenge its 50-day Moving Average at 24.51 with an overnight high of 24.42.

Bloomberg observes, “Fed speakers trump Trump,” Richard McGuire, the head of rates strategy at Rabobank International in London, wrote in a note. Trump’s speech lacked “fresh content for the market to trade off, with big tax cuts, deregulation and an infrastructure plan being mentioned but not supported by any details. Given this, all focus instead turned to the slew of hawkish rhetoric from Fed speakers.”

This creates a very large “inside” consolidation. There are two unfilled gaps below this level, the lowest at 18.62. I put a question mark on Wave 4 since there is plenty of room to continue this decline. However, a break above the 50-day tips the scales toward a possible Wave 5 underway, while a resumption of the decline beneath the 50-day says that Wave 4 is still active.

These wide swings have to be giving traders fits. The Cycles Model suggests the next Master Cycle low may be during the week of March 20.

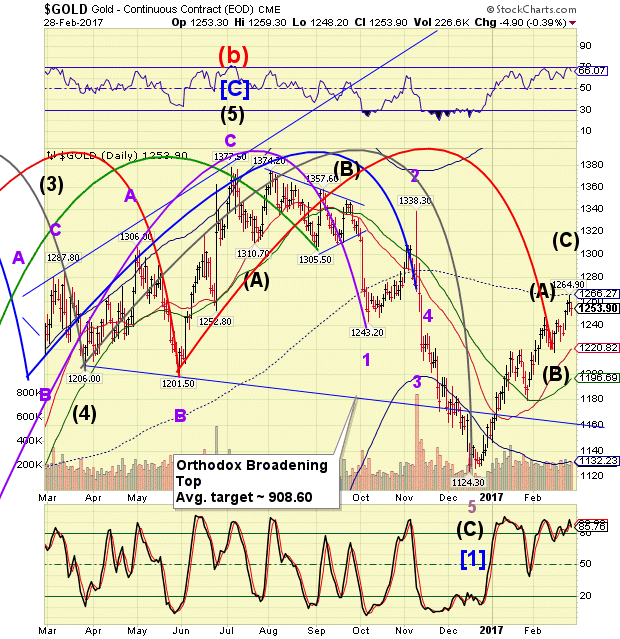

Gold futures hit an overnight low of 1240.00, overlapping an earlier high in the rally. There may be a need to make one more probe higher and that may happen (with overlap) in an Ending Diagonal. GLD shows clearly as an Ending diagonal with one more probe higher, as well.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.