SPX Stock Market Correction Continues

Stock-Markets / Stock Market 2017 Apr 15, 2017 - 04:40 PM GMTBy: Tony_Caldaro

The market started the holiday shortened week at SPX 2356. After a rally to SPX 2366 early Monday the market started to pullback. After a decline to SPX 2337 Tuesday morning the market rallied to 2353 by Wednesday morning. Then the market declined into the end of the trading week, closing at the SPX 2329 low. For the week the SPX/DOW lost 1.05%, and the NDX/NAZ lost 1.15%. Economic reports for the week were mostly negative. On the downtick: the CPI/PPI, retail sales, the WLEI, the Q1 GDP estimate, consumer sentiment, plus weekly jobless claims and the budget deficit rose. On the uptick: export/import prices. Next week’s reports will be highlighted by the Beige book, the NY/Philly FED, and industrial production. Best to your week!

The market started the holiday shortened week at SPX 2356. After a rally to SPX 2366 early Monday the market started to pullback. After a decline to SPX 2337 Tuesday morning the market rallied to 2353 by Wednesday morning. Then the market declined into the end of the trading week, closing at the SPX 2329 low. For the week the SPX/DOW lost 1.05%, and the NDX/NAZ lost 1.15%. Economic reports for the week were mostly negative. On the downtick: the CPI/PPI, retail sales, the WLEI, the Q1 GDP estimate, consumer sentiment, plus weekly jobless claims and the budget deficit rose. On the uptick: export/import prices. Next week’s reports will be highlighted by the Beige book, the NY/Philly FED, and industrial production. Best to your week!

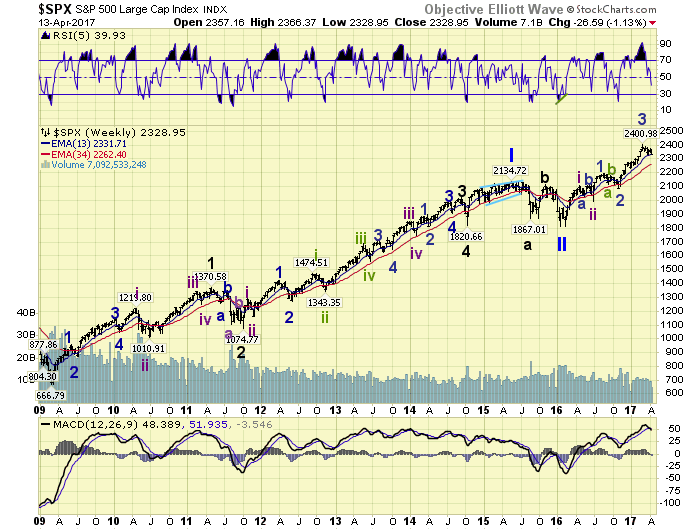

LONG TERM: uptrend

As suspected, the corrective activity since the early March all-time SPX 2401 high was confirmed as a Minor wave 4 correction this week. This suggests Minor wave 3 of Intermediate wave iii ended at that high, and Minor wave 4 has been underway since then. When a correction unfolds for this long, six weeks, before being confirmed, it is usually near its end.

The long-term count remains unchanged, except for upgrading the tentative green Minor 3 label to dark blue. A Major wave 1 of Primary III bull market is underway. Intermediate waves i and ii completed in Apr/Jun 2016, and Minor waves 1 and 2 completed in Aug/Nov 2016. Minor wave 3 just completed last month, and Minor wave 4 is currently underway. When it does conclude Minor wave 5 should take the market to all-time highs.

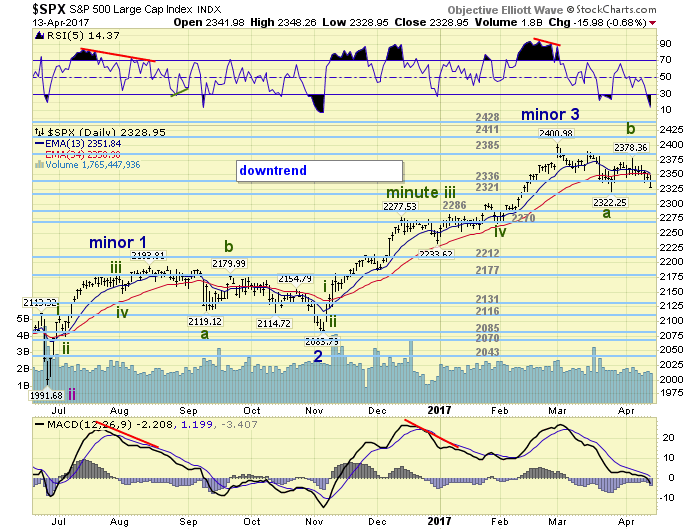

MEDIUM TERM: downtrend

As noted above a Minor 4 downtrend was confirmed this week, from the Minor 3 high at SPX 2401. The correction looks like it is unfolding in a double three: abc-x-abc. Or simply Minute a, Minute b, and Minute c. Minute a unfolded in three waves bottoming at SPX 2322. Minute b rallied in three waves to SPX 2378. Minute c is already unfolding in three waves and has hit SPX 2329 as of Thursday.

Should Minute c = Minute a then we should see a low around SPX 2299. Should Minute c extend, at SPX 2260 = 1.50 Minute a, or at SPX 2250 = 1.62 Minute a. Fibonacci supports are at SPX 2280 = 38.2% Minor 3 retracement, or at SPX 2243 = 50.0% retracement. There is OEW pivot support at the 2286 and 2270 pivots. And finally, the previous 4th wave bottomed at SPX 2267 which is wave support. Combining all these parameters the OEW 2270 and 2286 pivot ranges appear to be the most likely support area. Medium term support is currently at the 2321 and 2286 pivots, with resistance at the 2336 and 2385 pivots.

SHORT TERM

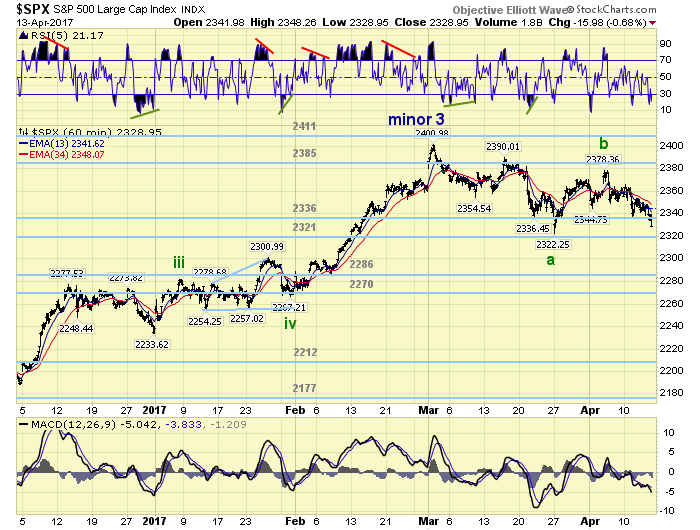

The short term count we had been tracking since early-November appeared to be unfolding quite nicely until, and even a few days after, the FED raised rates on March 15th. The market had hit a high at SPX 2401 on March 1st, pulled back to SPX 2355 by March 9th, then rallied to SPX 2390 on March 15th. After that the market pulled back about 20 points by March 20th, then started to rise into the 21st. When news broke that the Ryan healthcare bill was short of votes the market, and the short term pattern, started to breakdown. The market then made a low at SPX 2322 on March 27th. But the rally that followed was clearly corrective. It is clear on the hourly charts the healthcare bill failure helped terminate the uptrend.

Nevertheless the Minor 3 uptrend was the longest in time and price of the three impulsive uptrends in this ongoing bull market. Corrections, thus far, have been quite shallow at about 5+% and between 110 and 130 SPX points. You can do the math from the SPX 2401 high. Short term support is at the 2321 and 2286 pivots, with resistance at 2336 and 2385 pivots. Short term momentum ended the week quite oversold. Best to your trading!

FOREIGN MARKETS

Asian markets were mostly negative and lost 0.3%.

European markets were all negative and lost 2.1%

The DJ World index lost 0.5%, and the NYSE lost 1.1%.

COMMODITIES

Bonds are in an uptrend and gained 1.1%.

Crude appears to be in an uptrend and gained 1.8%.

Gold is in an uptrend and gained 2.5%.

The USD is in a downtrend and lost 0.7%.

NEXT WEEK

Monday: NY FED at 8:30, the NAHB at 10am, and after the close a speech from FED vice chair Fischer.. Tuesday: industrial production, housing starts and building permits. Wednesday: the FED’s beige book. Thursday: weekly jobless claims, the Philly FED and leading indicators. Friday: existing home sales and options expiration.

CHARTS: http://stockcharts.com/public/1269446/tenpp

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2017 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Tony Caldaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.