SPX Futures are Down this Morning

Stock-Markets / Stock Market 2017 Mar 14, 2017 - 02:56 PM GMT Good Morning!

Good Morning!

SPX futures are down this morning, but haven’t yet crossed either Short-term support at 2359.10 or the Head & Shoulders neckline at 2355.00. There is still a considerable distance to go. From a timing perspective, the time elapsed between that March 1 high at 2400.98 and the March 10 high at 2376.86 was approximately 45 hours. That is one-half the 12.9-day (90 hour) Cycle that we saw in last January’s decline. Should that observation be correct, it suggests the decline may extend to the close on Monday, March 20.

ZeroHedge reports, “European stocks declined for first session in five ahead of Wednesday's Dutch elections, debt ceiling expiration and the conclusion of the Fed's 2-day meeting where it is expected to raise rates by 25 bps. Tightening concerns emerged, also dragging down Asian shares and S&P futures, while the dollar continued its rise for a second day. Crude oil has ended its six-day drop. The pound tumbled 0.8% to the lowest since mid-January in a delayed reaction after Theresa May won permission to trigger the country’s departure from the EU. On today's US calendar, we get the Producer Price Index although most NYC-based traders are likely taking a snow day off or trading from home.”

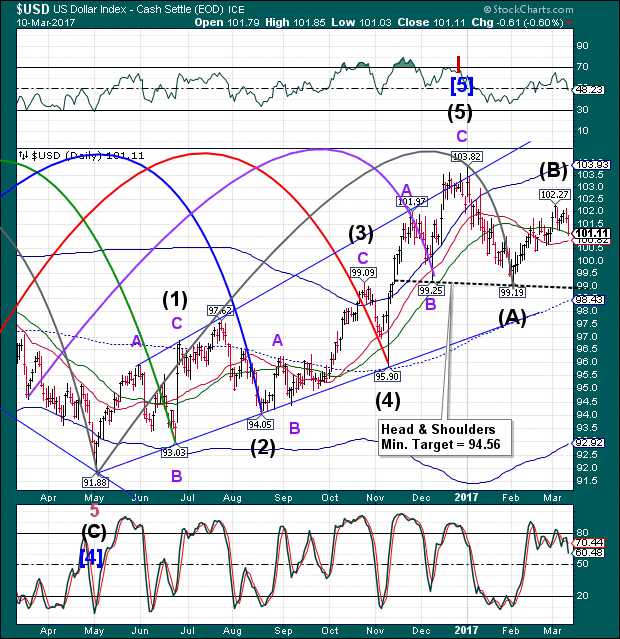

USD futures bounced this morning to a high of 101.54. That does not overlap Friday’s low at 101.57, suggesting that a further decline may be in the works. We need to see the USD plunge beneath both the 50-day Moving Average at 101.10 and the Intermediate-term support at 100.82 to have a confirmed sell signal.

Today’s USD objective is to approach or even decline beneath the Head & Shoulders neckline.

The decline in VIX appears to be over, with a (near-Fibonacci) 78.2% retracement. VIX futures are higher and appear to have risen back above the 50-day Moving Average, reinstating the VIX buy (SPX sell) signal. The Head & Shoulders neckline is waiting to be taken out.

There will be a report on the NYSE Hi-Lo Index after the open.

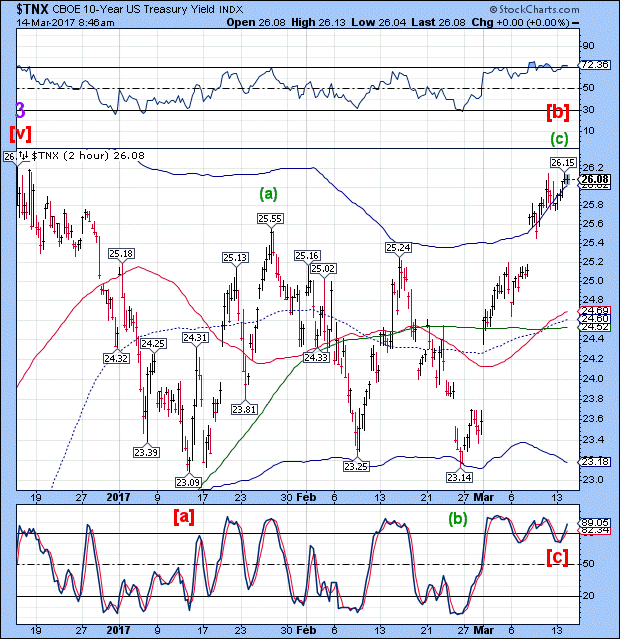

TNX is putting on the final probe of its rally this morning. It has extended its period od strength to make an inverted Trading Cycle high before plunging into its Master Cycle low by the end of next week, possibly in 8.6 days.

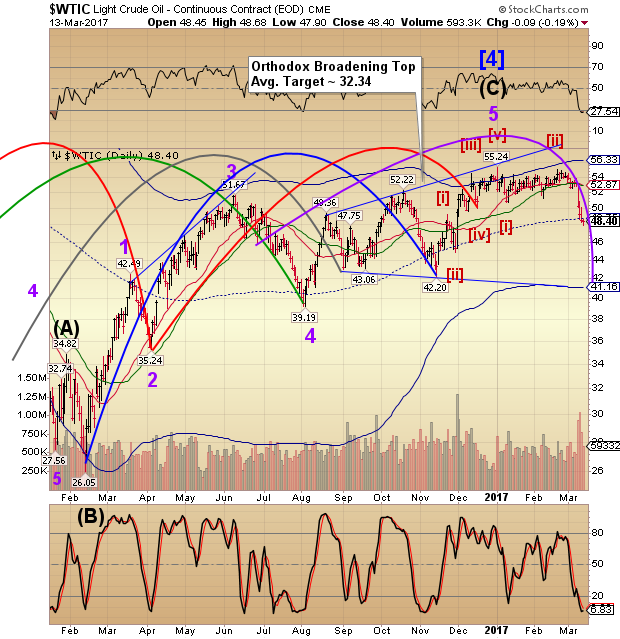

Oil futures tumbled to an overnight low of 47.60. While it may appear ready to recover, this is not the end of the larger decline, but only a bounce. The Cycles Model has the decline going through mid-April, which may be enough time to achieve its Orthodox Broadening Top target. Currently its Broadening top target for point 6 is 39.00 to 40.00.

Gold continues to remain within its consolidation range with no new information to report.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.