Have Central Banks Finally Achieved the Unthinkable, Inflation Unleashed?

Economics / Inflation Mar 02, 2017 - 05:08 AM GMTBy: Graham_Summers

Globally inflation is on the rise.

Globally inflation is on the rise.

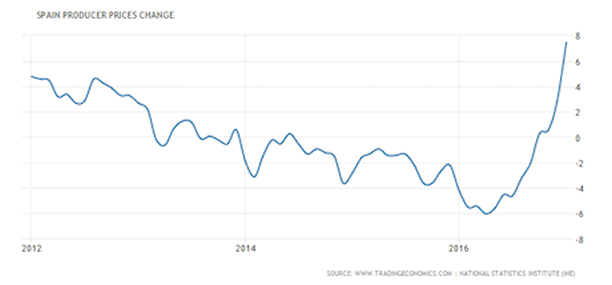

On Monday Spain reported a year over year 7.5% jump in its PPI reading (a measure of inflation). Take a look at that chart.

Spain is just the latest major economy to join the inflationary tide.

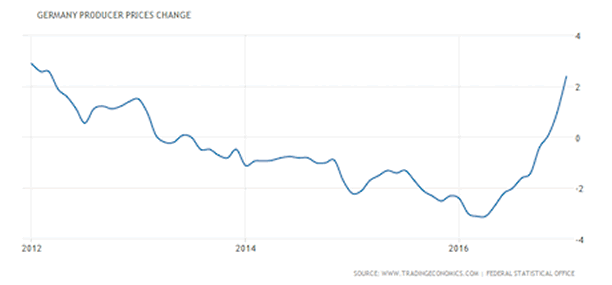

German also saw a recent spike in its PPI.

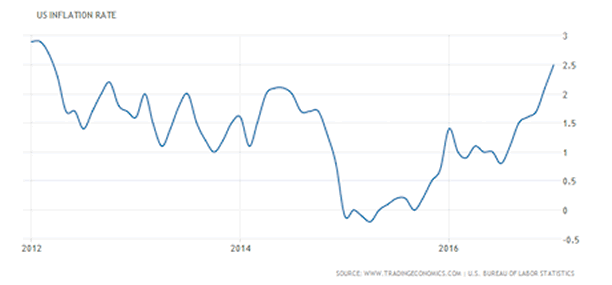

In the US, inflation is now well above the Fed’s target 2%, having ripped over 3% higher in the last six months alone.

This is much bigger than Trump or any single factor. After eight years of low interest rates and Trillions of Dollars in QE spent, global Central banks have finally unleashed inflation…

The big problem with this is that inflation is like ketchup in a bottle. It always takes longer to get achieve than you’d predict… but once it hits, you usually get more than you hoped for.

This is the sort of environment in which a major market event could happen. Over $100 trillion in bonds are at risk of entering a bear market if inflation REALLY takes hold.

And while the odds are low that we get an actual Crash… this environment is more conducive to Black Swan events than any other in the last seven years.

If you’re looking for active real time “buy” and “sell” alerts to help you make money from the markets I strongly urge you to take out a 98 cent trial to my Private Wealth Advisory newsletter.

Private Wealth Advisory is a weekly investment advisory that tells investors what stocks and ETFs to buy and sell… and when to do so.

Does it work?

A full 86% of our investments made money in the last 26 months. Yes, 86%, meaning we make money on more than 8 out of 10 closed positions.

Currently our portfolio is chock full of winners too, including gains of 10%, 12%, 15%, 25% even 33%.

Heck earlier this week, we just closed out an 18% winner this morning.

Best of all, you can explore Private Wealth Advisory for 30 days for just $0.98.

To do so…

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2016 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.