Charts That Reveal US Real Employment Status and It’s Not Good

Economics / Employment Mar 29, 2017 - 01:43 PM GMTBy: John_Mauldin

The “labor force” from which we get unemployment statistics includes only those people who are either working or wish to be working.

The “labor force” from which we get unemployment statistics includes only those people who are either working or wish to be working.

It ignores the retired, those in school, the disabled, and nonworking spouses—as well as those who are not interested in working.

That’s always been the case, of course. But even a 1% variance in the size of the labor force represents millions of people in a nation as large as the US. As I’ve mentioned before, this can paint a vastly different picture.

Here are five telling charts revealing ominous US employment trends that are often ignored or overlooked by our politicians.

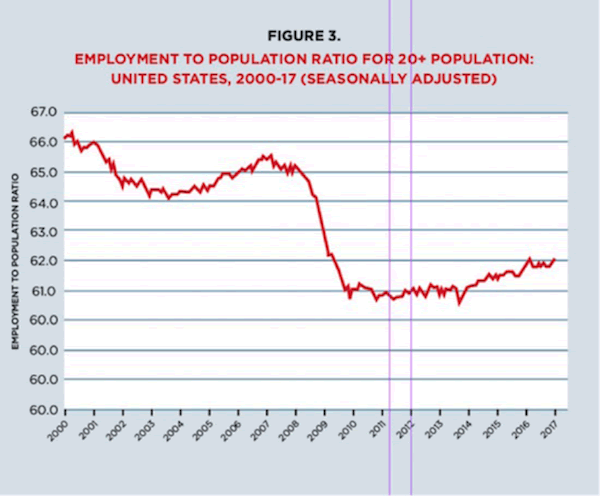

Fewer Adults Are Working Fewer Hours

A smaller percentage of the adult population is working now than in the past. The percentage declined in the early 2000’s recession. And it never fully recovered before plunging in 2008–2010. We see only a very slight upturn after the recession ended.

The problem is particularly acute for men, though it affects women as well.

When Federal Reserve officials gathered last week to raise interest rates, they reviewed the data that says the economy is near “full employment.” That notion is laughable to millions of regular Americans.

Nicholas Eberstadt, in “Our Miserable 21st Century” in Commentary magazine, digs into the data and estimates that for every unemployed American male between ages 25 and 55, there are three more who are neither working nor looking for work.

That’s about 5 million men who, for whatever reason, have dropped out of the labor force.

Here’s another and possibly even more startling number. Between 2000 and 2015, the total paid hours of work by all American workers rose 4 percent. The prior 15-year period saw a 35 percent increase in work hours.

That’s bad enough, but it gets worse. In that same 2000–2015 period, the adult civilian population grew almost 18 percent.

With the population growing far faster than the total number of work hours, it shouldn’t be surprising that so many people aren’t working.

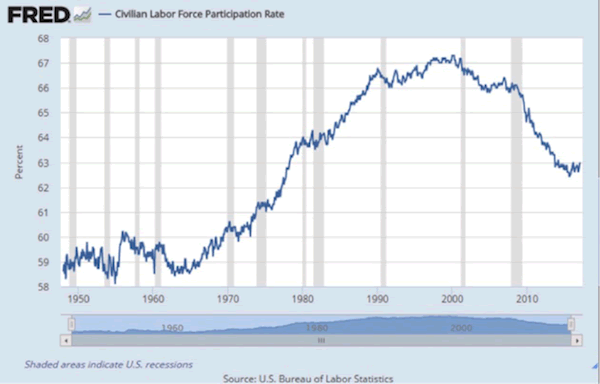

The Labor Force Participation Rate Is Declining

Let’s look at a few charts from the FRED database of the St. Louis Federal Reserve Bank.

This first chart shows the overall civilian labor force participation rate, which grew from the mid-1960s right up until the start of the century.

But this chart doesn’t paint the whole picture. It looks like things were just fine up until 2000. Not really. The next two charts show what really happened.

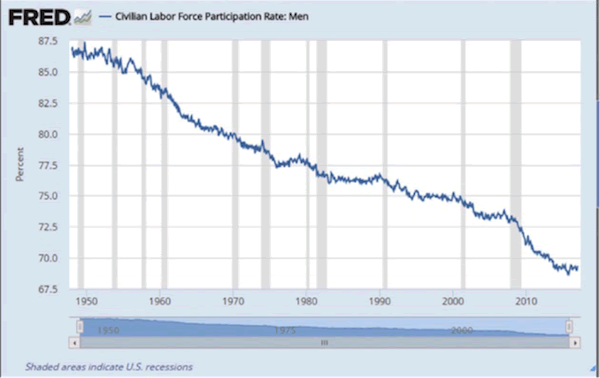

The Drop-Off in the Male Labor Force Participation Is Huge

The second chart is the male labor force participation rate. The drop-off has been significant.

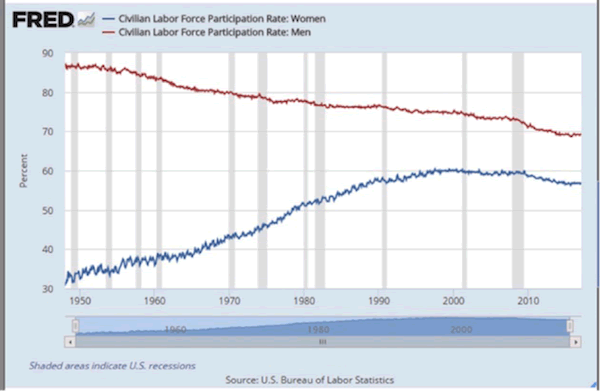

But the Female Labor Force Participation Rate Has Doubled

Note that the participation rate for women doubled in the 50 years up till 2000. Meanwhile, for men it went from almost 90% (87.4% to be precise) to just below 70% today.

And that falloff has been steady throughout the entire period.

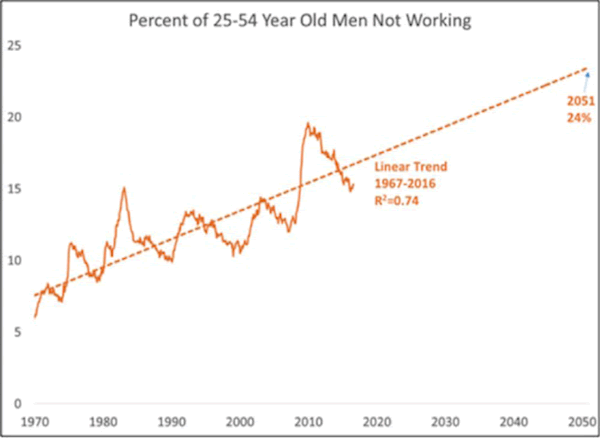

25% of Men Aged 25–54 Will Drop Out by 2050

Again, both men and women are dropping out of the labor force at higher rates. But Eberstadt shows it is more common for men to do so. The trend is getting worse, too.

Larry Summers shared the below trend chart in his Men Without Work book review.

If the trend since 1970 does continue, like I’ve written about before, nearly one-fourth of all men aged 25–54 will be voluntarily jobless by mid-century.

We have millions of unoccupied working-age males right now. What are they doing all day? Survey data suggests they spend much of their time staring at screens—either TV or video games.

I can’t find hard data, but I suspect this group works more than the surveys indicate. Much of the work happens off the books as they try to preserve government benefits or avoid child support payments.

Nevertheless, they surely don’t have stable careers. Why not? What holds them back?

- Education: Many of the aimless males barely made it through high school and aren’t ready for college.

- Safety Nets: Our well-intentioned social programs can create a disincentive for people to work.

- Addictions: A startlingly high number of men without work take prescription pain medicines. Others use alcohol or other drugs.

- Crime: I am not talking about an increase in crime, because overall US crime is actually in a real downtrend and has been for some time. The actual, often overlooked, problem is the large number of people with criminal records.

Men Without Work—That’s Bad for Everyone

As you can see, “men without work” is a tough problem. It’s as much sociological as economic, but it has a serious economic impact.

Technological solutions may not come to our rescue this time. If anything, technology is aggravating the problem by making it cost-effective for machines to do entry-level work that once needed humans.

Men without work eventually become men without hope, and that’s bad for everyone.

Get a Bird’s-Eye View of the Economy with John Mauldin’s Thoughts from the Frontline

This wildly popular newsletter by celebrated economic commentator, John Mauldin, is a must-read for informed investors who want to go beyond the mainstream media hype and find out about the trends and traps to watch out for. Join hundreds of thousands of fans worldwide, as John uncovers macroeconomic truths in Thoughts from the Frontline. Get it free in your inbox every Monday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.