Pensions Are On The Way Out But Retirement Funds Are Not Working Either

Personal_Finance / Pensions & Retirement Apr 25, 2017 - 06:53 PM GMTBy: John_Mauldin

US law provides for many kinds of tax-advantaged retirement plans. They fall into two broad groups: defined-benefit (DB) and defined-contribution (DC) plans.

US law provides for many kinds of tax-advantaged retirement plans. They fall into two broad groups: defined-benefit (DB) and defined-contribution (DC) plans.

Defined-benefit plans are mostly the old-style pensions. They came with a gold watch and ensured you some level of benefit for the rest of your life.

Your employer would invest part of your compensation in the plan, based on some formula. In some cases, you, the worker, might have added more money to the pot.

But either way, at retirement, your employer was required to send you a defined benefit each month or quarter. Usually a fixed-dollar amount, sometimes with periodic cost-of-living adjustments.

That all sounds very simple, and it was, but the once-common scheme ran into trouble that set standards for private-sector pension plans and defined their tax benefits under federal law.

DC plans are what most workers have now—if they have a retirement plan at all. The 401(k) is a kind of defined-contribution plan (as are various types of IRAs/Keogh/SEP plans, etc.).

They are called that because regulations govern who puts money into the plan and how much. Typically, it’s you and your employer. Your employer also has to give you some reasonable investment options, but it’s up to you to use them wisely. Good luck.

The rub, of course, is that much evidence now shows that most workers are not able to invest their 401(k) assets effectively. That reality explains some of the retirement angst.

But DB plans are no bed of roses, either. Especially when you put elected officials in charge of them and make unionized government workers their beneficiaries.

The Math Is Catching Up

Government entities now have massive retirement obligations to their retirees and workers that simple math says will land them in some form of default.

The really frustrating part is that this impending crunch was completely predictable, given what we know of politics in this country.

Elected officials make extravagant promises to attract votes or contributions. But everything takes time in government, so politicians just delay making changes long enough that everyone forgets or finds other things to worry about.

Pension promises aren’t like campaign promises to build new parks or sewers.

Governments can’t forget pension obligations. Pension plans are not like other, more general public services. They involve specific amounts of cash owed to specific people on specific dates.

Those dates will arrive, and the cash has to be there. State and local governments can’t run endless deficits the way the federal government does.

That’s all clear. Yet, for some reason, two things happened in recent decades:

- State and local politicians kept raising pension benefits.

- State and local workers believed the promises.

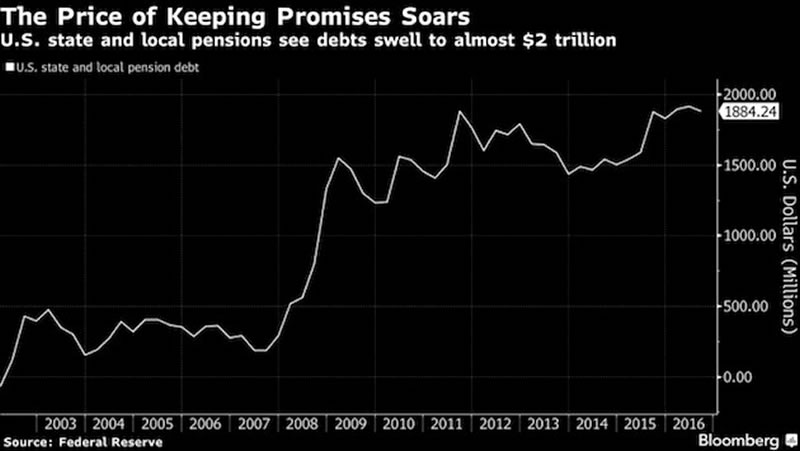

Soon the math catches up. Here’s a chart my friend Danielle DiMartino Booth included in a Bloomberg View article on this topic last month.

Here we see how state and local pension costs have soared in the last decade.

Total unfunded liabilities amounted to only $292 billion in 2007. They have more than quintupled since then, to $1.9 trillion.

The situation is actually far worse than the chart shows. The $1.9 trillion in liabilities presumes that the plans will earn far more over time than the 1.5% return they actually made in 2016. Danielle says unfunded liabilities are as much as $6 trillion by some estimates.

When we have a significant bear market during the next recession (that is not an if but rather a when), that $6 trillion figure will balloon to double that amount or more.

And remember, those are state and local obligations that must be paid from state and local tax revenues. Paying them would require tax increases for many municipalities and would more than double current tax rates.

Funding For Public-Sector Pensions Is Dangerously Low

Nationwide, state and municipal spending has risen from $730 billion in 1990 to $2.4 trillion in 2015. And yet, the amount of money used to fund pensions has risen only a fraction of the amount that other spending has.

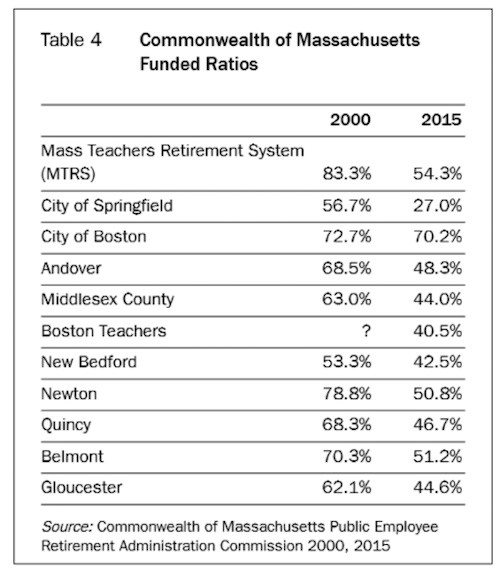

The financial problems of Illinois and many California cities are well known. Let’s turn to a chart listing some of the problem areas in the state of Massachusetts:

It’s hard to imagine good outcomes here. Retirees want what their contracts promised, but the money just isn’t there.

Governments have little recourse but to raise taxes—but the taxpayers aren’t captives. Higher property taxes will make them move elsewhere. Higher sales taxes will make them shop elsewhere.

What About Private-sector Pensions?

As noted, defined-benefit plans are disappearing. But many companies still have legacy plans covering current retirees and those nearing retirement.

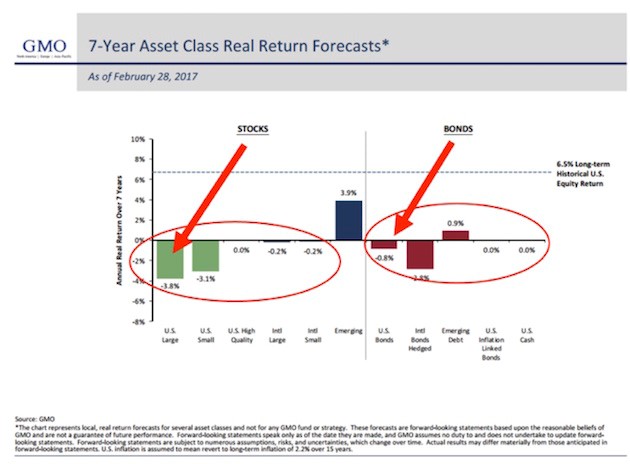

What if returns over the next seven years look like these projections from Jeremy Grantham of GMO (whose accuracy correlation has been running well north of 95%)?

The deeper you look, the worse this pension situation gets. Angst is a perfectly wise response for anyone who is retired or thinking about retiring in the next decade. People don’t have sufficient IRA or 401(k) savings. Social Security will be of limited help.

Defined-benefit pensions are unlikely to be as generous as advertised. And healthcare costs keep climbing. All of the above will keep taxes rising, too. Even as the economy remains mired in slow-growth mode at best or enters a long-overdue recession.

Can We See Any Glimmers Of Hope?

Some, yes. One answer for older workers is to work longer and delay retirement. That gives you more years to save and fewer years to consume your nest egg. It doesn’t have to be drudgery if you plan ahead and design your encore career strategically.

The Baby Boomer generation is still set to receive trillions in assets held by their still-living parents. That could help. The oldest boomers are now 72, which means their parents are likely in their 90s.

That said, if your retirement plan consists of waiting for your parents to die and leave you their house, you are still in a very risky position.

For one thing, how much is the house really worth? How much will it be worth as more people like you try to sell houses like that one? Who will buy them?

I talked in this article about our tendency to deal with immediate needs first. So many other things seem like higher priorities than retirement planning and saving. What do you do?

Theodore Roosevelt may have had the best answer: “Do what you can, with what you have, where you are.” Angst frequently paralyzes us. Don’t let it. Maybe you can’t do everything it takes, but you can do some of it. Start there.

Get a Bird’s-Eye View of the Economy with John Mauldin’s Thoughts from the Frontline

This wildly popular newsletter by celebrated economic commentator, John Mauldin, is a must-read for informed investors who want to go beyond the mainstream media hype and find out about the trends and traps to watch out for. Join hundreds of thousands of fans worldwide, as John uncovers macroeconomic truths in Thoughts from the Frontline. Get it free in your inbox every Monday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.