Stock Market Signs of Concern

Stock-Markets / Stock Market 2017 Apr 13, 2017 - 09:58 AM GMTBy: Donald_W_Dony

After a strong showing of strength from the markets over the last four months, a topping appears to be developing.

Some of the factors that seem to be soften the near-term bull market are geopolitical risks.

The building tensions around Syria and North Korea have placed many investors on edge and moved them toward safe-havens.

For example, some of the "classic" safe-havens such as gold, bonds and the Japanese Yen are coming off their lows and slowly advancing (Chart 1).

The yellow metal has been the best performer of these three rising about 10 percent since January and most recently advanced to $1275 mark, a new 5-month high.

Another important measure on how investors are feeling is the CBOE Volatility Index or VIX. This indicator is a reliable gauge on implied volatility of the S&P 500 options (lower portion of Chart 1). It is often referred to as simply the "fear index".

A mounting VIX suggests that investors see risk ahead and that the market will likely move sharply, whether downward or upward.

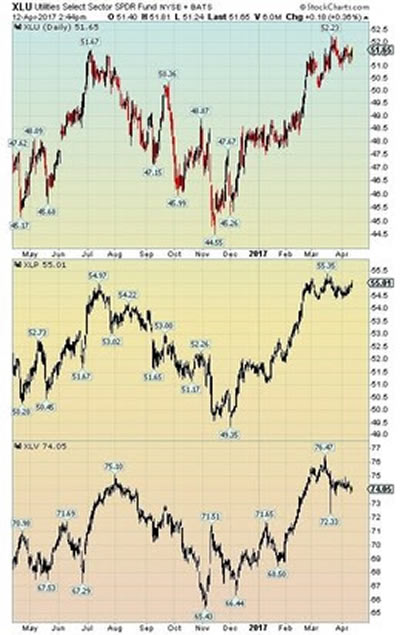

Another clear indicator of mounting investor concerns has been the recent advance in the utilities, consumer staples and healthcare sectors. These industry groups are also associated as "safe-havens" for investors (Chart 2).

Bottom line: After four months of solid advancement, North American indexes are on the backfoot and the beginnings of a topping pattern appears to be unfolding.

Rising "safe haven" assets and sectors suggest that investors are hedging their bets against possible market turbulence from Syria and North Korea's nuclear ambitions.

Our models suggest that this market pullback will continue for the next few months with an expected low in around late July or early August.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2017 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.