Negative Real Interest Rates to Drive Gold Price Higher

Commodities / Gold and Silver 2017 Apr 04, 2017 - 01:50 PM GMTBy: John_Mauldin

At its March meeting, the Federal Reserve raised interest rates by 0.25%. In doing so, it hiked rates for only the third time since 2006. However, in a strange turn of events, the Fed’s move was perceived as a dovish one by the markets.

At its March meeting, the Federal Reserve raised interest rates by 0.25%. In doing so, it hiked rates for only the third time since 2006. However, in a strange turn of events, the Fed’s move was perceived as a dovish one by the markets.

That’s because even with inflation at its highest level since 2012, the Fed said monetary policy will remain accommodative “for some time.” As has been the case in the past, the Fed is willing to let inflation consolidate above its 2% target before embarking on a more aggressive tightening path.

This willingness to let inflation “run hot” means even as nominal rates rise, real rates—that is, the nominal interest rate minus inflation—are headed into negative territory.

So what are the implications of negative real rates?

Negative Real Rates Drive Gold Higher

The consumer price index (CPI), the most widely used measure of inflation, averaged 2.67% for the first two months of the year. Even if inflation averaged only 2% for all of 2017—the Fed’s target—it would be a big problem for investors and savers alike.

Today, a one-year bank CD pays about 1.4%. Therefore, anyone who keeps their money in a bank is watching their purchasing power erode.

Of course, there are other options. You can put your money in US Treasuries or dividend-paying stocks—both popular sources of fixed income.

However, with both the 10-year Treasury yield and the average dividend yield for a company on the S&P 500 hovering around 2.35%, that doesn’t leave much in the way of real gains if inflation is running at 2% per annum.

If inflation rises or bond yields fall, real interest rates will be pushed into the red… and that’s very bullish for gold.

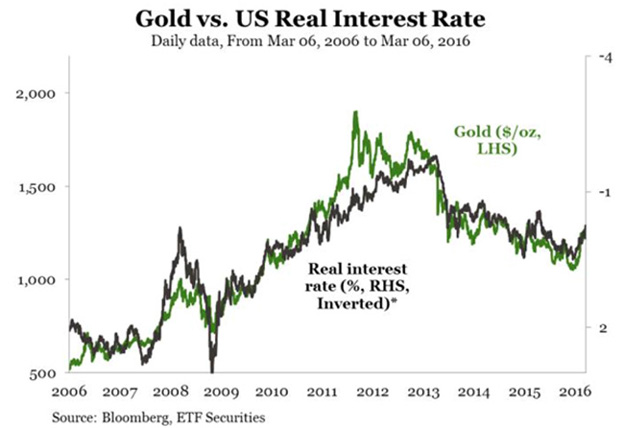

Gold is known as the yellow metal with no yield, but simple math tells us no yield is better than a negative one. Because of this, gold has done well when real rates are in negative territory. In fact, real US interest rates are a major determinate of which direction the price of gold moves in.

A study from the National Bureau of Economic Research found that from 1997–2012, the correlation between real US interest rates and the gold price was -0.82.

This means as real rates rise, the price of gold falls and vice versa. A -1.0 reading would be a perfect negative correlation, so this is a tight relationship.

The Fed’s hesitation to raise rates faster is contributing to another trend that is also bullish for gold.

A Falling Dollar Equals Higher Gold Prices

In the six weeks following the US election, the dollar skyrocketed 5.6%—a huge move for a currency.

However, since the beginning of the year, the greenback has given back most of its post-election gains. This is in part due to the Fed’s “dovishness” on interest rates.

The strong negative correlation between gold and the US dollar is a major reason the yellow metal is up over 9% year to date.

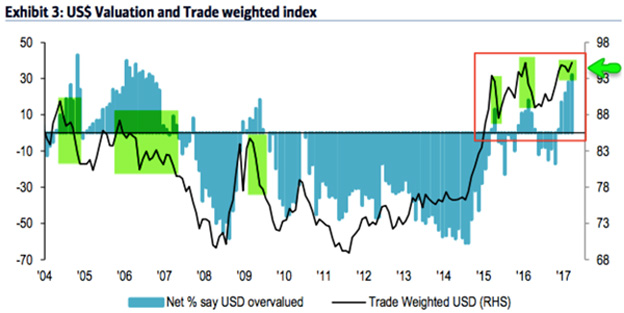

In the March edition of Bank of America Merrill Lynch’s Global Fund Manager Survey, respondents thought the dollar was at its most overvalued level since 2006. As the chart shows, the survey has a good track record of determining when the dollar is overvalued.

Source: Bank of America Merrill Lynch

Tying it all together, what do these trends mean for gold?

Gold Should Go Higher from Here

With arguably the two biggest drivers of the gold price trending in the yellow metal’s favor, gold is likely to go higher. Although the dollar could rise if Washington implements some structural reform, real rates aren’t headed higher anytime soon based on the Fed’s actions.

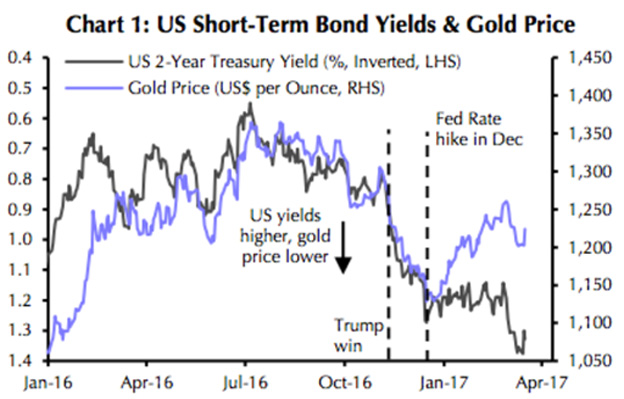

Bank of America Merrill Lynch said these two trends were part of the reason why it upgraded its forecast for gold to $1,400 per oz. by year-end. As the chart below shows, the market turned bullish on gold following the Fed’s December rate hike.

Source: Bloomberg

In closing, after nine years of doing its utmost to generate inflation, the Fed has finally succeeded. If past is prologue, as inflation rises over the coming months, gold will do very well.

If you’re considering getting some gold before it goes up, do your homework first. Find out everything you need to know about which type of gold to buy and which to stay away from at all costs… how to safely store your gold… and much more… in the revealing ebook, Investing in Precious Metals 101. Click here to get your free copy now.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.