Trump Stocks Bull Market Rolling Over? You Were Warned!

Stock-Markets / Stock Market 2017 Mar 22, 2017 - 11:28 AM GMTBy: Nadeem_Walayat

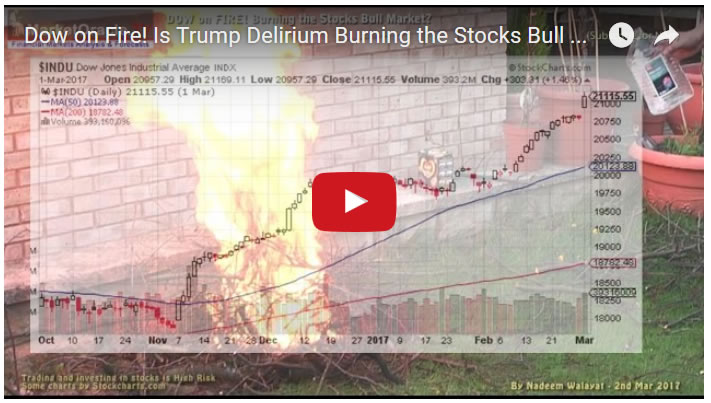

The stock market has been on a tear since Donald Trump surprised nearly everyone by winning the November 2016 US Presidential election, including the markets. Since which time the Dow has gone from a November low of 17,883 to an early March high of 21,200. That's a near 19% bull run in just 4 months! During which time America's Alt-Reality thin skinned President has often stepped forward to claim success for the stocks bull market rally under his Presidency.

The stock market has been on a tear since Donald Trump surprised nearly everyone by winning the November 2016 US Presidential election, including the markets. Since which time the Dow has gone from a November low of 17,883 to an early March high of 21,200. That's a near 19% bull run in just 4 months! During which time America's Alt-Reality thin skinned President has often stepped forward to claim success for the stocks bull market rally under his Presidency.

However those who follow my analysis will know that my Trump series of analysis began warning Mid December to take this extraordinary bull run opportunity to seek to reduce exposure to the stocks bull market as I expected it to end very badly for all those who had been jumping on board the Trump stocks bandwagon.

Whilst my last analysis virtually at the Dow's 1st of March trading high warned - The stock market rally from 20k to beyond 21k is more akin to a market literally being on FIRE. Literally burning the bull markets Foundations! And as is the case with all fires they do eventually simmer down and even go out! What form the stock market fires simmering down will take has yet to be deduced, i.e. will the market plunge or just flat line as it did along Dow 20k for over a month, one things for sure today's runaway burning bull run is NOT SUSTAINABLE!

02 Mar 2017 - Dow on Fire! Is Trump Debt Delirium Burning the Stocks Bull Market?

So here we stand with the Dow closing sharply lower at 20,668, with many again asking me what's most likely to happen next. Whilst the current focus of my in-depth analysis is on the countdown to Britain triggering Article 50 on the 29th of March, the formal process for Britain leaving the European Union i.e. my aim is to forecast what is likely to happen over the next 2 years BEFORE Article 50 is triggered this month, that and the linked SNP fanatics, who will likely soon proclaim that they to seek to build a wall along Scotland's southern border.

14 Mar 2017 - SNP Declare Scotland to Commit Economic Suicide Early 2019, 2nd Independence Referendum

Nevertheless, here is a trend extrapolation for the Dow from what has transpired over the past 2 weeks since I last warned that the Trump rally was burning the stocks bull market. Note this is not a forecast based on in-depth analysis but a taking into account of my bearish expectations and then extrapolating of the trend to date since the Dow's March 1st high of what could happen, so is obviously subject to revision in the light of more in-depth analysis, so do bare that in mind.

The trend extrapolation suggests that the whole of Trump stocks bull run could be erased by Mid Summer, when I am sure President Trump will be tweeting blame on fake NYSE stock quotes and that the Dow was actually still trading north of 22k in his Alt-reality universe.

Do ensure you are subscribed to my always free newsletter and youtube channel for forthcoming in-depth analysis and detailed trend forecasts.

In the meantime here's my take on the stock prospects for Britain's largest retailer in the wake of the Inflation Tsunami that I expect will have a devastating impact on the retail sector.

And more on the crisis the retail sector faces during 2017.

Ensure you are subscribed to my youtube channel for new videos as Britain counts down to BrExit.

By Nadeem Walayat

Copyright © 2005-2017 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.