Stock Market At the Brink...

Stock-Markets / Stock Market 2017 Mar 02, 2017 - 03:55 PM GMT The Markets appear to be dependent on what happens to the USD. This morning USD futures rose as high as 102.11, apparently completing the final probe of the retracement at a near Fibonacci 63%. A reversal from this high sets the wheels in motion with a decline beneath the 50-day Moving Average offering a sell signal.

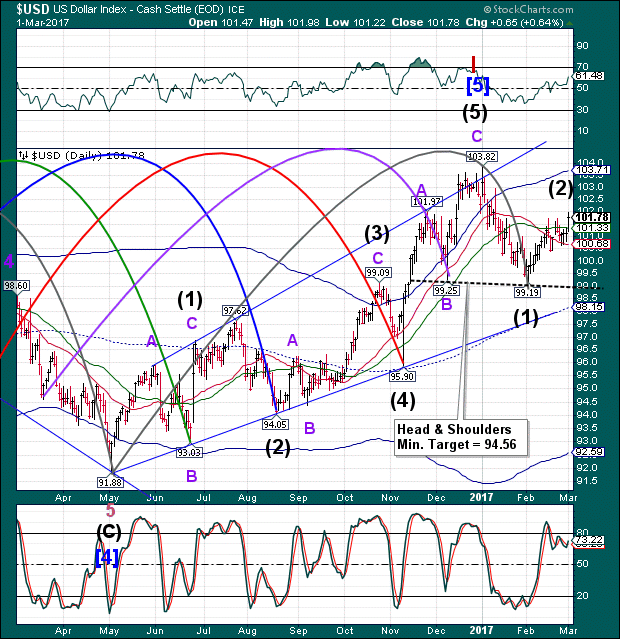

The Markets appear to be dependent on what happens to the USD. This morning USD futures rose as high as 102.11, apparently completing the final probe of the retracement at a near Fibonacci 63%. A reversal from this high sets the wheels in motion with a decline beneath the 50-day Moving Average offering a sell signal.

SPX futures are flat this morning, awaiting the turn in USD. Yesterday was calendar day 61 (60.2 is divisible by 4.3) and market day 43 (including holidays) from the December 30 low. One interesting note is that March 13 is day 130 from the November 3 low. November 3 is day 129 from the Brexit low. The Brexit low is 137 days from the February 11 low. And the February 11 low is 136 days from the September 29, 2015 low. All of these Cycles appear to be denominated by 129 days, which are Primary Cycles. July 20 also figures prominently as a potential Cycle low which is 129 days from March 13.

The 2008 decline came in 120 day Cycles. That extra bit of time can make a big difference in the magnitude of the declines.

VIX futures are flat to mildly lower this morning. We await the breakout above the inverted Head & Shoulders neckline for confirmation of the buy signal.

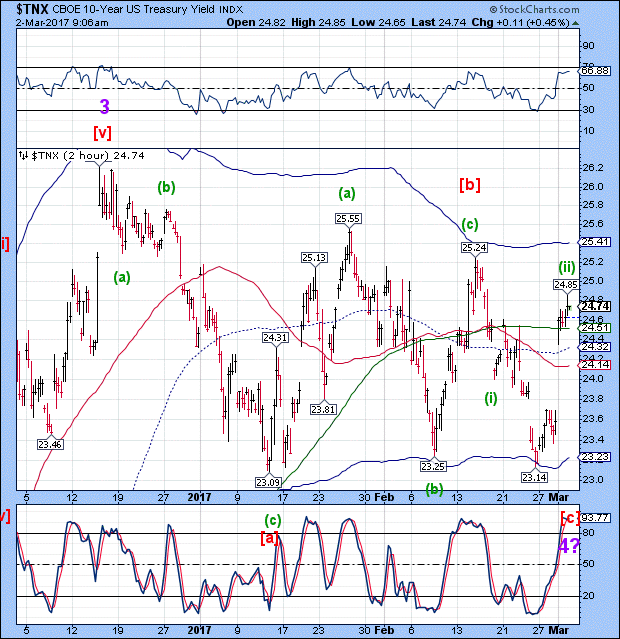

TNX appears to have completed its retracement at 81.4%. We must see the turn and a decline beneath the 50-day Moving Average for a sell signal. The expanded/irregular correction tells us that TNX may not linger too long at the top of this retracement.

The Fed seems determined to raise rates, not because of the data, but because the market seems to be very resilient.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.