The Number One Reason You Should Own Physical Gold

Commodities / Gold and Silver 2017 Mar 13, 2017 - 03:15 PM GMTBy: John_Mauldin

105 years ago, American financier J.P. Morgan testified before Congress. When asked if the control of credit involved a control of money, Morgan responded by saying, “Not always. [Credit] is an evidence of banking, but [credit] is not the money itself. Money is gold, and nothing else.”

105 years ago, American financier J.P. Morgan testified before Congress. When asked if the control of credit involved a control of money, Morgan responded by saying, “Not always. [Credit] is an evidence of banking, but [credit] is not the money itself. Money is gold, and nothing else.”

Although they are not the same, “money” and “credit” are used interchangeably in our vocabulary today. Given the massive credit expansion over the past four decades, understanding the difference between the two has never been more important.

A Colossus of Credit

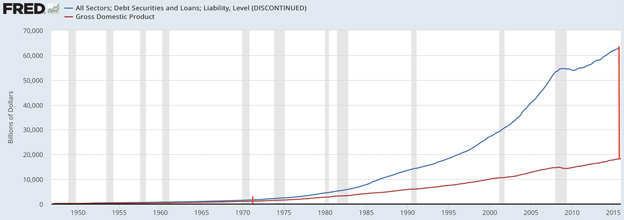

Until 1971, GDP and credit grew in tandem. However, in the 46 years since, credit has grown three-times faster than the economy.

Source: St. Louis Fed

As we know, 1971 was the year Richard Nixon took America off the gold standard. When the dollar was tied to gold, it limited the amount of credit creation. Since the shift to a fiat system, credit has been created, more-or-less, out of thin air.

As credit and debt are two sides of the same coin, governments and citizens have taken on huge amounts of debt—living beyond their means. This can be seen by looking at the increase in public and private debt levels.

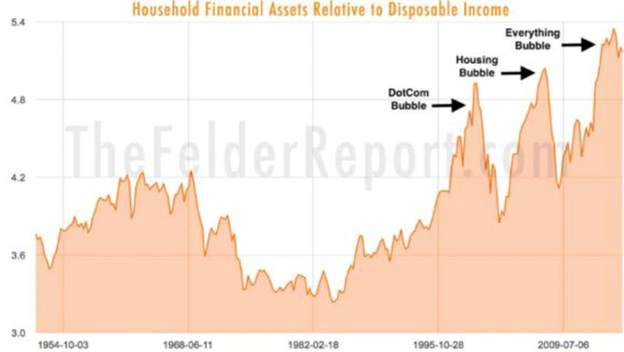

Much of this “credit” has been funneled into financial assets. Today, household financial assets relative to disposable income is at another “all-time” high.

Source: The Felder Report

This “financialization” of the economy has contributed toward increased market volatility. The higher percentage of wealth held in financial assets intensifies market sell-offs as more people buy and sell at the same time—often incorrectly. The explosion of margin-debt has also contributed to volatility as more people are forced to sell due to margin-calls.

It’s worth noting that last month, margin debt hit another record high. The two previous tops were one month and three months prior to the respective 2000 and 2008 market crashes.

Although this rapid credit expansion has fueled economic growth, it’s no “free lunch.” As Austrian economist Eugen von Böhm-Bawerk succinctly put it, “Debt is future consumption denied.”

All the consumption that has taken place on credit means future consumption must be foregone—you cannot consume more than you produce forever. So, what happens when those dues have to be paid?

Counterparty Collapse

In 2010, then Bank of England Guv’nor Mervyn King said of the financial system: "Its Achilles heel was, and remains, simply the extraordinary levels of leverage represented by a heavy reliance on short-term debt." Economic growth has become reliant on credit growth—and that’s a problem

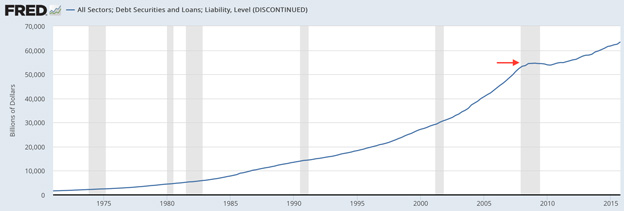

As previously mentioned, credit has grown three-times faster than GDP since 1971. However, there was one period when credit contracted in the past 46 years—can you guess when?

Source: St. Louis Fed

That’s right—all the layoffs, defaults, and pain of the past nine years were the result of that slight dip in 2009.

The problem with a credit-based system is all credit has counterparty risk. As financial assets are backed by credit, when credit conditions deteriorate or a counterparty collapses, so too will the related assets. In a credit-based system, one default can cause the whole structure to collapse as it nearly did in 2008.

Systemic collapse would have occurred, except trillions of dollars were pumped into the system to keep it alive. The same could happen again—right?

Even if the credit taps are turned on full-blast again, it may not save the system next time around as additional monetary accommodation is not an option, and government debt is approaching $20 trillion.

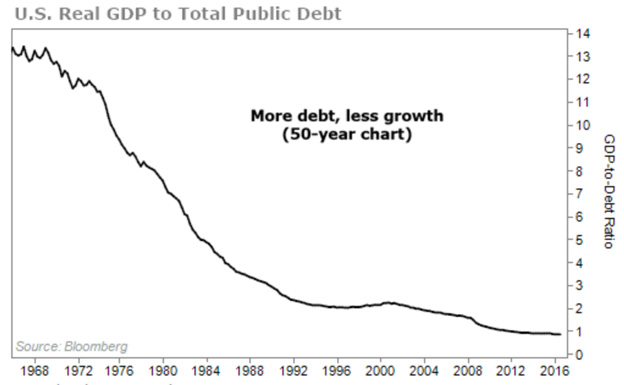

Furthermore, the marginal utility of debt has collapsed. Simply put, this means it takes more and more credit to generate less and less economic growth. The law of diminishing returns in all its glory.

Source: Bloomberg

When this massive credit expansion does come to an end, how can investors protect their wealth?

Money Matters

So, we return to J.P. Morgan’s comments, “Money is gold, and nothing else.”

When credit collapses, money will still exist. Unlike credit, money cannot be created out of thin air and doesn’t derive its value from elsewhere. Money—i.e. gold—has intrinsic value and is not a promise to pay, but payment in and of itself. To quote former Fed Chairman Alan Greenspan, “Gold has always been accepted without reference to any other guarantee.”

As gold is the only financial asset that is not simultaneously somebody else’s liability, it will be the last man standing when the credit bubble pops.

It could take years for this scenario to play out. However, allocating a sensible portion of your wealth to an asset that preserves it is generally preferred than owning one that can destroy it. As Robert Kiyosaki puts it in his uniquely energetic way in this interview with Hard Assets Alliance—gold is the ultimate wealth preservation tool.

Kyle Bass, CEO of Hayman Capital, made an interesting observation about gold's value and credit recently. In 2016, the global supply of credit—measured by M2—was around $100 trillion. The total value of all the gold mined in history is approximately $8 trillion. Therefore, if we revert back to a money-based system, gold must be revalued upward.

In a world where leverage and debt-ratios are at record highs, owning something of real value to protect your wealth hasn’t been more critical. Every credit boom in history has ended with a bust, this one will be no different.

Free Ebook: Investing in Precious Metals 101: How to Buy and Store Physical Gold and Silver

Download Investing in Precious Metals 101 for everything you need to know before buying gold and silver. Learn how to make asset correlation work for you, how to buy metal (plus how much you need), and which type of gold makes for the safest investment. You’ll also get tips for finding a dealer you can trust and discover what professional storage offers that the banking system can’t. It’s the definitive guide for investors new to the precious metals market. Get it now.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.