Bitcoin Price Rises Higher Than Gold… But Its Value Is a Different Story

Commodities / Gold and Silver 2017 Mar 30, 2017 - 08:41 AM GMTBy: John_Mauldin

Since hitting a record-low of $177 in January 2015, Bitcoin is up almost 600%.

Since hitting a record-low of $177 in January 2015, Bitcoin is up almost 600%.

On March 2, 2017, it reached a new high of $1,268 per unit—thus surpassing the price of an ounce of gold for the first time ever.

So, what’s the driving force behind this parabolic rise?

The More Dimwitted Governments Act, the Better It Is for Bitcoin

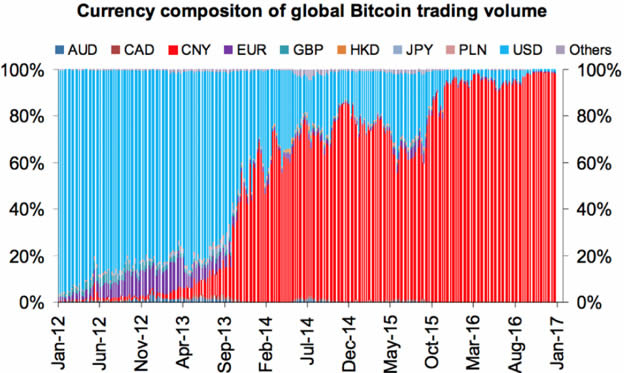

Since the beginning of last year, almost all Bitcoin trading has originated from China. This trend coincides with the introduction of capital controls. Since Beijing first enacted the controls in March 2016, over 90% of Bitcoin trading has been done through yuan.

Source: Deutsche Bank

In its short history, Bitcoin’s price has risen during episodes of monetary folly—as we’ve seen when similar capital controls were enacted in Cyprus and Greece in 2013 and 2015, respectively.

You could say it acts as a kind of “fear gauge” of public faith in fiat currencies and central banks.

A 2016 study found that 20% of Bitcoin users owned the currency because they “didn’t want banks and governments controlling their money.” This was the second-most cited reason for owning it behind “investment purposes.”

In that sense, Bitcoin is comparable to gold. However, in many ways they are polar opposites.

Bitcoin Is a Store of Volatility

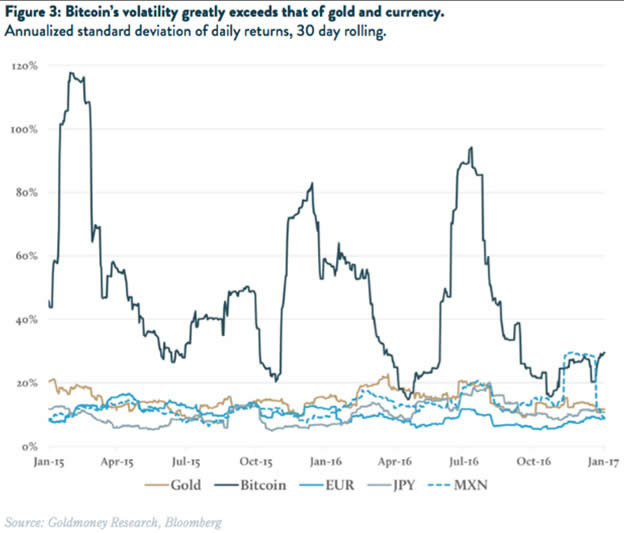

Gold has been a wealth preservation tool and a store of value for 2,500 years. Bitcoin was created in 2008 and has experienced large downside moves ever since. In the first week of 2017, Bitcoin dropped by over 30%.

A major reason for Bitcoin’s volatility is its small market size. The average daily trading volume (ADTV) of Bitcoin is $32 million. In comparison, the ADTV of the largest gold ETF (GLD) is $845 million.

This chart shows just how volatile Bitcoin is compared to gold and other major currencies.

Given the low ADTV, it’s impossible to buy $2 million worth of Bitcoin on any given day without moving the market. It is estimated that it would take only $50 million to dominate the Bitcoin market for five minutes. As such, there is huge potential for manipulation.

There have been attempts to expand the size of the market with the creation of a Bitcoin ETF. This would add liquidity and ease to investing in Bitcoin.

Unfortunately for users, the proposal was shot down by the SEC a few weeks ago. On that news, Bitcoin plunged as much as 20% on some exchanges in just a few short hours.

While it has recovered most of its losses since, the move is a stark reminder of how volatile Bitcoin can be.

Another knock on Bitcoin being a long-term store of value is that 60%–80% of the transactions on its exchanges are done by machines. Therefore, its price is largely driven by algorithms and speculators.

Bitcoin also has significant counterparty risk as evidenced by the Mt. Gox and Bitfinex scandals. Users of the respective exchanges had bitcoins valued at $460 million and $72 million stolen from them. Those who weren’t directly affected also suffered when Bitcoin plummeted on the news.

Bitcoin’s built-in scarcity and inability to be counterfeited are attributes it shares with gold. However, it cannot be considered a store of value, for the reasons stated above.

Good Reasons to Opt for Gold Instead

Gold is the ultimate long-term store of value and the only financial asset that is not simultaneously someone else’s liability. In a world filled with counterparty risk, this is a vital attribute.

Given the recent price drop, now could be a good time to add the yellow metal to your portfolio. For investors who wanted to buy gold at the bottom in December but didn’t, now is your second chance.

Rising rates are actually good for gold. As the Fed hiked rates by a quarter-point last week, investors could be getting a bargain at around $1,240 per ounce, given the Fed's dovish stance towards very gradual rate increases.

With two major European elections approaching, and the UK ready to trigger Article 50, rising uncertainty will add to gold’s attractiveness. China’s ongoing domestic problems are also bullish for the yellow metal.

This is a great time to buy gold, but investors must be aware that “paper gold” (i.e. gold ETFs) is not the same as buying physical metal. For those looking to preserve their wealth, gold bullion is the only option.

In closing, with the price of Bitcoin now higher than that of an ounce of solid gold, we will side with Jim Rickards and take the gold. Bitcoin has its merits as a speculation, but it’s too early to consider it a store of value.

Free ebook: Investing in Precious Metals 101: How to Buy and Store Physical Gold and Silver

Learn how to make asset correlation work for you, how to buy metal (plus how much you need), and which type of gold makes for the safest investment. You’ll also get tips for finding a dealer you can trust and discover what professional storage offers that the banking system can’t.

It’s the definitive guide for investors new to the precious metals market. Get it now.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.