Gold Prices See Seventh Day Of Gains After Terrorist Attack In London

Commodities / Gold and Silver 2017 Mar 23, 2017 - 01:12 PM GMTBy: GoldCore

– Gold prices higher seven days in row – best gains since Brexit

– Gold prices higher seven days in row – best gains since Brexit

– Gold spikes to three week high after terrorist attack in London

– Global stocks fell yesterday after attack in London

– Stocks resilient today and start day flat

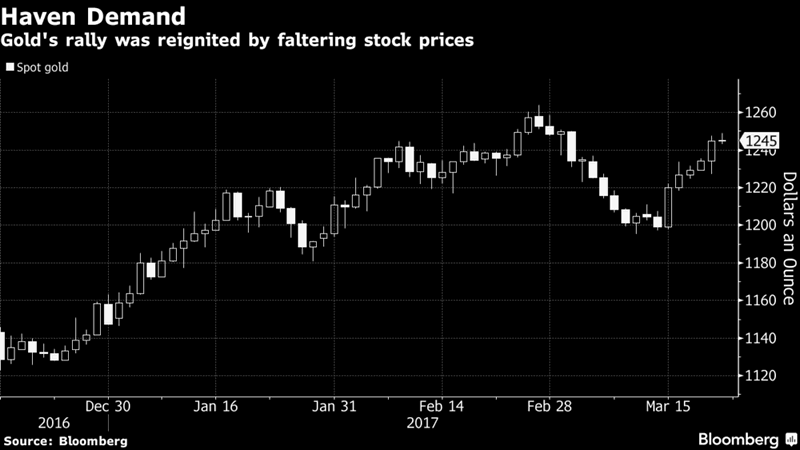

– Gold rallies 4.1% in recent days as stock prices falter

– Sterling fell yesterday but flat today

– Risk of terrorist ‘spectacular’ shows importance of gold

– Trump faces big test today and failure may impact stocks

– Silver rose 0.3% yesterday and is another 0.5% higher today to $17.69 per ounce

– Uncertainty to provide support for gold and should test resistance at $1,250 per ounce and above that at $1,300 per ounce

Gold prices reached a 3-week high yesterday after the terrorist attack in London pushed gold to $1,251.30 per ounce – the highest it’s been since February 28.

Gold prices have risen over 4% in the last seven days as global equities slumped and risk aversion returned to markets. Gold has consolidated on the gains of the last seven sessions today and prices are marginally higher just above $1,250 per ounce.

London’s worst attack in more than a decade left five people dead, including the assailant and the police officer he stabbed, and at least 40 injured.

The history of these attacks, including those in France, Germany and Belgium last year as well those in Madrid and London more than 10 years ago, show there was little impact on economic confidence or financial markets. However, these attacks, despite being tragic were relatively small in scale and not of the magnitude of the September 11 attacks in New York.

The concern is that with economies fragile and markets looking very over valued, a spate of new terror attacks or indeed what is termed a terrorist “spectacular” akin to ‘911’ or simulated attacks across the western world as warned of by Isis recruits, could be damaging.

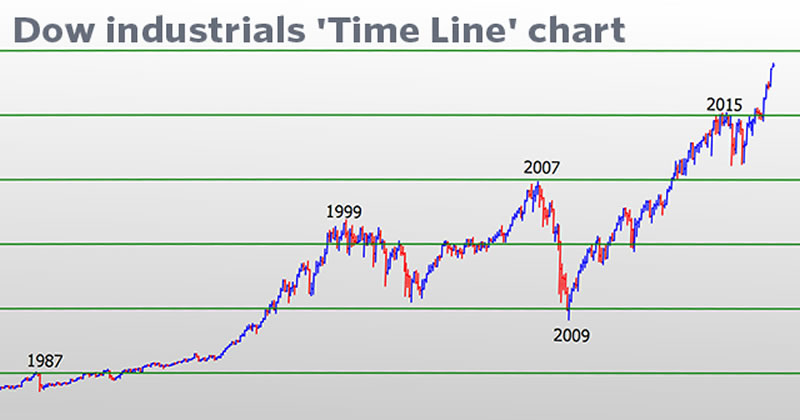

Markets are now also getting jittery about President Trump’s ability to push through policies that may benefit the U.S. economy. This is creating doubts on the so-called reflation trade that has seen stocks become “irrationally exuberant” in recent weeks.

Today’s focus is on whether Trump can gather enough support in a vote today to pass a bill to roll back Obamacare. It is the first major test of his legislative ability and whether he can keep his promises made to his supporters and the electorate.

Failure to eliminate the healthcare plan would suggest that Trump’s efforts to cut taxes and boost infrastructure will also be impeded. This could see stocks in the U.S. come under pressure and lead to renewed safe haven demand for gold.

Heightened political uncertainty in the U.S., the UK and indeed the EU will support gold and should lead to it testing resistance at the $1,250 to $1,260 per ounce level and above that resistance at $1,300 per ounce.

Silver rose 0.3 percent to $17.54 yesterday and is another 0.4% higher today to $17.69 per ounce.

Platinum and palladium also made gains and were up 0.5 percent at $962.55 per ounce and 0.3 percent to $788.85 respectively. Both have eked out further gains today with platinum at $968 and palladium rising 1.2% to $801 per ounce.

Gold Prices (LBMA AM)

23 Mar: USD 1,247.90, GBP 997.95 & EUR 1,157.93 per ounce

22 Mar: USD 1,246.10, GBP 999.50 & EUR 1,154.76 per ounce

21 Mar: USD 1,232.05, GBP 989.21 & EUR 1,141.37 per ounce

20 Mar: USD 1,233.00, GBP 993.92 & EUR 1,146.57 per ounce

17 Mar: USD 1,228.75, GBP 991.85 & EUR 1,140.53 per ounce

16 Mar: USD 1,225.60, GBP 998.74 & EUR 1,143.24 per ounce

15 Mar: USD 1,202.25, GBP 986.69 & EUR 1,132.04 per ounce

Silver Prices (LBMA)

23 Mar: USD 17.55, GBP 14.04 & EUR 16.27 per ounce

22 Mar: USD 17.58, GBP 14.12 & EUR 16.30 per ounce

21 Mar: USD 17.31, GBP 13.88 & EUR 16.01 per ounce

20 Mar: USD 17.23, GBP 13.92 & EUR 16.03 per ounce

17 Mar: USD 17.40, GBP 14.08 & EUR 16.21 per ounce

16 Mar: USD 17.46, GBP 14.21 & EUR 16.28 per ounce

15 Mar: USD 16.91, GBP 13.87 & EUR 15.92 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.