Investment Lessons to Be Learned from Golf

Stock-Markets / Investing 2017 Mar 04, 2017 - 12:00 PM GMTBy: David_Galland

Dear Paraders,

Dear Paraders,

In my youth, I viewed golf as something only old people enjoyed. Make that OLD people.

While I was never much for sports, in my early forties I discovered polo, one of the most exhilarating sports on the planet, of which golf is pretty much the antithesis.

As polo is also one of the world’s most dangerous sports, I began to play less frequently when our children arrived, hanging up my spurs entirely about eight years ago.

Around the same time, we began to shift our life to Argentina as part of the founding group of La Estancia de Cafayate. As the project included a golf course designed by the late great Bob Cupp, I decided I should learn a bit about the game.

On the face of it, golf appears to require little more than swinging a club at a stationary target. Compared to connecting with a bouncing polo ball while mounted on a horse running 20 miles an hour and other riders bumping into you, it appears to be child’s play.

Likewise, connecting the sweet spot of a bat with a baseball flying at 100 mph seems a far more daunting task.

Yet, with a bit of time, one learns there are many aspects of golf that make it special. So special, in fact, that aficionados will abandon their families for entire weekends in order to chase a little white ball over hill and dale.

Which made me wonder what it is that makes golf so addictive. In the process of finding out, I discovered useful parallels between golf, living a fulfilled life, and even investing.

Why Golf Doesn’t Suck

Even if you aren’t a golfer or interested in enhancing your life, stick with me a bit and I will discuss lessons you can learn from golf that you can put to work in the rather more serious business of investing.

First, however, a quick run-through of some things about golf you may not know or fully appreciate.

Golf contains the secret of happiness.

A sizable industry exists around identifying the various ways we humans can more readily experience a state of happiness. While the topic would warrant a very long Parade, one proven “secret” to being happy involves setting a goal or goals just above your ability to accomplish them… and then conquering them.

As a beginner golfer, that describes pretty much every shot. Yet even the most experienced and competent players will regularly be confronted with a shot that seems all but impossible. Say, a 40-foot putt on an undulating green to win a championship.

To fully appreciate the point, look at the photo of Tiger Woods below. Here is a man who has played the game since he was two years old, and yet he couldn’t be more energized or more excited, because he made a difficult putt at the right time.

The average golfer will hit the ball more than 90 times during a game. Each and every one of those shots represents a fresh new challenge, perhaps out of a bad lie, or a deep sand trap, around a tree, or one of another thousand possibilities.

Once the new golfer begins to more often succeed at conquering those challenges, the resulting energy quickly becomes addictive.

Golf tells you a lot about your state of mind.

While I am sure this is true of many sports, your state of mind plays a huge role in golf.

Over the years, I have come to view my golf score as something of a “Peace of Mind meter.” A horrible score is invariably a flag that some part of my life is out of sync. In my case, it is typically pressing work that needs attending to. But it could just as well be family trouble, or finances, or all the other devils that plague the human mind.

Conversely, a great score tells you that you are relaxed and at peace with the world. In either case, golf can be an important indicator that you either need to take some action or keep on doing what you are doing in enjoying your life.

Golf encourages constant improvement.

Over the years, I have played with some exceptionally talented players. But every one of them is constantly striving to better their best score, or break below the next major level.

Initially, a golfer will want to shoot better than 100. Then the day they accomplish that, the target shifts to 90, then 80, then even par. Thus, every time you pick up your golf bag, you do so with the full intent to improve, versus simply knock around for four hours.

Your determination to improve sets in motion the actions necessary to improve your game—maybe by watching videos, attending clinics, or just going to the driving range to create a repeatable swing.

Golf forms firm friendships.

Far too many studies to recount demonstrate that the people who live the longest and the happiest are those with the most friends. And golf is, for the most part, a social game.

I have two golf buddies in particular, Frank down here in Cafayate and Charlie back in the US. It’s hard to put a finger on exactly why or even when our passion for the game brought us together, but a true golf buddy becomes akin to a member of the family.

There are other golf buddies you may not play with as regularly, but when you do, you sync up with them perfectly. Kind of like when you meet a childhood friend after a long absence.

You know each other’s favorite swear words, drinking habits, general skill level, and much more. Pete, Bill, Jon (CB), John, Chiri, Dave, Brett, Christine, Rob, and a few others all fill out my extended list of golf buddies, and I am a better, happier person thanks to them.

Golf tells you a lot about a person’s character.

Outside of a tournament, golf is almost entirely a self-policing activity. The “whiff” is a good example. If you swing at the ball with intent and miss (it happens), that counts as a stroke. Your fellow players might be otherwise engaged searching through weeds and such, so you could pretend it was a practice swing—but most golfers I know wouldn’t dream of doing so. That would be cheating.

As an aside, I well remember one of the first times I played a “serious” game of golf. It was in Santiago, Chile. An investment guru acquaintance of mine with a very low handicap (the lower the handicap, the better of a golfer you are) invited me to play with him. Prior to teeing off on the first hole, the topic of golf cheating came up, and he stridently said, “I would NEVER do business with someone who cheats at golf!”

Not two holes later, he sliced his ball into a copse of trees. With a bit of searching, his caddy found the ball and called us over. The caddy crouched down over the ball, then threw my acquaintance a knowing look. The guru nodded conspiratorially, and the caddy slyly tossed the ball onto more favorable ground.

I forgot his excuse for obviously cheating, but no matter—long before we set foot on the course, I had come to the conclusion that the guru was shifty in business, so the golf cheat was merely confirmation.

Speaking of which, I recently read an interview with John Daly, a professional PGA player who had played golf on more than one occasion with Donald Trump and, separately, with Bill Clinton. Though the reporter tried to lead him into saying Trump was a cheat, he only had positive things to say about Trump’s game. The worst cheater? Bill Clinton.

In Daly’s words:

“[Donald] hits it good,” said Daly. “He’s a decent player. [Clinton], that’s Mr. Mulligan right there. If he doesn't like the shot, he just throws another one down and hits it. [He says] ‘I’m just out here practicing.’ There's a range for that.

“Donald will actually finish a hole and write his score down. Bill will not even finish a hole and write a score down. You can’t hit seven shots and say it was a par!”

Golf involves learning a wide range of skills.

Earlier, I referred to the apparent simplicity of the game, given the basic action is to swipe at a stationary ball. But that overlooks the nuances involved of hitting a ball resting above or below your feet, or that has settled in deep grass, on a patch of hard-packed dirt, up against the edge of a sand bunker, behind a copse of trees… or… or…

Absent a co-conspiring caddy to improve your ball position, in each case you have to choose the right club, then make subtle adjustments to the loft of the club and how you address the ball in order to give the shot the shape needed to advance to your target.

While other sports also have their nuances, I believe none requires the same repertoire of skills as golf.

Golf is a form of interactive art.

Like painters, each golf course represents the artistic vision of the designer. Instead of working with paint, pencil, or clay, their work involves shaping the face of the earth, integrating trees, shrubbery, water, sand traps, and more. Rather than admiring the artist’s work from a distance, the players literally immerse themselves in the art.

Because each designer’s vision is unique, so are their golf courses. Unlike, say, a basketball court or baseball diamond. As the designers always strive to challenge the golfer, every new golf course is also a puzzle, one the passionate golfer looks forward to solving.

Finally, golf provides the opportunity for fresh air and exercise.

The golf course here at La Estancia de Cafayate is over four miles long. While that may not seem a lot, zig-zagging up and down hills on a warm day with 30 pounds of clubs on your back will keep you in pretty good shape.

Personally, I’m one of the “I do my exercise in the gym” crowd, so I drive a golf cart, but I have nothing but respect for those who lug their clubs around the course.

There are, I am sure, additional nuances to the game that the duffers among you will wish to add—and please do, using the commenting function at the bottom of the page. However, I do hope that my incomplete list helps to better explain golf’s attraction.

Investment Lessons to Be Learned from Golf

There are several valuable parallels between golf and investing.

For starters, anyone who is responsible for managing some or all of their own investments must recognize that, like each new hole on a golf course, the investment terrain is also constantly changing.

In the same way that a good golf player must be prepared for pretty much any scenario, so should be a good investor.

For example, based on the historical record, the US “recovery,” as weak as it is, is due to come to an end.

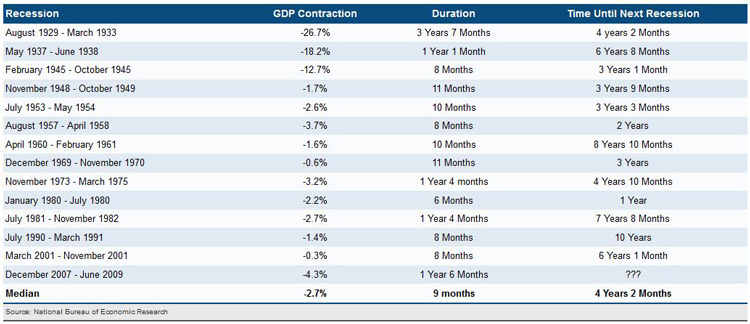

As I pointed out in the latest edition of our premium research service, Compelling Investments Quantified, the last recession officially ended in June of 2009, seven years and eight months ago.

Yet, per the table here, since 1929 the median time between recessions in the US has been just four years and two months. Thus, based on the historical record, this recovery is already long in the tooth.

Does that mean investors should sell everything and run to cash?

That is one way you might play it. However, should the Trump administration actually pass tax reform, repeal Obamacare, and cut back the thick entanglement of regulations choking US businesses, being entirely in cash could miss a big run up in US stocks.

Thus, rather than take an all-or-nothing approach to the current market, you need to play the ball as it currently lays. It’s a tough lay, but there are strategies you can use to reach your goal of beating the market and growing your nest egg.

The one we use at Compelling Investments Quantified revolves around investing in companies selling below their intrinsic value. We use a combination of tools to make the call, including calculating each company’s Graham number, the product of multiplying historic P/E and P/B numbers.

More important, we crunch the numbers on each stock using our proprietary CIQS model, a series of over 50 quantitative and qualitative tests a stock must pass before we’ll recommend it.

If you are not using a computer and, specifically, a quantitative model to help guide your investing at this point, you are playing at a distinct disadvantage in the zero-sum game of investing.

Sticking with the golf analogy, that is akin to playing with a set of old hickory clubs, versus the high-tech models now on sale. Or maybe insisting on using your putter to drive the ball off the tee.

I’ll give you an example, using a popular stock, Tesla (TSLA)—a company I have mentioned on several occasions in the past. Saying the company’s valuations are stratospheric, or that its business model is… um, schizophrenic, would be understatements.

On the latter point, did you see the recent announcement that Tesla’s CEO Elon Musk plans to send people to the Moon next year via his SpaceX endeavor? Talk about a lack of focus.

Just for giggles, I asked Jake Weber, senior analyst for Compelling Investments Quantified, to run Tesla through our model. Here’s his response:

Hands down the worst CIQS score I've ever ran. It scored a 12.86. Although technically possible, I honestly didn't think a company could score that low. I suppose comparing it to other solar/battery companies might boost its score, but I used other auto companies for comparison.

It scored a 4.75 out of 35 on the fundamentals, 0 out of 30 for valuation, 0.83 for moat (I gave it some credit for intangible assets; Morningstar gave it no moat but said it has potential to develop moat in brand and cost advantage), 1.5 out of 5 for five forces, 4.17 out of 10 for technicals (positive price strength and volume trend), and 1.43 out of 5 for sentiment (positive insider buying; its B-bond rating is in the highly speculative category of the S&P).

The advantages of doing a deep dive on any company you are considering investing in should be obvious. Even so, the portfolios of most investors are made up of stocks bought on hot tips, or based on a one-dimensional analysis provided by some guru.

Another parallel between golf and investing is the energy and happiness that comes from picking a winning investment and seeing it exceed your goals.

Like golf, where patient practice will greatly enhance the odds of making the 40-foot putt, time, study, and focus are required to build a winning portfolio. Start by learning a particular investment method, say value investing, then keep going to add additional skills. While I don’t use them much, a friend of mine has a lot of success trading options, so that might be worth your time to learn as well.

There is a saying one of my golf buddies likes to use, “You can’t rush golf.” Likewise, you can’t be in a rush to invest, and you can’t lose your cool and panic just because things don’t break the way you hoped. Truly, investment profits are made not when you sell, but when you buy.

Also, like a good set of golf clubs, every investor needs a good set of tools. I am not a big chartist, but I rarely buy a stock without consulting the charts, using www.stockcharts.com.

I also rather like www.gurufocus.com. While it has some useful free features and articles, the paid service is worth the price. Among other things, it has the full historical financial data on every company, plus which stocks the top funds or money managers are buying or selling, info on insider trading, and more.

Finally, I rely heavily on the research we do on behalf of Compelling Investments Quantified to guide my own investments. Unlike so many newsletter writers that talk the talk but don’t walk the walk, I invest five digits or more in the stocks our research finds worthy of recommendation.

For more details on the service, including our current portfolio, and our fully guaranteed six-month trial subscription, click here now.

At the end of the day, while investing is a far more serious endeavor than golf, I believe the best way to view investing is as a game. A complex, difficult, yet energizing game, which requires time and effort to learn in order to rise above the ranks of the clumsy amateur.

And with that, it’s time to pack up the tools for now as my golf buddy Frank and I have a tee time to make.

Here Come the Clowns

For this week’s Clowns feature, we have multiple entries. Perhaps a sign that the level of foolishness in the world is accelerating?

The Collapse of California. We start with a great opinion piece, supported by abundant data, showing that thanks to the clownish politicians in charge of the Moonbeam State and their insistence on pursuing a politically correct agenda that benefits almost no one, the state is now firmly on the slope to a collapse. An important read.

Taking Whining to a New Level on College Campuses. More and more US universities are establishing “Bias Response Teams” or some derivations of that idea. For example, the University of Wisconsin calls theirs the “Hate Response Team.”

The Daily Caller posted an article suitably titled, “The 12 Dumbest Ever ‘Bias Incidents’ on America’s College Campuses.” To give you a sense of the thing, here’s one of the entries:

At fancypants Colby College, a picturesque little liberal arts college in small-town Maine, the 13-person “Bias Incident Prevention and Response Team” investigated someone who uttered the phrase “on the other hand” in 2016. An unidentified student charged that these commonly used words are “ableist.”

Click here to read the full article.

Trump Did It! By now, you probably heard about the snafu at the Oscars, where the highly praised film La La Land was awarded the Best Picture Award, before it turned out that a “mistake” had been made and that the real winner was Moonlight, a low-budget movie about the fictional life of a gay black person, which could have also won awards for “Most Politically Correct” or “See, We Aren’t Racist!” Awards if those were on offer by the Academy Awards voters.

While it is refreshing to see that the embarrassing on-stage gaffe wasn’t blamed on Climate Change, no one should be surprised that certain clowns are instead blaming the incident on a vengeful Donald Trump. Apparently as payback for so many actors attacking him during the broadcast. Here’s one story.

And with that, I will sign off for the week by thanking you for reading and for passing along The Passing Parade to others you think might find this free service of value!

David Galland

Managing Editor, The Passing Parade

Garret/Galland Research provides private investors and financial service professionals with original research on compelling investments uncovered by our team. Sign up for one or both of our free weekly e-letters. The Passing Parade offers fast-paced, entertaining, and always interesting observations on the global economy, markets, and more. Sign up now… it’s free!

© 2017 David Galland - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.