Gold Hit by Massive Wave of Stoploss Selling for Record Plunge

Commodities / Gold & Silver Aug 12, 2008 - 06:37 AM GMTBy: Mark_OByrne

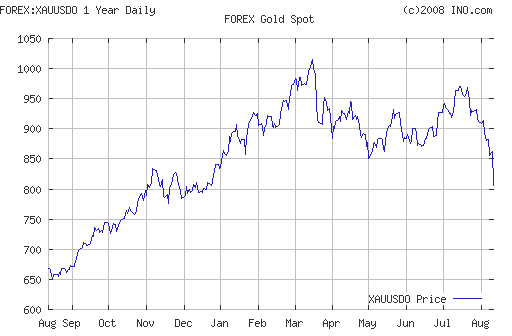

Gold finished trading in New York on Friday at $821.50, down $36.00 and silver was down 71 cents to $14.48. Gold continued to fall in Asian and early European trading and is trading at $809.00/809.60 per ounce (1100 GMT).

Gold finished trading in New York on Friday at $821.50, down $36.00 and silver was down 71 cents to $14.48. Gold continued to fall in Asian and early European trading and is trading at $809.00/809.60 per ounce (1100 GMT).

Speculative Paper Sellers V's Long Term Physical Investors

The breach of the psychologically and technically important $845 - 850/oz level yesterday saw a massive wave of stop loss sell orders being executed leading to gold plummeting more than 4%. Hedge funds, institutions and trend following black box traders had significant stop loss orders beneath this level and this has led to the significant retrenchment.

Gold's short term trend remains firmly down on falling oil and commodity prices, a stronger dollar, rallying equity markets and renewed risk appetite.

Yet, gold looks increasingly oversold after falling more than 20% in less than a month (from a high of $988 on June 15 th to $810 today) and now being well below the 200 day moving average and at 8 month lows. Gold is now at levels now seen at the end of 2007.

Despite the savage recent sell off, it is worth remembering that gold remains up by more than 20% since this time last year at the outset of the ongoing financial crisis.

There is again strong physical demand internationally at these levels, especially from the Indian subcontinent. Reuters reports significant physical demand for gold in the mid $800's as gold stocks are scarce and premiums high ahead of the first festival of the Indian buying season, the Raksha Bandhan festival.

Initial fears regarding the health of the monsoon season have been allayed and this should result in the usual very significant and sizeable imports of gold into India in the coming weeks.

As usual the Indian subcontinent's voracious appetite for gold imports should result in a floor being put under the gold market and mean that prices remain supported at these levels.

The speculative paper sellers in the derivative and futures markets have clearly won this latest bout in the gold markets. However, long term value investors are likely to again have the last laugh as the physical market and real supply and demand issues will again likely lead to higher prices in the coming weeks.

Gold is now very oversold on all sorts of technical indicators and bargain hunters will be buying with both hands at these levels.

Stagflation and Geopolitical Risk

Stagflation has not disappeared simply because of a sharp correction in commodity markets and a rally in stock markets. The UK's property market has ground to a halt amid what is being termed a “mortgage drought” and this has happened as official figures confirmed that prices for UK-manufactured products last month rose by 10.2 per cent from a year earlier, marking their fastest annual pace of increase since 1986. Official inflation is set to reach 5% in the coming months as goods prices surge.

While oil has corrected sharply, it is important to remember that oil remains up more than 60% since this time last year and nearly 20% since the start of 2008. Stagflation is clearly affecting most major economies and this will likely result in gold rallying back as sharply as it has fallen in the coming weeks.

Also, geopolitical risk remains and the war in Georgia has the potential to degenerate into a more dangerous conflict. Russia, is clearly flexing its muscles in the Caspian region and this has implications for European and western energy security.

Today's Data and Influences

Today sees the release of the US trade report for June, which is forecast to show a rise in the deficit. The U.S. needs a lower dollar in order to boost exports and the recent rally in the dollar will likely lead to an increased deficit in coming weeks.

Gold and Silver

Gold is trading at $809.10/809.60 per ounce (1100 GMT).

Silver is trading at $14.35/14.40 per ounce (1100 GMT).

PGMs

Platinum is trading at $1481/1488 per ounce (1100 GMT).

Palladium is trading at $308/315 per ounce (1100 GMT).

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold and Silver Investments Limited No. 1 Cornhill London, EC3V 3ND United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.