SPX may be Aiming at the Cycle Top Resistance

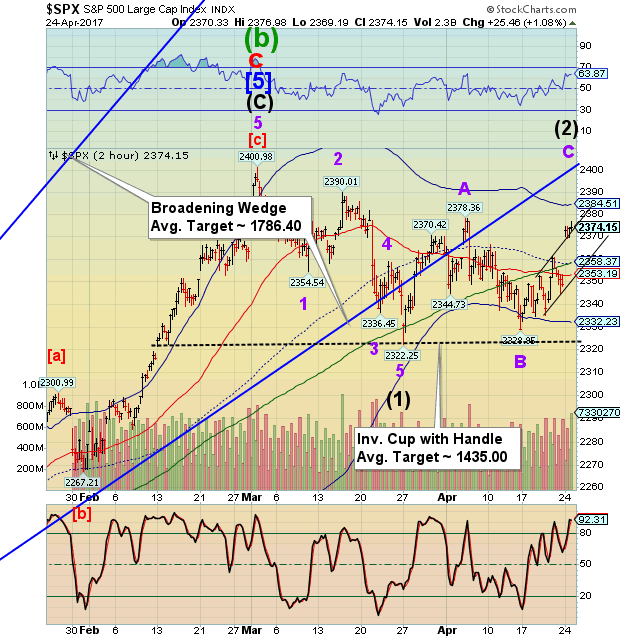

Stock-Markets / Stock Market 2017 Apr 25, 2017 - 02:49 PM GMT Yesterday I asked the question, “Will the SPX reverse in hour 86?” We got our answer as SPX rallied through the rest of the day. Interestingly enough, the rally thus far took 90 hours. 90.3 is divisible by 4.3 and also happens to be 12.9 days. This may be a good spot for a reversal.

Yesterday I asked the question, “Will the SPX reverse in hour 86?” We got our answer as SPX rallied through the rest of the day. Interestingly enough, the rally thus far took 90 hours. 90.3 is divisible by 4.3 and also happens to be 12.9 days. This may be a good spot for a reversal.

SPX futures are positive this morning, but The corrective Wave appears to be nearly finished. An additional probe to the 2-hour cycle Top at 2384.51 may do the job.

ZeroHedge reports, “After yesterday's violent gap up in stocks across the globe in response to the "expected" outcome from the French election, today the risk on sentiment has continued if to a lesser extent, with stocks in Europe, Asia all rising while S&P futures point to a higher open. Yen, gold decline, while the euro traded as high as 1.09 this morning before fading some gains; oil is up modestly.”

ZH observes, “Yesterday, Bloomberg's Richard Breslow expressed surprise at the exuberant market euphoria that resulted from a French election outcome that was "everybody's base case." 24 hours later, his surprise remains and as he says in his latest daily note, "what I do question is why everyone keeps telling me this was their forecasted and most likely outcome, yet the world has changed." Maybe nothing Breslow answers, and muses that it is all just the market gaps without any actual price discovery:

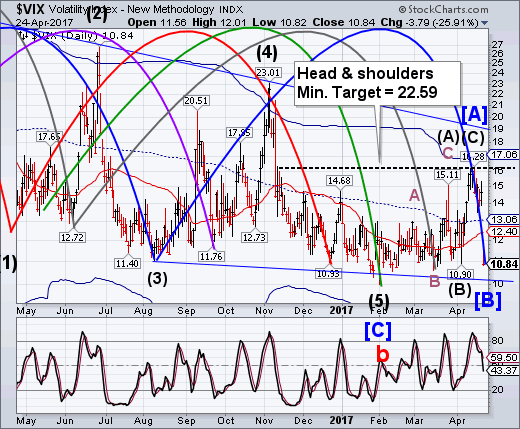

VIX futures are down, but not beneath the February 1 low of 9.97. I had assumed that the 10.90 low on April 5 was an early Master Cycle low, so making a new low was not on my radar. Last night I reviewed the Cycles Model to find that yesterday was day 258 in the Master Cycle, making a perfect match for a low. That may carry over to this morning, but what this does is elevate the VIX to the next higher degree of Elliott Wave and the Cycles.

That strongly suggests Wave (1) of [C] may completely retrace the decline from August 24, 2015, or at least the high posted on December 27, 2015 at 32.09.

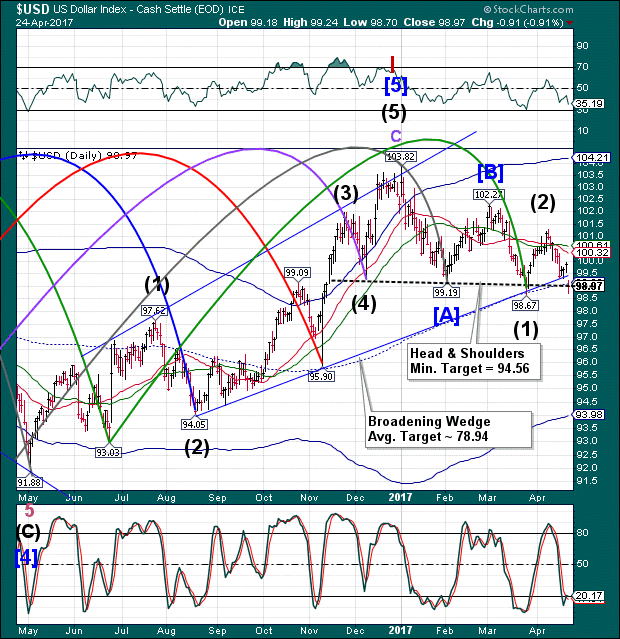

USD violated the Head & Shoulders neckline, but did not take out the March 27 low at 98.67. Doing so would be the final confirmation that the USD may proceed to its Head & Shoulders target. USD is due for a Master Cycle low on May 3, which is also a Pi date. Although it appears oversold, I wouldn’t count on the USD to make an early bottom.

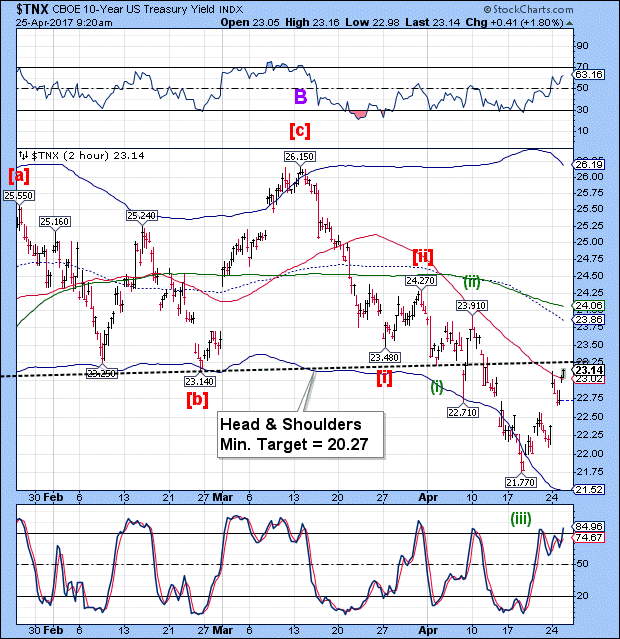

It appears that TNX may challenge the Head & shoulders neckline after all. The retracement has already covered 64% of the decline, so it has met the Fib requirements. We’ll keep an eye on this to see if something else is going on.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.