Financial Markets Improvised Explosives

Stock-Markets / Financial Markets 2017 Apr 27, 2017 - 06:10 PM GMTBy: DeviantInvestor

What happens when new currency is created with few limits by central banks and commercial banks?

What happens when new currency is created with few limits by central banks and commercial banks?

Answer: Far too much debt and currency are created.

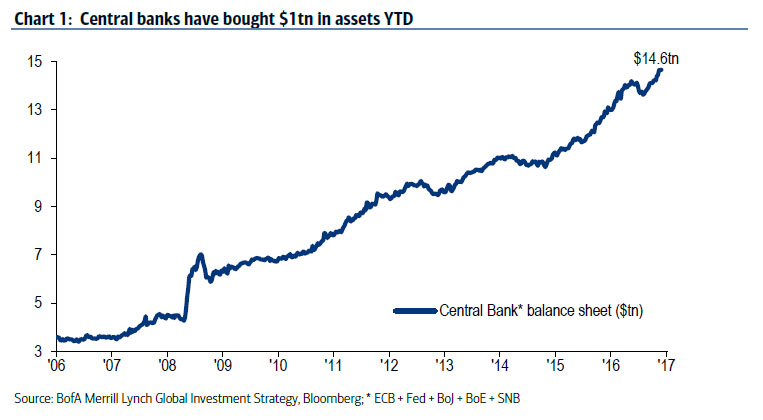

Central Bank Balance Sheets have increased by $10 trillion in the last decade and $1 trillion YTD in 2017.

What happens when an extra $10 trillion in central bank debt plus another $80 trillion or so in other global debt is created in a decade?

Answer: Prices rise because each fiat currency unit purchases less.

Market early 2007 early 2017

NASDAQ Composite 2,400 6,000

S&P 500 Index 1,400 2,370

T-Bond 110 150

Gold 700 1,250

Silver 13 18

Crude Oil 60 50

The debt creation “money hose” levitated the NASDAQ and other stock markets, the bond market, and most commodities. Crude Oil, like gold and silver, rallied much higher and then crashed.

In the U.S. the Dow, S&P, and NASDAQ appear healthy while the economy, employment, and middle class limp along. Many pension funds, after nearly a decade of levitated stock market returns and repressed interest rates, look like a train wreck in the next decade.

Are we close to a blast that will explode our financial world? It hardly matters what the fuse will be, but a few come to mind:

- Escalating war in Syria, Middle-East, and/or North Korea.

- Government shut-down and loss of confidence in the administration and congress.

- Derivative crisis, similar to 2008 meltdown.

- Collapse of the Euro and EU.

- German or Italian banks implode.

- Global dollar crash and rise of the SDR as the new “trading currency.”

- Federal Reserve revival of Quantitative Easing and more aggressive dollar devaluations.

Regardless of which “snowflake” (The James Rickards example) causes the avalanche, there is an avalanche in our future, whether it is an overdue stock market crash, on-going bond market crash, another massive QE program to levitate markets that leads to a crash in the dollar, wars in Syria, North Korea, or wherever the powers-that-be choose for 2017-2018. Read “Neocons Have Trump on His Knees.”

John P. Hussman, Ph.D. Stalling Engines: The Outlook for U.S. Economic Growth

“… we expect S&P 500 annual nominal total returns to average just 0.6% over the coming 12-year period, even if underlying economic growth accelerates to historically normal rates.”

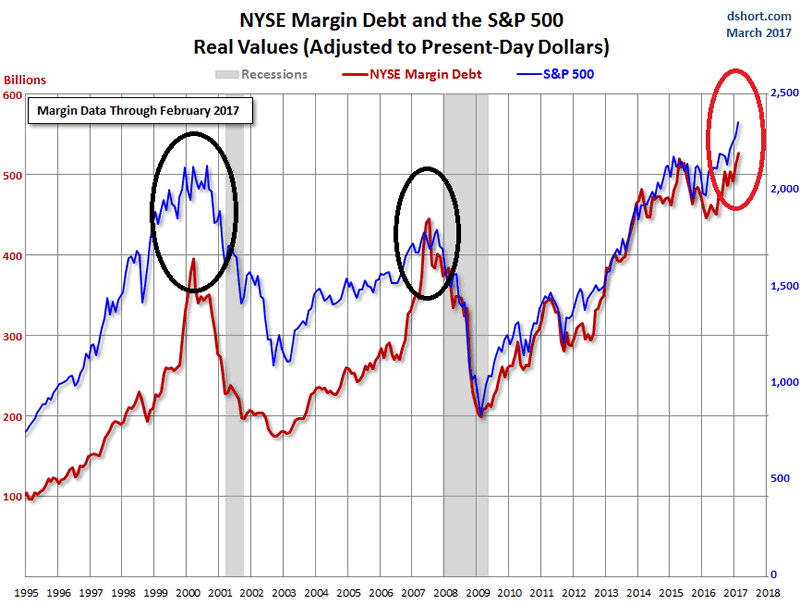

Margin Debt:

Margin debt looks dangerously high, similar to conditions before the 2000 crash and 2008 crash.

Wolf Richter: Stock Markets Sit Blithely on a Powerful Time Bomb

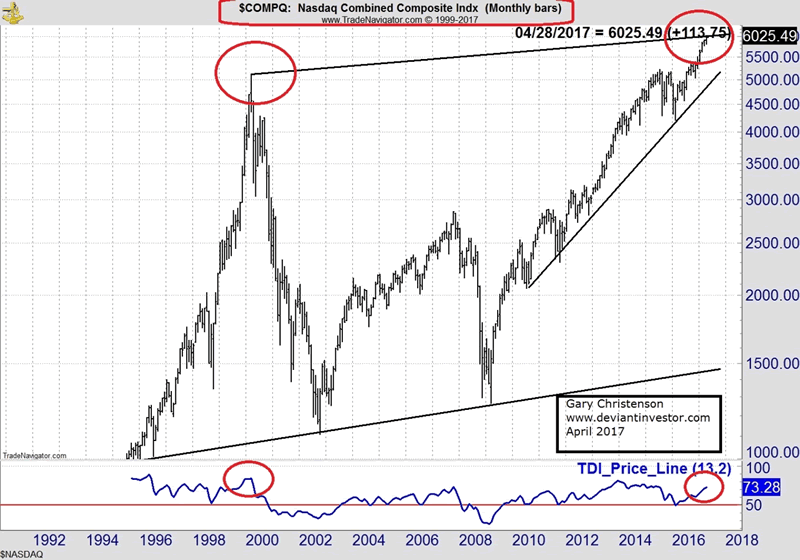

What about the flamboyant NASDAQ? (Log Scale)

The monthly chart shows 25 years of speculation and crash behavior. The NASDAQ looks toppy. Watch out below …

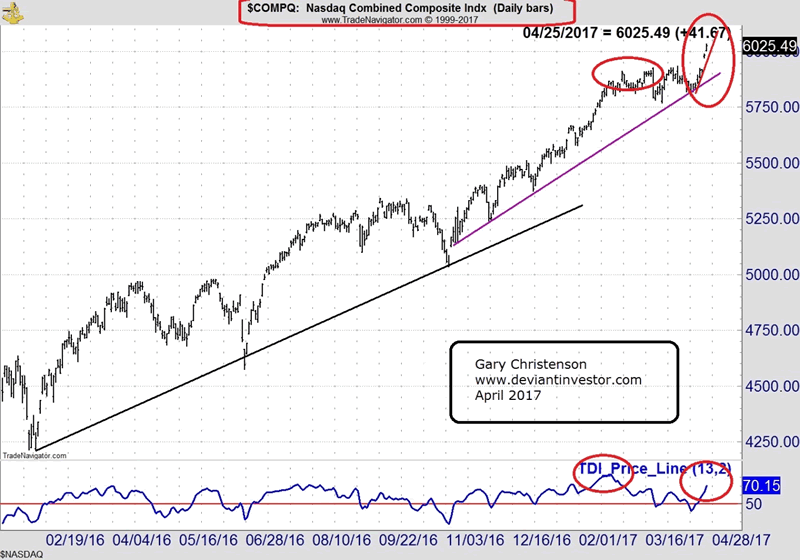

The weekly NASDAQ Composite has accelerated higher – from about 4,600 to 6,000 in ten months. Look out below.

The daily and weekly charts show upward acceleration and increasingly steep support lines. Markets can accelerate higher for only so long before they either correct or crash.

But we are told the Fed and President Trump will make everything great again, the Fed will buy stocks and print dollars as needed to inflate the bubble etc. etc. etc.

Example: “We’re Seeing a Healthy Pause Now, Higher Markets Later This Year.”

Contrary to the Happy Talk from the media:

Sovereign Man: Charles Schwab “announced that the number of new brokerage accounts soared 44% during the first quarter of 2017… the fastest pace in 17 years.” (since the dot-com bust)

Graham Summers: “Stocks Just Triggered a Rare Weekly Sell Signal”

“Paul Tudor Jones Has a Message for Janet Yellen: ‘Be Terrified’”

“…years of low interest rates have bloated stock valuations to a level not seen since 2000, right before the Nasdaq tumbled 75% over two-plus years.”

James Rickards: “Markets Are Set Up for a Fall”

“Once the stock market surveys this landscape of higher rates, slower growth, possible recession and government shutdown, it has nowhere to go but down.”

My opinion: The NASDAQ is primed for a major correction. Other indexes will follow. In response global central banks will print currencies, levitate markets, buy stocks, extend and pretend, and buy time … making the inevitable crash more devastating.

All-time highs in stocks, escalating war news, Italian banks, French politics, Syria, North Korea, Deutsche Bank, blaming Russia, and a dozen other danger zones suggest caution, encourage gold and silver purchases, and create skepticism regarding media “happy-talk.”

Timing a top is difficult given manipulated markets, contrived politics and managed news, but April and May of 2017 look like a time for caution, reduction in stock portfolios, and insurance in the form of gold and silver bullion safely stored outside the banking system.

Read my book: “Buy Gold Save Gold! The $10 K Logic.”

Amazon: Paperback and Kindle

gechristenson.com: Paperback and PDF.

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2017 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.