Is Now a Good Time to Invest in the US Housing Market?

Housing-Market / US Housing Mar 23, 2017 - 06:49 PM GMTBy: Nicholas_Kitonyi

The US housing market has maintained its subdued growth following Trump’s election to The White House. Towards the end of last year, especially in the run-in to the US presidential elections, there was what appeared to be a strong belief that Trump would be bad for the stock market if elected as president, and by extension the overall economy of the US.

The US housing market has maintained its subdued growth following Trump’s election to The White House. Towards the end of last year, especially in the run-in to the US presidential elections, there was what appeared to be a strong belief that Trump would be bad for the stock market if elected as president, and by extension the overall economy of the US.

However, the US stock market has experienced one of the best runs in history repeatedly breaking the all-time highs from one week to the next. The housing market, on the other hand, has experienced a rather slower growth since Trump’s election, but the point is that it’s been growing, nonetheless.

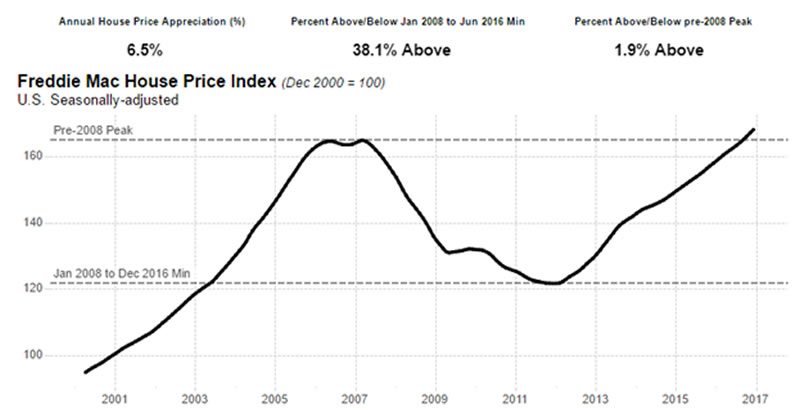

This has been characterized by a rise in the US House Price Index, as demonstrated on the following chart by Freddie Mac.

Based on the Freddie Mac House Price Index curve above, the US housing prices have just gotten past the highs of the pre-2008 period by nearly two percentage points. This also puts it more than 38% above the levels reached during the 2008 global financial crises, which brought the world markets to their knees.

Now, given the current circumstances in the US housing market, many are wondering whether it could be the best time to invest in the industry. On the other hand, there are also those who are thinking of cashing out on their property investments with housing prices already appearing to have peaked in the last couple of years.

For those looking to profit off their investments, then that would mean selling. However, based on recent data, selling property in the US has not been particularly easy. Research shows that old houses are now taking longer to sell than before with the owners probably being forced to sell at a discounted price. In addition, some people looking to sell their properties do not understand well the contents of a listing contract agreement, and this has led to some having to re-list their houses.

Nonetheless, the real estate market is composed of different players including agencies that offer to buy houses from individual sellers right away without having to wait for a buyer. As such, it would appear that probably the fastest way to sell your house in the US right now would be via these buy and hold agents, rather than a listing real estate agency.

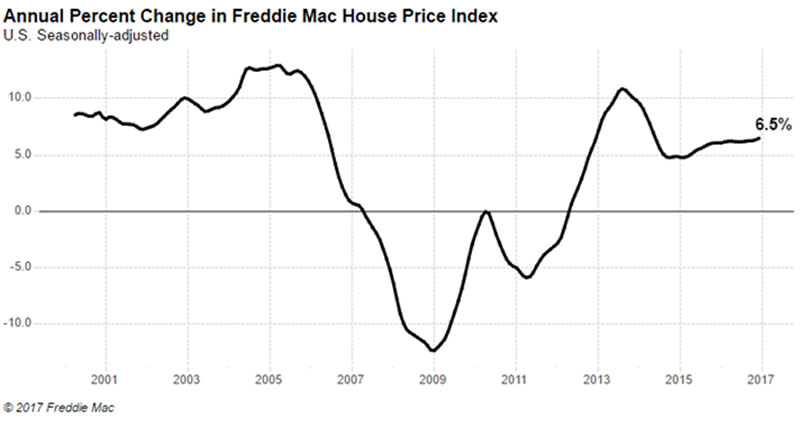

The growth of the US housing market appears to be settling down to moderate levels and the house price index is also mirroring the same trajectory. The annual change in Freddie Mac house price index currently stands at 6.5%, which is a slight increase from 5% recorded in 2015. In late 2013, the Freddie Mac House price index was registering a change of more than 10% after experiencing a sustained growth for a period of over two years.

Given the indicative stability in the US house price index over the last two years, it is now easier to plan on buying a house than it was a couple of years ago. As such, buying a house in the US is probably now easier than selling one. Mortgage rates remain low at just over 4.4% despite the recent interest rate hike and the lending market continues to attract more players.

The US housing market is one of the country’s main economic indicators. A continuous growth shows that the economy is still growing and this is one of the reasons why the Federal Reserve was able to increase interest rates in March. More rate hikes are planned before the year end, but again, this will depend the kind of signals the market sends with regard to investor sentiment on more rate hikes.

While this uncertainty continues to hover around the US housing market, the decision on whether to buy or sell a house as an investment will rest on the predictability of the House price index, the mortgage rates, and the trend in the small loan market.

Conclusion

In summary, the US housing market is not only an economic symbol for the country, but also a global economic indicator. The US attracts investors from all over the world, with several of them investing in the real estate market.

Currently, Canada, Asia, Europe and Latin America are the leading foreign investors in the US real estate market. A decline in investments these foreigners could be a signal that the global real estate market is slowing.

As for now, it looks like it’s a good time to invest in the US housing market. There are growth opportunities in various suburbs and metro areas while urban and high-end markets continue to experience a higher price index.

By Nicholas Kitonyi

Copyright © 2017 Nicholas Kitonyi - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.