Risk on Stock Market French Election Euphoria

Stock-Markets / Stock Market 2017 Apr 24, 2017 - 04:08 PM GMT SPX futures went euphorically higher as the DAX made an all-time high this morning.

SPX futures went euphorically higher as the DAX made an all-time high this morning.

Currently the level of the SPX futs are near 2375.00. SPX is in the 84th hour of its Cycle which began at 2378.36. If the current EW reading is correct, it should reverse in the next three hours without overcoming its April 5 high.

Last Thursday, Bloomberg noted, “European Central Bank officials signaled that their liquidity facilities remain available to counter any market tension that may arise in the aftermath of France’s presidential election, the first round of which takes place Sunday.”

This apparently happened.

ZeroHedge reports, “Risk is definitely on this morning as European shares soar, led by French stocks and a new record high in Germany's Dax, after a "French relief rally" in which the first round of the country’s presidential elections prompted investors to bet that establishment candidate Emmanuel Macron will win a runoff vote next month, and who is seen as a 61% to 39% favorite to defeat Le Pen according to the latest just released Opinionway poll.”

Wall Street is delighted. That does not lessen the fact that Washington faces a likely shutdown at the end of the week. In addition, there are numerous key events that may dampen investors’ spirits.

VIX futures got clobbered this morning, dropping well into the 11.00 handle.

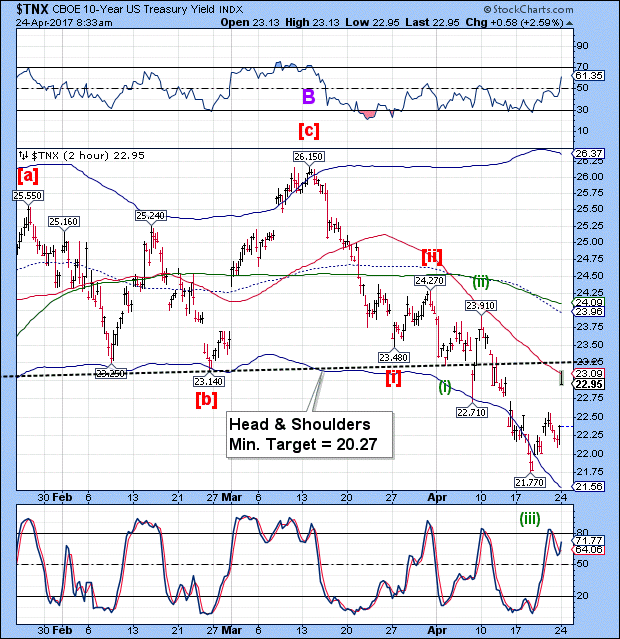

TNX shot up to its short-term resistance at 23.09. It may not last in that position, as the correction appears to be complete, or nearly so.

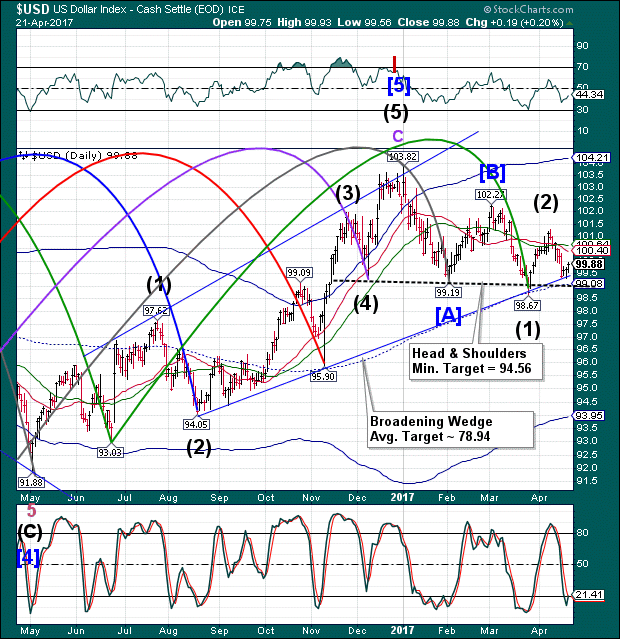

USD futures plunged to 98.81 this morning, tripping the Head & Shoulders neckline and mid-Cycle support…

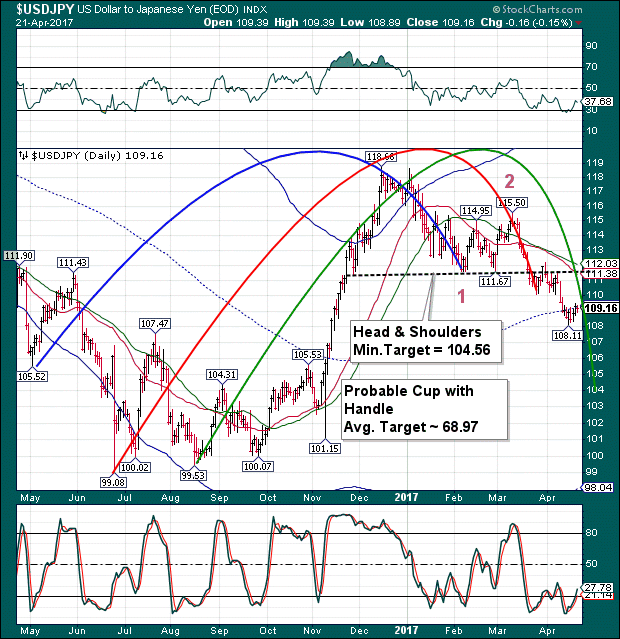

…However, the USD/JPY (Yen carry) rose as the Yen corrected even more than the USD this morning.

The Shanghai Index declined more than 1% today as it broke through mid-Cycle support at 3141.06.

ZeroHedge reports, “Despite another liquidity injection and the rest of the world in 'euphoric risk-on' mode over the French election results, Chinese stock, bond, and commodity markets tumbled overnight...

On Friday, we asked "Is China Trying To (Slowly) Burst Another Stock Market Bubble?" as Chinese monetary conditions were tightening dramatically...

China’s banking regulator, which said late Friday it will focus on guarding against financial risks, has ordered local units to assess cross-guaranteed loans, according to a Caixin report.

Having gone 86 trading days without a loss of more than 1% on a closing basis, the longest stretch since the market’s infancy in 1992... Breaking below its 200-day moving-average.”

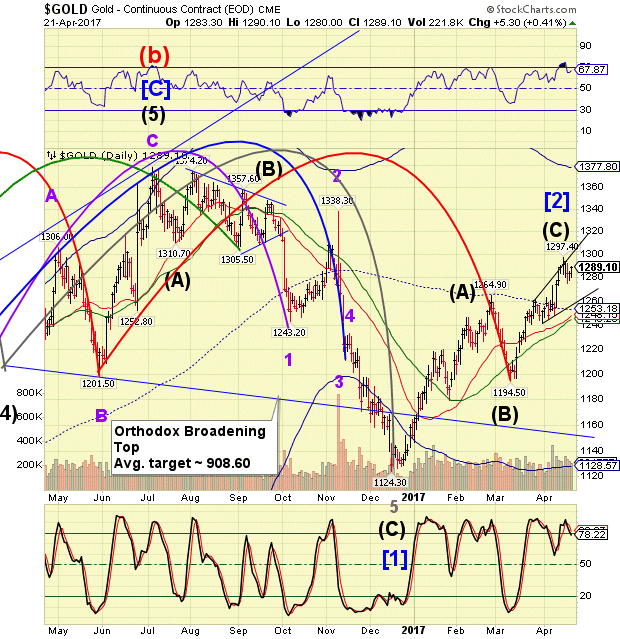

Gold did not react well at all this morning as the futures declined to a low of 1266.00. It is currently bouncing off the lower trendline of a small Broadening Wedge. It is on an aggressive sell signal, but short positions may be better taken at the Wave 2 bounce.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.