Short Term Stock Market Bottom Close

Stock-Markets / Stock Market 2017 Mar 27, 2017 - 06:00 AM GMTBy: Brad_Gudgeon

Last week, I was looking for weakness not to exceed 4%. The drop was closer to 1.7%. A positive divergence is occurring on the 1 and 2 hour charts, which should lead to a bounce soon. There is fib support around 2329/30. Already, Sunday night, SPX futures are down 14 points. An attempt to rally into month's end looks likely, perhaps to near 2365 SPX and the dropping 20 day moving average.

GDX looks like it trying to find a Z wave bottom of an XYZ bull flag. Overall, there looks to be higher prices ahead. I'm waiting for more pull back to go long.

Last week we had a great week trading SPXS +5% and DUST +6%. Our option players also had another great week.

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com.

Copyright 2017, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

2017 is shaping up to be a game-changing year for copper, with Trump’s $500-billion infrastructure plan, booming Chinese demand and the recent interest rate hike from the Fed, copper prices are soaring. And for this little known small-cap miner on the verge of discovering the world’s largest deposit, the timing could not be better

The place to be for copper’s 2017 bull run is Chile, where Arena Minerals Inc. (TSX:AN.V; OTC:AMRZF) has gained access to one of the largest copper land packages in one of the world’s hottest copper regions ever…and they’ve got the cash, experience, and local team base to do it.

Not only has Arena managed to get its hands on a massive property that was a highly sought-after piece of copper territory by many major miners in the world. There’s a sudden new urgency to boost mining—from copper and gold to lithium —and the venue is fast become a foreign miner’s best friend.

In the meantime, while major miners like BHP Billiton, Rio Tinto, Glencore and Anglo American lost nearly $20 billion in core earnings as commodities plunged in 2014 and 2015, 2016 saw a turnaround, and 2017 is all about the bull—here’s why:

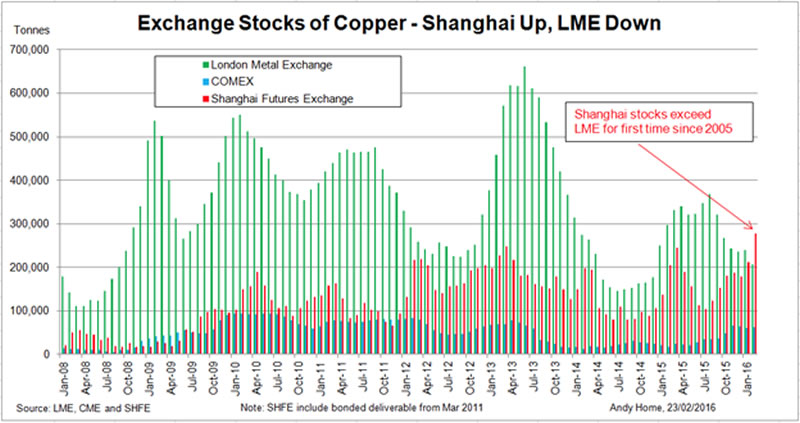

- China copper demand is again on a boom swing. It happened in 2004/2005, when Shanghai inventories rose above the London Metal Exchange (LME) inventories, which is the world’s standard. A massive bull market ensued—and the same thing is happening again, right now:

- Trump’s $500-billion infrastructure plan has already driven copper prices up, and coupled with Chinese demand, this has real staying power.

- Continued workers’ strikes at major copper mines are further boosting prices.

- The Fed raised key interest rates after a two-day policy meeting last week, and this has weighed on the dollar and benefitted copper prices, making it one of the best stocks to add to an investor portfolio right now.

- We’re going to be short on supply, and the shortage is expected to become evident in the first half of this year, where we could see a repeat of the ‘China boom’ of 2005—or even better. Goldman Sachs reaffirmed its bullish stance on the red metal and warns of a serious supply risk which could possibly lead to an aggressive price spike.

The reality, we don’t have another mega-project in the works, and the major deposits have already been found. This means that Arena is sitting on what appears to be the only mega-copper venue that hasn’t been explored and exploited. It’s an unheard-of achievement for a small-cap miner.

Here are 5 reasons to keep an eye on Arena Minerals (TSX:AN.V; OTC:AMRZF), one of the most unique small-cap miners in the world today:

#1 This is the Copper Jackpot

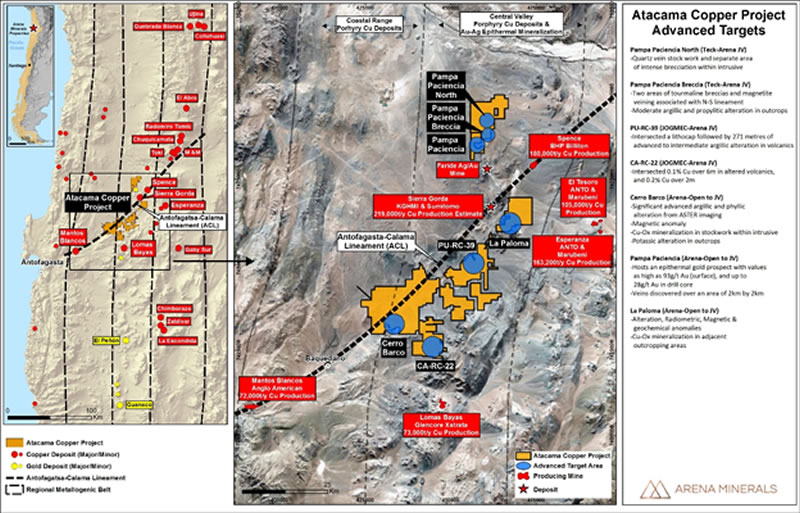

The Atacama Copper is the project to end all projects in Chile’s copper heartland and covers approximately 73,000 hectares in the heart of the Antofagasta mining district.

Arena’s flagship project is an original 2,930-square-kilometer exploration venue, only 50 kilometers from Antofagasta—a highly active, mining friendly area that is inundated with world class operating mines and brilliant infrastructure.

It’s also home base of Antofagasta Plc—a wildly profitable copper miner owned by Chile’s wealthiest family.

Atacama is packed full of major players because it has a very distinct exploration advantage.

Only a short distance in almost any direction is another of the world’s biggest copper mines, including BHP Billiton’s (NYSE:BHP) Escondida copper porphyry deposit, the largest open-pit copper mine in the world. Mining giant Rio Tinto (NYSE:RIO) has a 30% interest in Escondida as well.

Atacama isn’t hot just for copper—it’s a mining bonanza for everything from gold and silver to lithium as well. U.S. firm Albemarle Corporation (NYSE:ABL) acquired Rockwood Holdings here, and Chilean producer Sociedad Quimica y Minera (SQM) is all over Atacama.

It’s here that Arena is drilling towards what could end up being the biggest copper porphyry discovery in the world. And it’s getting closer and closer to the jackpot.

Arena started out here with a whopping 300,000 hectares and started zeroing in on areas of interest. And the probability of finding copper porphyry is higher because this is a geological wonderland for metals, and particularly for copper.

Chile’s elongated western margin is bounded by an earthquake-inducing, mountain-building and ore deposit-forming subduction zone, all ‘pushing up’ the metals belt.

To the south of Atacama, we have the giant Escondida, and to the north, Collahuasi. In between we’ve got El Indio, Los Pelambres, and El Teniente--all bursting at the seams with copper prospects.

This is the elephant hunt of the decade, and early indications are that the edge of a porphyry system has already been hit by one of Arena’s partners on the ground, JOGMEC (Japan Oil, Gas and Metals National Corporation). As they work towards the bullseye here, these are billion-plus-type projects, and a major small-dunk for a company of Arena’s size.

#2 A Small-Cap Makes a Big-Cap Play

No one but Arena (TSX:AN.V; OTC:AMRZF) --not even the biggest players--could gain access to this major play. And many have tried.

The advantages are piling up for Arena, which is proving to be one of the smartest small-caps ever to have landed a play in the big leagues.

But this is where visionary management and strategic partnerships come into play—and this is exactly where Arena excels.

Arena secured option agreements carving up the property with Teck (NYSE:TECK) and JOGMEC. What does that do for Arena? It gives it a big-cap play and all of its costs are covered—and more. It even gives Arena covered payments and work commitments.

More specifically, Arena’s JV deals significantly reduce Arena’s ongoing commitments, and makes for an investor dream:

- Arena retains material interest without incurring further costs

- It minimizes dilution to shareholders

- It means a major increase in spending with more aggressive timelines—straight to the bullseye

- It means more and faster drilling

Smart JV agreements like this are hard to come by, and this is what makes Arena exceptional, because this is a tough market to play for drilling speculation. Not only will Arena have the money, it will spend to get to the big copper discovery of the decade. They’ve put the brakes on dilution, and the end result will be the drilling of over 241 holes.

So, we’re looking at large projects in prime copper territory owned by a $10-million market cap company with a solid revenue stream. It doesn’t get much more exciting than this.

#3 Visionaries with Unmitigated Determination

So, we know that Arena managed to hold on to one of the most brilliant copper exploration plays in the world but how did they get it in the first place? You can’t get in on the Atacama without knowing the right people, and without commanding a great deal of respect.

This is president and CEO William Randall and executive vice-chairman Dan Bruno, both born and raised in Latin America, and both with extensive mining and capital raising experience. They put Arena together to take advantage of their existing relationships in Chile, and in particular with Chile’s giant SQM.

But it gets even better from here: Another board member is Paul Matysek--one of the most energetic driving forces on the small-cap mining scene today. He’s created shareholder value of well over $2 billion in gold, lithium, potash and uranium, and now he’s breaking out with copper.

Then we have Chairman of the board Mark Eaton, a well-known head of sales for CIBC in Toronto whose last success was Belo Sun Mining Corp. (TSX:BSX) in Brazil, which got close to a billion dollars and is now gearing up to come into production in Brazil with about 7 million ounces.

Next to the stellar track record of its management, the company is backed by mining visionary and successful entrepreneur Ross Beaty – current executive chairman of Alterra Power Corp. and chairman of Pan American Silver Corp.

Along with an impressive line-up of experts, they have pulled off the spectacular in Chile. The

relationship with SQM bears special attention. Everyone has been gunning for a crack at this play for three decades, but it’s owner, SQM, wasn’t biting. SQM was a government-run entity that was privatized, and it controls some 4 million hectares of land in Chile. Because of its focus on lithium, potash, iodine and nitrate, there are huge parcels of land in the prime copper and gold districts that were left untouched.

A few years ago, SQM came under pressure to divest, and Arena got first dibs on this unexploited heartland.

#4 Permits in Place, Cashed-Up and Ready to Drill

Right now there’s a major catalyst, which makes for the perfect time for Arena (TSX:AN.V; OTC:AMRZF) to ping on investor radar. They’ve kept quiet about their massive project for a year, while they went through the permitting process. Now that they just revealed the news it’s full speed ahead. Arena was granted environmental and drilling permits 10 days ago, and they’ve already moved one drill on the property, with the second scheduled for next week.

So, the time for savvy investors to move is now.

Arena is permitted for 241 drill holes, each one about 150 meters. And it’s scheduled to go down at breakneck speed, with the first 15,000 meters slated for completion by the end of April.

After that, there will be a month or two drill break, and then it all starts again, with results coming in between mid-April and mid-June. You’ll want to be positioned well ahead of this.

#5 Positive Cash Burn

In 2016 the company received more cash from JV partners than its overall burn, which isn’t only unique, it’s largely unheard of in the exploration game right now.

There hasn’t been a better time in recent history for a new copper discovery. Even better...

All of the catalysts there are positive for copper prices—from the potential for higher demand in the U.S. under a new administration and stronger demand from China, to increased supply disruptions that are causing a rally right now and show no sign of abating and a lack of new copper projects coming online.

The most impressive thing on the copper scene right now is Chile’s unexploited copper deposits, and by far the most impressive move was Arena’s scooping up of big-cap territory that could lead us to the biggest discovery in the world.

By. James Burgess of Oilprice.com

Legal Disclaimer/Disclosure: This piece is an advertorial and has been paid for. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Oilprice.com only and are subject to change without notice. Oilprice.com assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report. All content contained herein is subject to the terms and conditions set forth in the original article posted on Oilprice.com and subject to the terms and conditions therein.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.