Janet Yellen Just Popped the Stock Market Bubble

Stock-Markets / Stock Market 2017 Mar 17, 2017 - 05:44 PM GMTBy: Graham_Summers

The Fed hiked rates for the third time in eleven years.

The Fed hiked rates for the third time in eleven years.

In so doing it has confirmed what many have long suspected: that the only thing that matters to the Fed is stock market levels.

The Fed certainly doesn’t care about GDP growth. If it did, it would be evident that now is NOT the time to be hiking rates.

Let’s take a look.

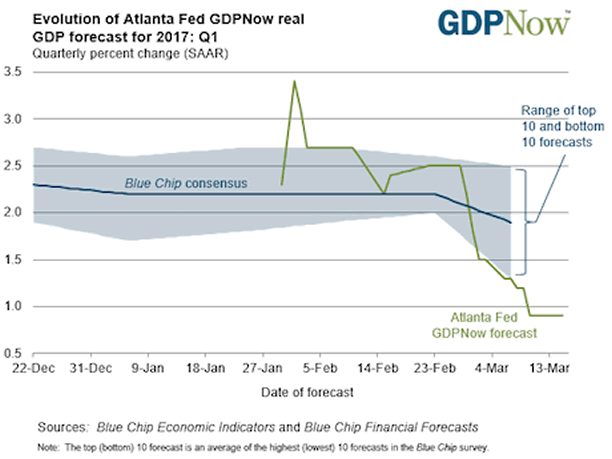

Last quarter’s GDP growth was abysmal at 1.8%. Since that time the Fed’s own GDP model has collapsed to just 0.9%. Look at the below chart and tell me you think it warrants two rate hikes in a three month period. We’re talking about a 2.5% GDP collapse in the space of six weeks.

By the way, this is a rosy projection. If you run 1Q17 GDP numbers using actual consumption instead of projection consumption then GDP growth is non-existent or 0%.

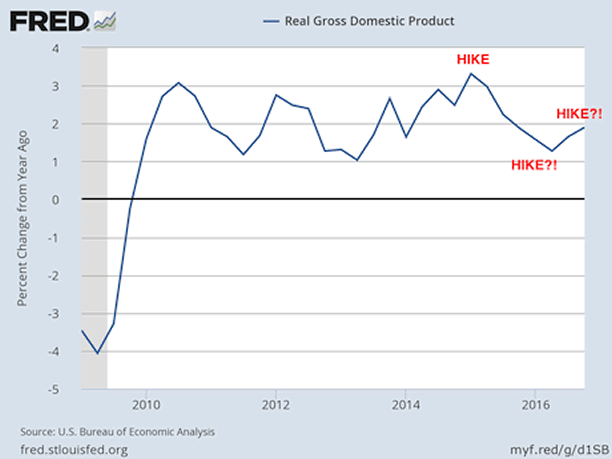

Moreover, a historical perspective only adds evidence that the Fed isn’t looking at GDP numbers when deciding to hike rates. The 4Q15 rate hike makes sense… but 4Q16 and now again in 1Q17?! Why would the Fed want to hike twice in three months during sub-2% GDP growth!?

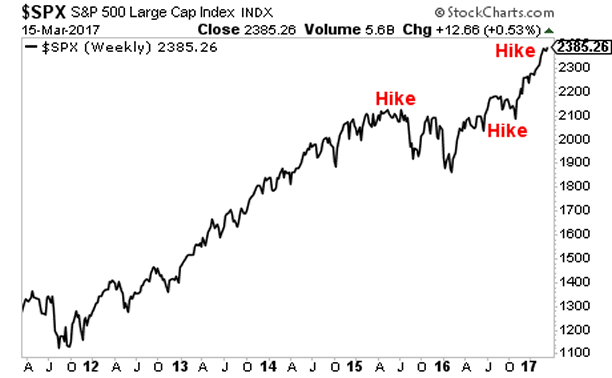

The simply answer is stock prices. When you look at a chart of the S&P 500, the 4Q15 hike makes sense. So does the decision to walk back additional hikes in 2016 (since the markets collapsed).

Now that the markets are once again roaring, the Fed has decided it’s time to start hiking again. And so it’s hiked twice in three months to attempt to deflate the stock market bubble.

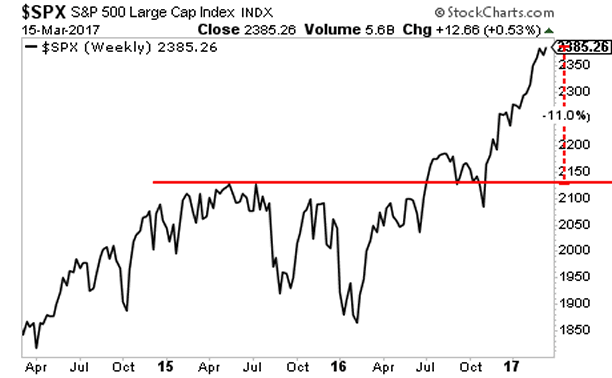

The only problem with this is that stock bubbles don’t deflate easily. Usually they collapse in a big way. This time will be no different. We’ve got air pockets all the way down to 2,125 on the S&P 500.

If you’re looking for active real time “buy” and “sell” alerts to help you make money from the markets I strongly urge you to take out a 98 cent trial to my Private Wealth Advisory newsletter.

Private Wealth Advisory is a weekly investment advisory that tells investors what stocks and ETFs to buy and sell… and when to do so.

Does it work?

A full 86% of our investments made money in the last 26 months. Yes, 86%, meaning we make money on more than 8 out of 10 closed positions.

Currently our portfolio is chock full of winners too, including gains of 10%, 12%, 15%, 25% even 33%.

Just yesterday we closed out two more winners of 8% and 9%.

Best of all, you can explore Private Wealth Advisory for 30 days for just $0.98.

To do so…

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2016 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.