Gold Pressured By Increasing Odds of March FED Rate Hike

Commodities / Gold and Silver 2017 Mar 01, 2017 - 05:07 PM GMTBy: Jason_Hamlin

The gold price has corrected by roughly $25 over the past few days. This pullback has been driven by increased odds of a Fed rate hike during March. Federal Reserve officials have been making hawkish comments lately, which has been supportive of the USD index and thus bearish for precious metals. After hitting a 2017 high of $1,265 on Monday, the gold price has since dropped back to $1240 today.

The gold price has corrected by roughly $25 over the past few days. This pullback has been driven by increased odds of a Fed rate hike during March. Federal Reserve officials have been making hawkish comments lately, which has been supportive of the USD index and thus bearish for precious metals. After hitting a 2017 high of $1,265 on Monday, the gold price has since dropped back to $1240 today.

On Monday the odds of a March rate hike were around 40%, but they have since increased to around 70% to 80% today. New York Fed President William Dudley told CNNMoney on Tuesday that the case for raising interest rates is growing.

“I think the case for monetary policy tightening has become a lot more compelling,”

San Francisco Federal Reserve Bank President John Williams also made hawkish comments:

“In my view, a rate increase is very much on the table for serious consideration at our March meeting. We need to gradually ease our foot off the gas in order to avoid a ‘too hot’ economy that in the end isn’t sustainable.”

Yellen speaks Friday and will give investors the best indication of where the Fed is headed going into its two-day meeting on March 14-15. While I have no crystal ball, I don’t think the FED will raise rates again during March. If they do, it will be by a maximum of 25 basis points.

The ISM manufacturing index rose more than expected this week, from a reading of 56 to 57.7. This news also contributed to the lower gold price, as improving economic fundamentals decrease investor appetite for safe haven assets and lend support to the dollar.

However, the labor market was weaker than expected with the employment index falling to 54.2, down from January’s reading of 56.1. Inflation also remains muted with the prices index falling to 68, down from the previous reading of 69. This data would suggest that a rate hike is not quite as pressing as the headline numbers might suggest.

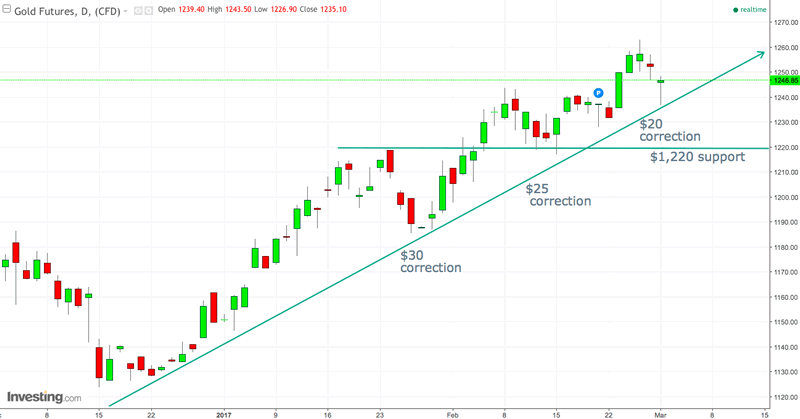

The gold chart shows that the current pullback is nothing to be concerned about. The gold price has corrected by $30 and $25 already in 2017 and both times it was followed by a resumption of the uptrend. I think the current correction will be no different and am looking for support at $1,220 to hold. This level is significant because it was resistance in late January and support during February. The 100-day moving average is also right around this level, currently at $1,216 but rising.

If support at $1,220 should fail, look for support at $1,200 to hold. The $1,200 level was key support twice during 2016 and coincides roughly with the 50-day moving average.

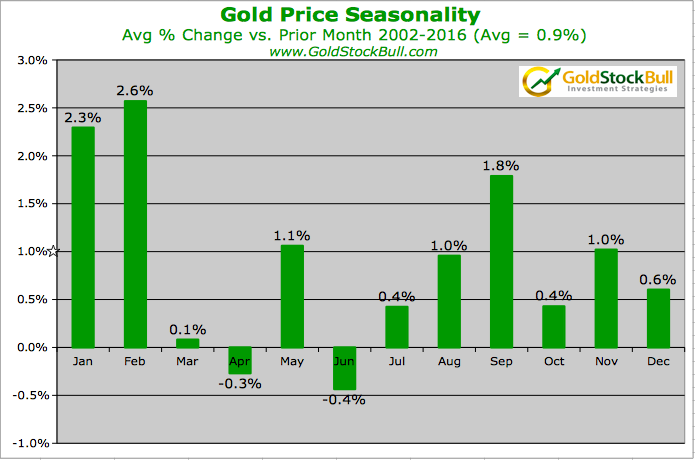

The bottom line is that the current pullback in gold and silver prices is a normal part of any bull market cycle and should not lead investor to panic out of their positions. Last week we turned short-term bearish and warned subscibers that a pullback was likely. March and April tend to be very weak seasonal months for precious metals.

Some investors view this as a cue to turn their attention elsewhere, but it is precisely during these months that the best buying opportunities can be found. So, we are actively screening a large number of mining stocks, running our valuation models, doing cross-company comparisons, contacting management about upcoming catalysts and narrowing our list of target stocks to buy on the dip.

This new bull cycle in precious metals that started in January of 2016 cannot be stopped by Federal Resereve jawboning or minor rate hikes from NIRP to ZIRP. Rates remain well below historic norms at we don’t see this changing anytime soon. There will be no modern day Volcker, because the conditions that neccesitated his aggresive rate hikes do not exist today.

We believe the gold price is headed to $2,000 within the next few years and that mining stocks will continue to offer compelling leverage. Junior mining stocks in particular are going to geneate spectacular gains for investors and our portfolio is well-positioned to take advantage of these trends. We believe that for long-term gold investors, all dips over the next several years will prove to be excellent buying opportunities.

If you would like to view the GSB portfolio, receive our newsletter, research and trade alerts, you can sign up here.

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. Click here for instant access!

Copyright © 2017 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.