Stock Market Investors Stupid is as Stupid Goes

Stock-Markets / Stock Market 2017 Apr 05, 2017 - 07:38 PM GMTBy: James_Quinn

If you prefer fake news, fake data, and a fake narrative about an improving economy and stock market headed to 30,000, don’t read this fact based, reality check article. The level of stupidity engulfing the country has reached epic proportions, as the mainstream fake news networks flog bullshit Russian conspiracy stories, knowing at least 50% of the non-thinking iGadget distracted public believes anything they hear on the boob tube.

If you prefer fake news, fake data, and a fake narrative about an improving economy and stock market headed to 30,000, don’t read this fact based, reality check article. The level of stupidity engulfing the country has reached epic proportions, as the mainstream fake news networks flog bullshit Russian conspiracy stories, knowing at least 50% of the non-thinking iGadget distracted public believes anything they hear on the boob tube.

This stupendous degree of utter stupidity goes to a new level of idiocy when it comes to the stock market. The rigged fleecing machine known as Wall Street has gone into hyper-drive since futures dropped by 700 points on the night of Trump’s election. An already extremely overvalued market, as measured by every historically accurate valuation metric, soared by 4,000 points from that futures low – over 20% – to an all-time high. Despite dozens of warning signs and the experience of two 40% to 50% crashes in the last fifteen years, lemming like investors are confident the future is so bright they gotta wear shades.

The current bull market is the 2nd longest in history at 8 years. In March of 2009, the S&P 500 bottomed at a fitting level for Wall Street of 666. In a shocking coincidence, it bottomed on the same day Bernanke & Geithner forced the FASB to rollover like mangy dogs and stop enforcing mark to market accounting. Amazingly, when Wall Street banks, along with Fannie and Freddie, could value their toxic assets at whatever they chose, profits surged. The market is now 240% higher.

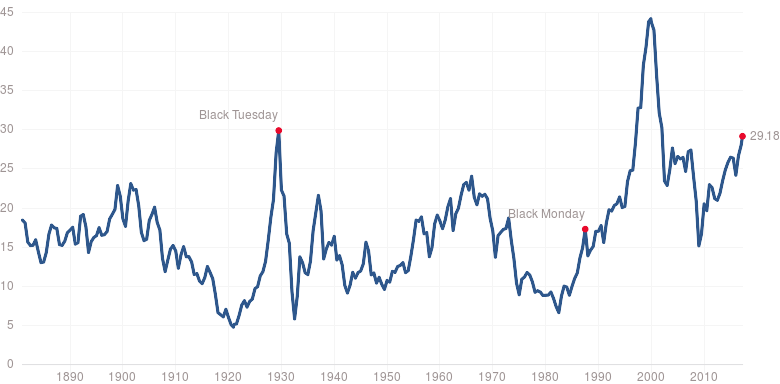

You have the second longest bull market in history, while stock market valuations, as measured by the Shiller PE ratio and every other historically accurate valuation method, are higher than 1929 and 2007, but the Wall Street hype machine and the business network shills adamantly declare this bull has years to go and thousands of points of upside. Greybeards who haven’t been captured by the Wall Street machine honestly point out the market will deliver 0% returns over the next ten years at these valuations. Eric Peters’ words of wisdom will fall on deaf ears:

“The longer a market trends lower, or higher, the more confident people become that tomorrow will look like today. And what they forget is that the single most important consideration in investing is your starting point.”

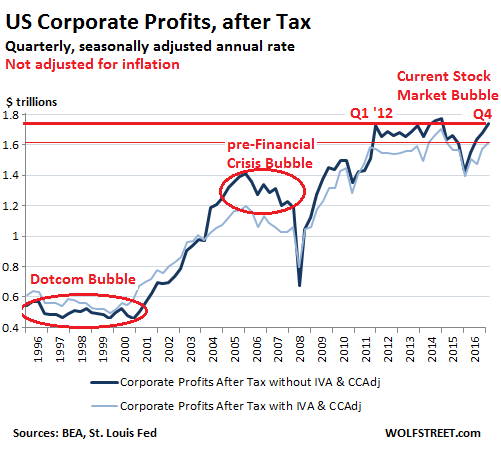

You would think the PE ratio of the market rising to historic highs must be due to corporate profits continuing to rise and making investors confident about the future. The narrative being flogged by the fake news networks is a strong economy and surging corporate profits are the reason for all-time high stock prices. The narrative is fake news, as corporate profits have been stagnant for the last five years, as the market has advanced by 70%.

In March of 2009, at the height of the financial crisis, Fed overnight interest rates were at an emergency level of .25%. Eight years later after a “tremendous” economic recovery, Fed overnight interest rates are still at an emergency level of .75%. Ten year Treasuries were 2.9% in March 2009 and are currently 2.3%. If this was a true economic recovery, would rates be at these levels?

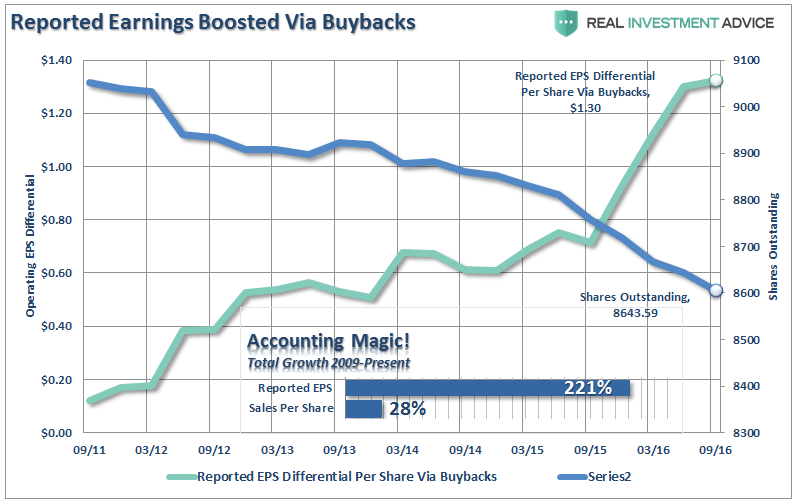

The truth is, this entire bull market has been generated through financial engineering. A critical thinking individual, which eliminates all CNBC bimbos/talking heads and Ivy League educated Federal Reserve schmucks, might ask how reported corporate earnings per share since 2009 have risen by 221% when corporate revenues have only risen by 28%. That’s quite a feat – creating fake earnings without increasing revenue. It’s easy when you implement a three pronged scheme to manufacture a phony economic and stock market recovery.

Step one was to “temporarily” repeal FASB Rule 157 in March 2009 so banks could value their toxic real estate assets at whatever price they chose. Mark to fantasy versus mark to market allowed the criminal Wall Street banks to generate billions in fake profits. Step two was for the Federal Reserve to buy $3 trillion of toxic worthless assets from the criminal Wall Street banks at 100 cents on the dollar and stick them on their own insolvent balance sheet.

Step three was breathing life into failing corporations with unnecessarily low interest rates. The Fed’s 0% interest rates allowed Wall Street banks to generate billions in risk free profits by depositing reserves at the Fed. ZIRP also allowed insolvent financial firms, underwater real estate developers and zombie retailers to refinance their massive levels of debt at ridiculously low interest rates – eliminating the market clearing creative destruction that happens in free markets. Corporations also used off-balance sheet shenanigans to suppress leverage levels and boost earnings.

Lastly, S&P 500 companies embraced the benefits of globalization by off-shoring millions of jobs to slave labor camps in the Far East, drastically reducing their cost structures and boosting earnings. These same corporations used the BLS fake inflation data as the reason to suppress wage increases for their employees at a 2% level, further boosting earnings. As a humorous aside, executive pay and bonuses advanced at double digit rates.

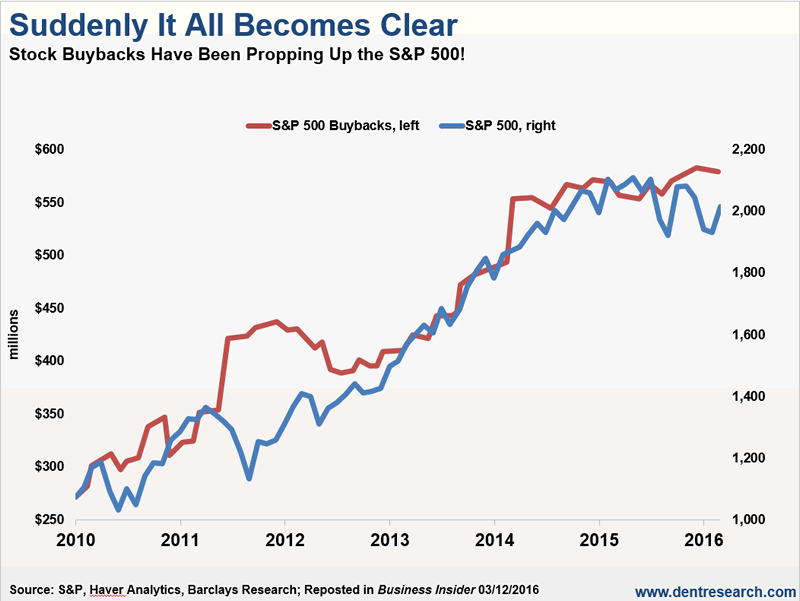

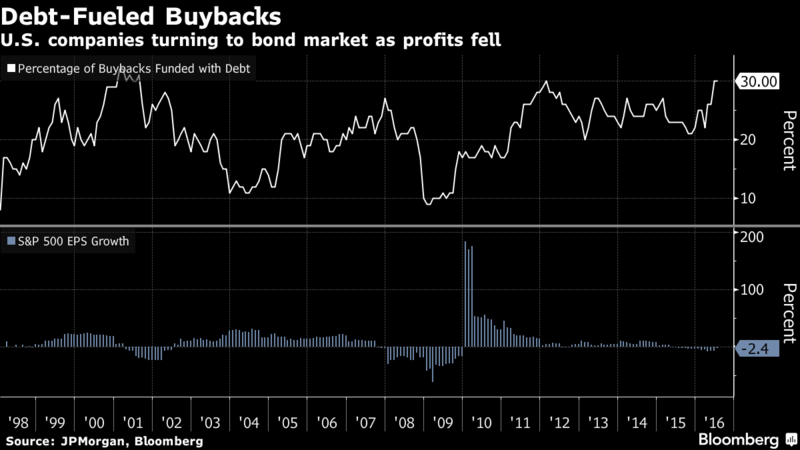

The following chart sheds some light on this “fundamentally” driven bull market.

S&P 500 companies have bought back $500 billion in stock in the last two years, and $2.1 trillion since 2010. Until recently, individual investors have been net sellers for the last eight years. Pension funds have not been net buyers. That means the entire stock market surge has been reliant upon corporations buying their own stock and Wall Street institutions using their HFT machines to rig the system. And this entire scheme has been enabled by the Federal Reserve’s crisis level low interest rates for the last eight years.

After you’ve run out of accounting gimmicks, refinanced all your debt, and outsourced as many jobs to the third world as possible, how else can you make your earnings per share rise? Why invest your money in capital, innovation, research or human resources to grow your sales, when you can just buy back your own stock and goose earnings per share the easy way. Goosing EPS by reducing the number of shares makes it easier for the Wall Street fleecing machine to pump stocks and it makes it easier for corporate CEOs and their executive teams to “earn” their million dollar bonuses while stiffing their employees with 2% raises.

But it gets better. Since 2009 over $1 trillion of debt was taken on by S&P 500 companies just to buyback their own stock. The narrative about corporations being flush with cash is complete bullshit. In the last two years, the trend of issuing debt to buyback stock has accelerated to an all-time high of 30%. Think about that for one moment. With stock market valuations at all-time highs, the brilliant Ivy League educated MBA CEOs of the largest companies in the world have issued $300 billion of debt in the last two years to buyback their stock at all-time highs.

The stupid, it burns. This ridiculous miss-allocation of corporate funds was enabled by the Fed keeping interest rates so low for so long. The Fed is always the culprit in the boom and bust cycles that plague our rigged economic system. The big banks and corporations always get bailed out when their reckless financial schemes blow up, while the average American gets screwed by inflation, stagnant wages, and higher taxes. Retail CEO’s were buying back their stock over the last eight years and are now declaring bankruptcy and closing stores at a record pace. Maybe they could have used the cash used on buybacks to sustain their businesses.

Corporate debt levels are at all-time highs despite a supposed eight year economic recovery. The debt was used to buyback stock rather than invest in the business. Revenues have been stagnant and earnings are now falling. Interest rates are being ratcheted up by the Fed, and the economy is falling into recession. With debt levels already high and interest rates rising, the buyback machine is going to shut off. Without corporate buybacks what will sustain the stock market rise?

The trillion dollars of stock bought at record high prices with debt will be vaporized in the next inevitable stock market crash. But the debt will remain. And the CEOs will plead ignorance and say who could have known as they cash their multi-million dollar paychecks. The Wall Street shysters know their only hope now is to lure the stupid money into the market as they head for the exits. That’s why their hype machine has been in overdrive with the Snapchat IPO and gushing articles about Tesla’s Model 3 revolutionizing the auto industry. It’s enough to make a sane person gag.

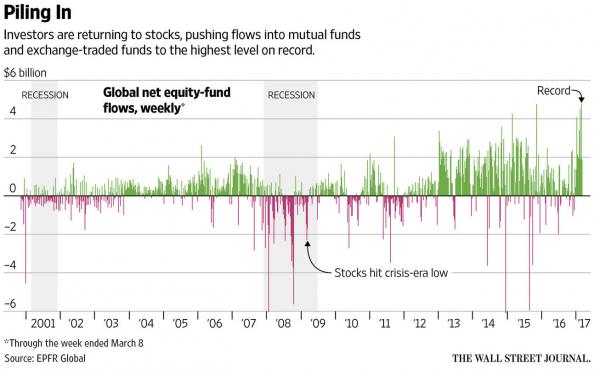

And it’s working. The little guy has been hesitant to dip their toe back in the water after seeing 50% of their net worth obliterated in 2000/2001 and then again in 2008/2009. It seems the election of Donald trump and his promises of tax cuts, walls, infrastructure and fixing healthcare have enthused the masses into investing in the stock market at its all-time high. I guess they forgot how much it hurt when they were clubbed over the head eight years ago. Well, they are going to relearn that lesson again.

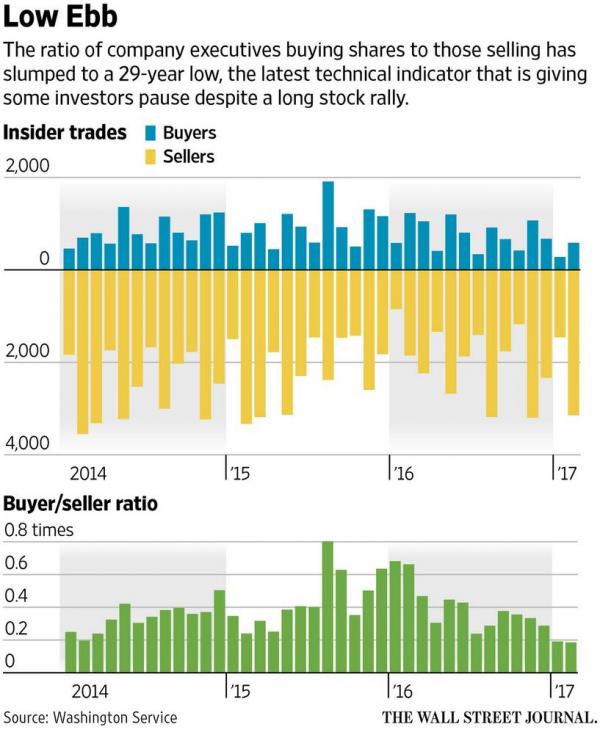

As the stupid money goes in, the smart money heads for the exits. The perfect example of how American corporations are led by greedy, short-term oriented, unprincipled, dishonest, corrupt egomaniacs can be seen in their personal actions versus the their corporate mandates. As Wall Street touts stocks to the little guy and corporate executives commit billions of shareholder dollars towards buying back their stock, corporate executives are cashing in their stock options and selling like there is no tomorrow. What a despicable display of self-interest.

If all is well and the market is headed higher then why are corporate executives buying their own firms’ shares at the slowest pace in at least 29 years. According to the Washington Service, there were a total of 279 insider buyers in January, the lowest since 1988. Moreover, the number of sellers has also grown in recent months, pushing the ratio of buyers to sellers in February to its lowest since 1988 as well. If the market isn’t overvalued, then why are corporate executives, who know their business’ prospects better than anyone, selling their stocks at a far greater rate than buying? It’s because they are going to let the ignorant investing masses be left holding the bag when the shit hits the fan.

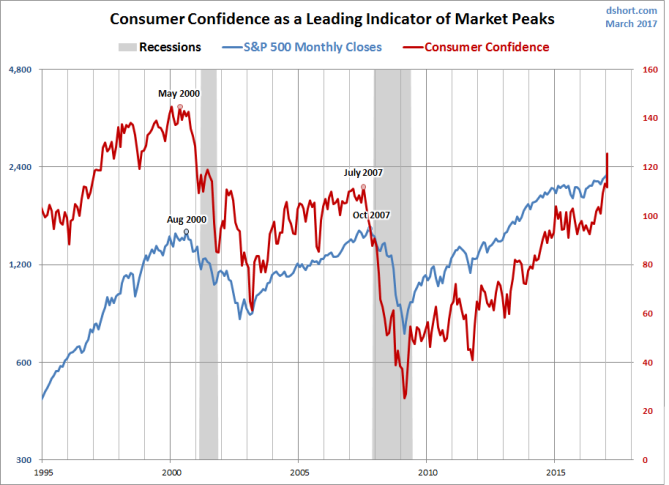

Human beings are so predictable en mass that it’s almost humorous to watch them get it good and hard once again. They are like Wile Coyote thinking they will surely catch the Road Runner this time by using the same old methods that have failed a thousand times before. Their confidence rises just before they go over the cliff once again. We’ve reached that point again for the third time in the last seventeen years. Consumer confidence is at a sixteen year high (seems odd considering retailers are closing 3,500 stores in the next few months). The previous peaks were in May 2000 and July 2007. We all know what happened next. But it will surely be different this time. Jim Cramer tells me so.

So all the pieces are in place for an epic stock market crash, along with a real estate and debt market crash as an added kicker. The arrogant, over-confident thirty year old MBA investment geniuses and their super computer algorithms are sure they are smarter than the next guy and will get out before it’s too late. They think there will be a clear event which will signal it’s time to go. The markets are so overvalued, so dependent on the Fed, and so propped up by massive amounts of leverage, they will topple under their own weight at any moment. Central bankers, Wall Street bankers, politicians, pundits, experts, and the stupid lemmings will be shocked by this truly unexpected development.

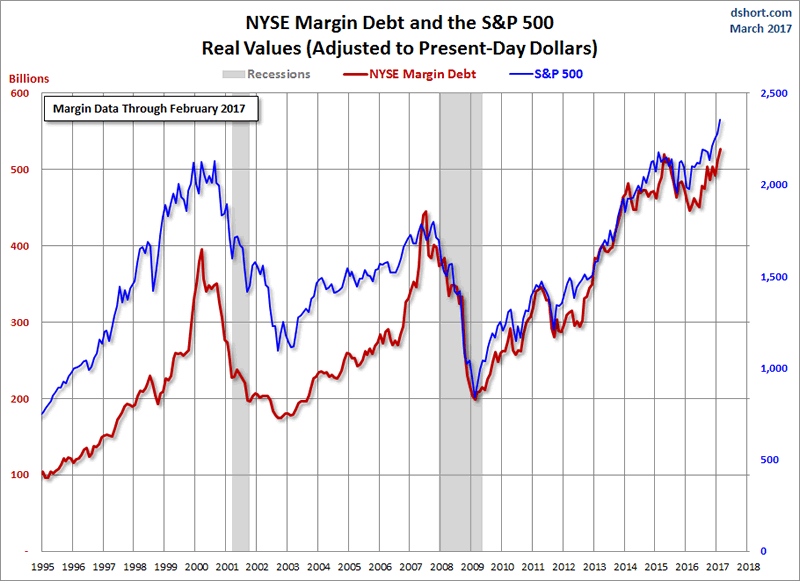

Data reported in the last week will be the gasoline thrown on the fire when this market starts to burn, turning it into a towering inferno. Margin debt has reached an all-time high, as supremely confident investors (aka speculators) know the trend is their friend. They have borrowed over $500 billion against their stock portfolios to buy some more Snapchat, Tesla, Amazon, Facebook, Google and Apple. The previous peaks of $400 billion to $425 billion in 2000 and 2007 have been far surpassed. What happened after those previous peaks? I forget. I’m sure this time will be different. A CNBC bimbo spokesmodel told me so.

Lance Roberts, an honest, analytical, critical thinking investment manager describes what will happen, because it always does:

“Investors can leverage their existing portfolios and increase buying power to participate in rising markets. While “this time could certainly be different,” the reality is that leverage of this magnitude is “gasoline waiting on a match.”

When an event eventually occurs, it creates a rush to liquidate holdings. The subsequent decline in prices eventually reaches a point which triggers an initial round of margin calls. Since margin debt is a function of the value of the underlying “collateral,” the forced sale of assets will reduce the value of the collateral further triggering further margin calls. Those margin calls will trigger more selling forcing more margin calls, so forth and so on.”

I watched The Big Short a couple weeks ago for the second time. The lessons from that movie will never grow old. Greed drives human beings to do reckless things in the pursuit of riches. Men think in a herd like manner and go mad in pursuit of their delusional aspirations of wealth and power. Those who see the irrationality and stupidity of the herd are scorned and ridiculed until they are ultimately proven right. Delusions die hard, but they do die as reality always wins.

“We find that whole communities suddenly fix their minds upon one object, and go mad in its pursuit; that millions of people become simultaneously impressed with one delusion, and run after it, till their attention is caught by some new folly more captivating than the first.” – Charles Mackay, Extraordinary Popular Delusions & the Madness of Crowds

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2017 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.