Stocks Are Completely Mis-pricing the Risk of a Another Debt Ceiling Screw Up

Stock-Markets / Stock Market 2017 Apr 16, 2017 - 06:14 PM GMTBy: Graham_Summers

While everyone continues to focus on Trump and his policies, a much larger issue looms.

That issue is the US debt ceiling.

The US Government hit its debt ceiling on March 16, 2017. The Government employed “extraordinary measures” to keep the Government open. At that time, Congress had a little over three weeks to deal with this issue.

Given how divided Congress has become, it’s no surprise this has gone nowhere. Congress left for its spring recess without fixing this.

Congress returns on April 21st and will have just a handful of sessions to resolve this issue before its deadline. (April 28 2017).

In order to resolve this issue, Congress will have to resolve the budget… which includes issues that are EXTREMELY contentious (the US/Mexico border wall for one).

Put simply… in order to avoid a Government shutdown and potential repeat of the 2013 Debt Ceiling Crisis, the same Congress that cannot even get an Obamacare Repeal off the ground (one of the most sought after pieces of legislation in over a decade)… is supposed to somehow work out a budget including VERY contentious issues… in a HANDFUL of sessions.

Good. Luck. With. That…… particularly at a time when it is clear certain groups in Congress are all too happy to blow up deals in order to sabotage the Trump administration’s agenda.

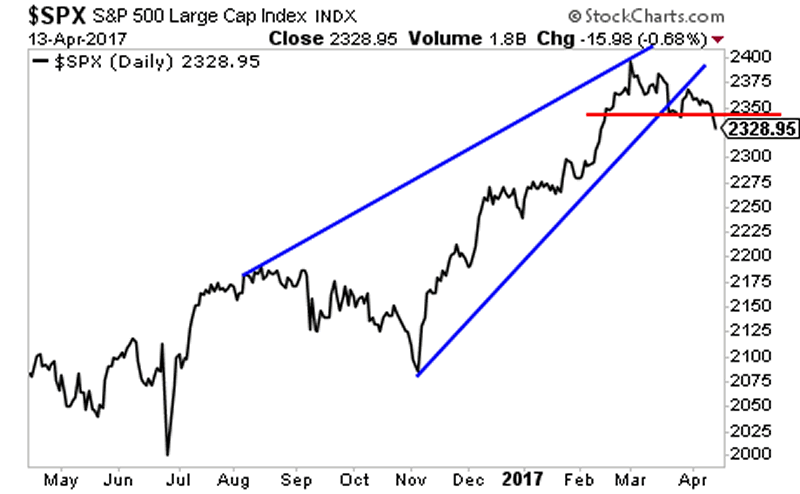

This is an absolute mess. And the market is only just beginning to wake up to the risk here with the S&P 500 breaking below critical support on Thursday.

If you are concerned about a potential debt crisis in the US, you can take easy steps to prepare for it.

Indeed, you could even make money from it with the right investments.

On that note we are already preparing our clients for how to make money from this with tree simple investment strategies designed to pay out when the markets enter periods of heightened risk.

To learn them you can pick up a free Investment Report here:

http://phoenixcapitalmarketing.com/bondbubble2.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2017 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.