China’s Domestic Problems Are Good News for Gold Investors

Commodities / Gold and Silver 2017 Mar 07, 2017 - 12:38 PM GMTBy: John_Mauldin

In 1978, one year after taking control of impoverished China, Deng Xiaoping declared “to get rich is glorious.” Since Deng’s declaration, China’s per-capita GDP has grown by over 5,000%.

In 1978, one year after taking control of impoverished China, Deng Xiaoping declared “to get rich is glorious.” Since Deng’s declaration, China’s per-capita GDP has grown by over 5,000%.

China is without question the biggest economic success story in recent history. However, rapid growth has come at a cost. China’s total debt/GDP ratio is now a staggering 277%—and the credit expansion is showing no sign of slowing. New bank loans in 2016 totaled $1.84 trillion—8% above the previous record.

Although the economy grew by 6.7% in 2016, the debt is causing a host of problems in China.

State-Owned Meltdown

While government and household debt “only” add up to 65% of GDP, non-financial corporate debt now sits at a staggering 170% of GDP. So where is all the money going?

As the financial crisis caused exports to plummet, local and provincial governments created hordes of state-owned enterprises (SOE) to keep the economy moving. These SOEs now account for around 40% of China’s industrial assets. Combined, they are the size of Germany’s economy.

The spending spree softened the blowback from the crisis, but ended up funding unproductive projects (like the building of “ghost cities”). As a result of the debt-fueled binge, around 55% of total corporate debt belongs to these SOEs.

The good news is that China now has some of the world’s best airports and railways. The bad news? Bills are coming due for these grand projects, and the money isn’t there to pay them.

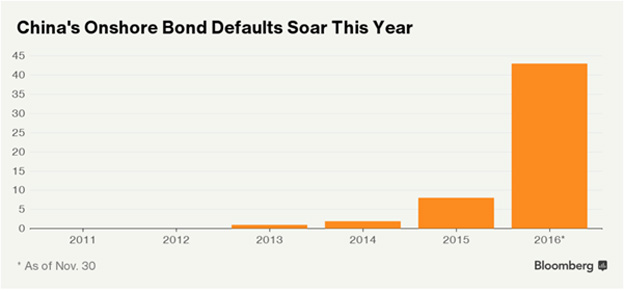

In 2016, around 25% of China’s largest 1,000 firms owed more in interest than they earned before tax. While only a handful of SOEs have been liquidated, bond defaults increased five-fold last year.

Many of these SOEs are now zombie companies—bankrupt but kept alive by a steady drip of credit. A 2014 audit of SOEs found that 20% of recent loans were taken out to pay older ones.

So where have these SOEs been getting the money from?

Lurking in the Shadows

Over 30% of all new loans since 2007 have originated from China’s shadow banking system. Moody’s estimated China’s shadow banks have $8.1 trillion in outstanding loans—over 70% of GDP.

Local governments have accounted for much of this borrowing, financing SEOs with the funds. Since 2014, local government borrowing has increased by 53%.

To generate revenue, China’s shadow banks have also been selling investment instruments called wealth-management products (WMP) to investors. WMPs are uninsured financial products that invest in assets ranging from real estate to corporate bonds. They offer investors higher returns, upward of 10%, and are regarded by many as having the implicit backing of banks or local governments. Given their attractiveness, more than $4 trillion has been invested in WMPs, and they are now included as part of China’s central bank’s regular assessment of risk.

Although money has been pouring into these products like into an AAA-rated bond, they are anything but.

These products contain risky assets like junk bonds and mining equities. Also worrying is that WMPs are now investing in one another. As such, they have been likened by some to Western lenders’ exposure in the subprime crisis.

Layers of liabilities accreting on the same underlying asset mean any defaults could spiral into a full-blown crisis. And it’s not only shadow banks who have exposure to these products.

As WMPs can be held off balance sheet, they have exploded as a new source of revenue for banks. In 2016, China’s largest 32 banks, which own 70% of bank assets, held around 20% of their loans off balance sheet. Banks have also been moving “bad loans” into WMPs to clean up their balance sheets.

The shift away from bank deposits and the interconnectedness leaves China’s financial system on much less solid footing. China withstood the Asian financial crisis in 1997 and 1998 and the global financial crisis in 2008 and 2009 in part because its financial system depended on highly stable household and corporate deposits parked at huge, government-controlled banks.

Although there haven’t been any major defaults thus far, that may be about to change.

Bursting Bubbles

While the official non-performing loan (NPL) rate for China’s banks is 1.75%, the real figures are much higher. The IMF puts the percentage of “loans at risk of default” in China between 10% and 15%. Ratings agency Fitch estimates it’s somewhere in the region of 15–21%.

These NPLs haven’t been an issue so far. However, with the PBOC raising interest rates and reining in credit, things could be about to get dicey.

Property prices in major Chinese cities like Shenzhen have grown at over 20% per annum for the past few years. With the PBOC tightening, prices are beginning to fall. As real estate loans are the most highly leveraged, a substantial drop in prices could cause massive defaults.

But it’s not just direct defaults that are the problem.

Many WMPs are heavily invested in real estate. If defaults begin to rise, the contagion could spread throughout the whole system. The IMF has cited the interconnectedness of China’s financial system as the country’s primary problem.

It’s estimated that a bailout of China’s banking system would cost at least $1.7 trillion. That’s excluding the shadow banking system, which is estimated to cost another $375 billion.

While many Americans may not be aware of these problems, the Chinese are becoming increasingly uneasy about the situation.

Risk-Off Rotation

As a result of China’s domestic problems, the yuan has come under pressure. Since August 2015, it has fallen almost 10% against the US dollar. To try and halt the decline, the PBOC has raised interest rates.

While higher rates help the yuan by encouraging savings, it’s negative for two reasons. First, it makes credit more expensive, which hurts those who need it to survive—like many SOEs. Second, as credit creation is closely linked to real estate prices, it will drive down prices, thus potentially hurting investments like WMPs.

In further efforts to support the yuan, China is selling its foreign reserves. Since 2014, the country has burned through over $1 trillion in reserves. China’s FX reserves are now at $3 trillion, the lowest levels since 2010.

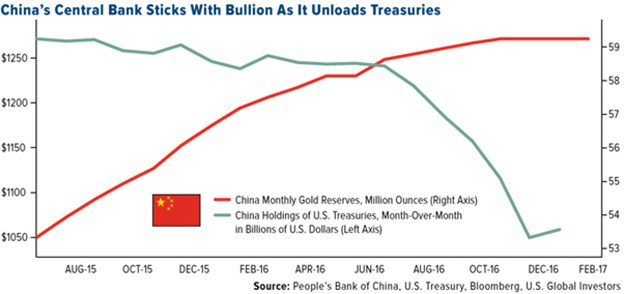

Also at their lowest level since 2010 are China’s holdings of US Treasuries. China dumped a record $190 billion worth of Treasuries in 2016—the biggest decline on record. While China is burning through FX reserves and dumping Treasuries at a record pace, there is one asset they are acquiring.

The Golden Dragon

The PBOC has been steadily increasing its gold holdings and now “officially” has around 59 million ounces, a figure that very well could be much higher.

At today’s prices, that’s worth around $73.75 billion. But it’s not only the central bank accumulating the yellow metal.

Given the recent stock market volatility and the rapid increase in property prices, many Chinese have turned away from investing in these traditional assets. Also, unless you are politically connected, you can no longer get your money out of the country because of restrictive capital controls.

As a result, many Chinese have turned to buying gold. In December, gold imports from Switzerland were 158 tonnes, up from 31 tonnes in November. It’s estimated that between 1,000 and 1,500 tonnes a year goes into China—all of which is private demand.

So what does China’s unsustainable credit expansion and affinity for gold mean for the US?

American Implications

Given China was until recently the largest foreign holder of US Treasuries, if it continues to reduce holdings, it could cause problems stateside.

Weak Chinese demand will push up yields and could hinder any planned fiscal expansion and less flexible refinancing options. Given its own elevated debt levels and tepid economic growth, higher interest costs would be extremely negative for the US.

While China’s weak demand for US debt could spell trouble, its domestic problems are much more problematic. If China experiences a debt meltdown and liquidity in short-term funding freezes as it did during the US Financial Crisis, which looks increasingly more probable, it could have massive implications for US markets. When Chinese equity markets declined by 15% in 2015, US markets dropped 10% shortly thereafter.

If China continues to dump Treasuries and its problems continue to worsen, how can investors protect themselves from the contagion?

It could be wise to take a lesson from Chinese investors and add physical gold to your portfolio. As gold bullion is the only financial asset not simultaneously somebody else’s liability, when China’s massive credit expansion results in hubris and excessive speculation, it will likely do extremely well in offsetting declining positions.

The main reason many Chinese are buying gold is to preserve wealth against the backdrop of massive fiscal stimulus and lax credit conditions. Never has a big economy piled up so much debt so quickly without serious repercussions.

Japan and the US both tried in the past two decades, and each time it resulted in huge financial losses and monetary-policy experimentation we have yet to know the full effects of.

Don’t miss this buying opportunity!

To learn more about working with the Hard Assets Alliance to add physical gold bullion to your portfolio, please download our SmartMetals Action Kit or call 1-888-993-2207 to speak with HAA’s General Manager, John Grandits.

Free Ebook: Investing in Precious Metals 101: How to Buy and Store Physical Gold and Silver

Download Investing in Precious Metals 101 for everything you need to know before buying gold and silver. Learn how to make asset correlation work for you, how to buy metal (plus how much you need), and which type of gold makes for the safest investment. You’ll also get tips for finding a dealer you can trust and discover what professional storage offers that the banking system can’t. It’s the definitive guide for investors new to the precious metals market. Get it now.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.