Stock Market Most Overvalued On Record — Worse Than 1929?

Stock-Markets / Stock Market 2017 Mar 15, 2017 - 02:31 PM GMTBy: GoldCore

The US stock market today has never been more dangerous and overvalued, according to respected Wall Street market analyst John Hussman.

The US stock market today has never been more dangerous and overvalued, according to respected Wall Street market analyst John Hussman.

Indeed, Hussman goes as far as to say that “this is the most dangerous and overvalued stock market on record — worse than 2007, worse than 2000, even worse than 1929” as reported by Marketwatch.

For some months now, Hussman of Hussman Funds’ has been warning in his research that investors are ignoring extremely high stock market valuations and are being lulled into a false sense of security by central bank liquidity, massive quantitative easing and zero percent and negative interest rates.

Hussman begins his latest research note by quoting the late, great Sir John Templeton:

“Bull markets are born on pessimism, grow on scepticism, mature on optimism, and die on euphoria.”

He then warns

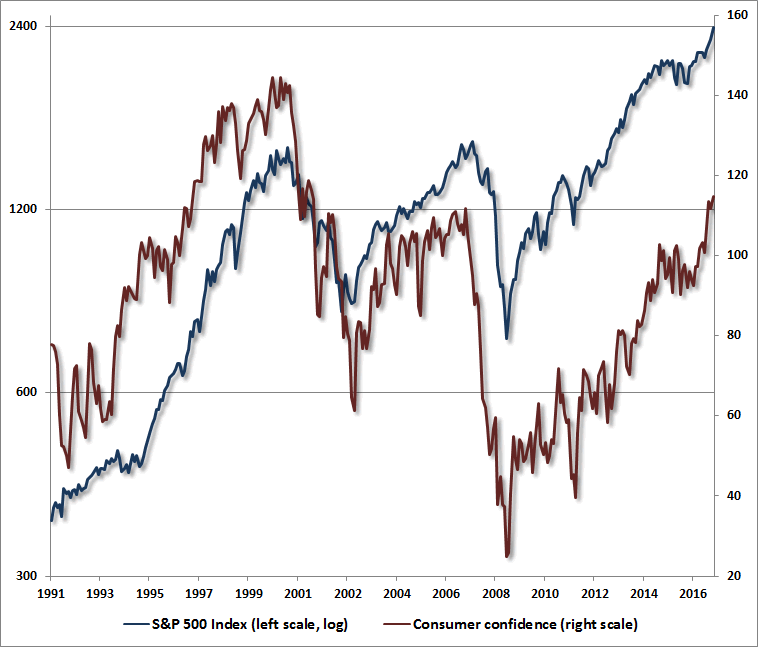

“A week ago, bullish sentiment among investment advisers soared to the highest level in 30 years (Investor’s Intelligence), joined last week by a 16-year high in consumer confidence. When one recognises that the prior peak in bullish sentiment corresponds to the 1987 market extreme, and the prior peak in consumer confidence corresponds to the 2000 bubble, Sir Templeton’s words take on both relevance and urgency.”

Hussman advises investors become more defensive, because the market could be about to enter a brutal bear market as seen throughout history.

Huge crowds gather in shock at the New York Stock Exchange after 1929 stock-market crash.

Hussman Funds provide in-depth analytical research on the US stock market. They use long-term valuation models, reversion to the mean and mathematics to support their views.

Dr Hussman says what we’re currently seeing is worse than 2007 when the global financial crisis brought the world economy to its knees, worse than 2000 when the tech bubble popped and caused a market catastrophe, and even worse than the biblical Wall Street 1929 crash.

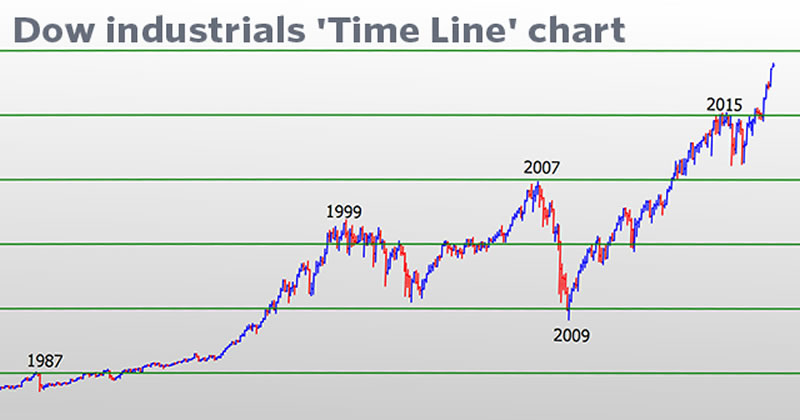

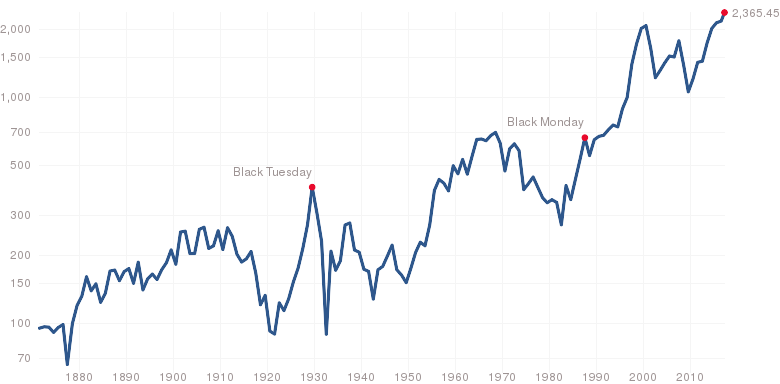

The Dow Jones Industrial Average recently breached the hugely important psychological level of 20,000 and has recently surged over 20,100 to 21,115.

Throughout history, the first breach of these important psychological resistance levels is usually the end of — rather than the beginning of — a stock market boom. After the initial breach of the barrier, it takes years for the market to make a permanent breach through these ‘barriers’ (see below).

Is this time different?

We do not know and no one has a crystal ball, however it is important to realise that the U.S. stock markets and bond markets are priced for perfection, despite a very uncertain outlook for the U.S. and the world.

Brexit, the risk of Frexit and EU contagion, uncertainty created by the Trump Presidency and considerable geopolitical risk from a myriad of unresolved conflicts – from North Korea to Russia to Iran and the geo-political mess that is the Middle East.

These over valued stock markets are also vulnerable given the scale of over valuation that is evident in bond markets and the real risk of a very significant sell off in global bond markets.

Bond markets have come under pressure in recent days with yields rising in many key markets. Italian debt looks particularly vulnerable with Italian 10 year yields rising and concerns that a break above 2.50% in the third largest bond market in the world (debt valued at €2.2 Trillion) has the potential to jettison Italy out of the European monetary union.

Bond guru Bill Gross is also warning that investors need to keep an watchful eye on the U.S. 10 year bond yield as a breach of 2.6% will mean that “a secular bear bond market has begun.”

A massively indebted EU and U.S., which reaches the debt ceiling today, with indebted households and fragile economic recoveries will struggle when interest rates revert back to more normal levels.

Markets are priced for perfection and yet the political, financial, economic and monetary outlook is less than perfect. Euphoria and “irrational exuberance” will inevitably revert to “fear and loathing”.

The question is when and by what one catalyst or combination of catalysts?

Given the scale of the risks facing investors and pension owners today, it is prudent to reduce allocations to stocks and bonds and increase allocations to physical gold.

Hussman’s Research Comment Can Be Accessed Here

Gold Prices (LBMA AM)

15 Mar: USD 1,202.25, GBP 986.69 & EUR 1,132.04 per ounce

14 Mar: USD 1,203.55, GBP 992.33 & EUR 1,130.86 per ounce

13 Mar: USD 1,207.80, GBP 989.79 & EUR 1,132.07 per ounce

10 Mar: USD 1,196.55, GBP 983.56 & EUR 1,127.15 per ounce

09 Mar: USD 1,204.60, GBP 991.39 & EUR 1,140.64 per ounce

08 Mar: USD 1,213.30, GBP 997.70 & EUR 1,149.00 per ounce

07 Mar: USD 1,223.70, GBP 1,003.56 & EUR 1,157.62 per ounce

Silver Prices (LBMA)

15 Mar: USD 16.91, GBP 13.87 & EUR 15.92 per ounce

14 Mar: USD 17.00, GBP 14.02 & EUR 15.99 per ounce

13 Mar: USD 17.02, GBP 13.92 & EUR 15.95 per ounce

10 Mar: USD 16.89, GBP 13.91 & EUR 15.92 per ounce

09 Mar: USD 17.14, GBP 14.10 & EUR 16.23 per ounce

08 Mar: USD 17.40, GBP 14.32 & EUR 16.48 per ounce

07 Mar: USD 17.70, GBP 14.52 & EUR 16.74 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.