Gold Exports From U.S. – Something Big Is Happening

Commodities / Gold and Silver 2017 May 11, 2017 - 02:14 PM GMTBy: GoldCore

by SRSRoccoReport.com : Most Americans didn’t realize it, but something BIG changed in the U.S. gold market in the beginning of 2017. While precious metals sentiment and buying in the U.S. has dropped off considerably in the first quarter of 2017, the East continues to acquire gold, HAND OVER FIST.

by SRSRoccoReport.com : Most Americans didn’t realize it, but something BIG changed in the U.S. gold market in the beginning of 2017. While precious metals sentiment and buying in the U.S. has dropped off considerably in the first quarter of 2017, the East continues to acquire gold, HAND OVER FIST.

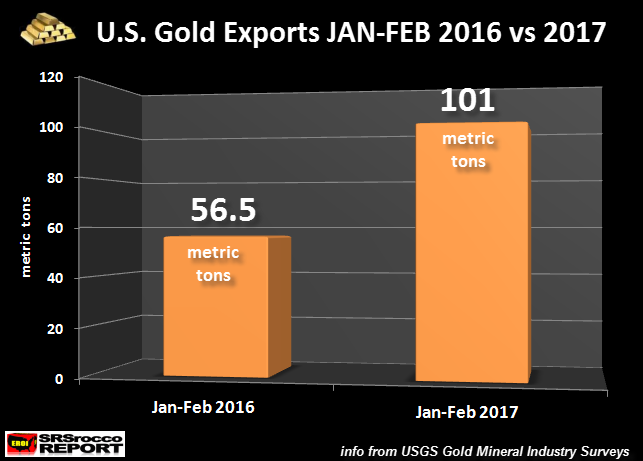

How much gold? Well, let’s just say…. U.S. gold exports have nearly doubled during JAN-FEB 2017 versus the same period last yearTotal U.S. gold exports JAN-FEB 2017 surged to 101 metric tons (mt), compared to 56.5 mt last year. This is quite interesting because total U.S. gold mine supply plus gold imports for JAN-FEB 2017 only equaled 80 mt. Thus, the U.S. suffered a 21 mt gold supply deficit in the first two months of the year. Which means, someone had to liquidate an additional 21 mt of gold from their vaults to export to the East….. where they still understand the vital role of gold as REAL MONEY.

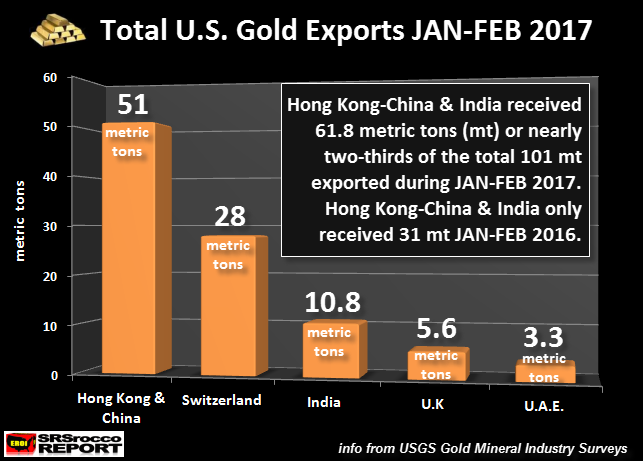

And where did the majority of U.S. gold exports head to? You got it….. Hong Kong-China & India.

Of the 101 mt of U.S. gold exports JAN-FEB 2017, Hong Kong-China and India received 61.8 mt, or nearly two-thirds of the total. Switzerland received 28 mt, U.K. imported 5.6 mt and the U.A.E. acquired 3.3 mt. The remaining 2.3 mt went to various countries such as, Germany, Canada and Mexico.

What is also quite interesting, is that the majority of the year-over-year increase went to Hong Kong-China and India. U.S. gold exports to Hong Kong-China and India doubled from 31 mt during JAN-FEB 2016 to 61.8 mt JAN-FEB 2017.

What does this all mean? It means, as U.S. precious metals investors continue to BICKER, COMPLAIN, BELLY-ACHE and WHINE about the low gold price, the Chinese and Indians smile as they continue to exchange increasing worthless fiat money for shiny yellow metal.

Matter-a-fact, I have heard from several sources, that many precious metals investors in the U.S. are selling gold into the market. This has to be one of the STUPIDEST things to do. Of course, if a person needs to sell gold to purchase something or pay bills… that is understandable. But, to sell gold because of low market sentiment, goes against all sound reasoning and logic to own gold.

People need to realize the U.S. and global financial and economic system are in the BIGGEST BUBBLE in history.

To sell one’s GOLD INSURANCE at this time, makes me wonder… what the hell happened to IQ’s recently?

Source: SRSRoccoReport.com

Gold Prices (LBMA AM)

11 May: USD 1,221.00, GBP 945.66 & EUR 1,122.95 per ounce

10 May: USD 1,222.95, GBP 944.61 & EUR 1,124.99 per ounce

09 May: USD 1,225.15, GBP 948.51 & EUR 1,124.20 per ounce

08 May: USD 1,229.70, GBP 948.71 & EUR 1,123.45 per ounce

05 May: USD 1,239.40, GBP 958.06 & EUR 1,130.33 per ounce

04 May: USD 1,235.85, GBP 958.15 & EUR 1,131.05 per ounce

03 May: USD 1,253.95, GBP 971.18 & EUR 1,148.99 per ounce

Silver Prices (LBMA)

11 May: USD 16.37, GBP 12.70 & EUR 15.06 per ounce

10 May: USD 16.29, GBP 12.59 & EUR 14.99 per ounce

09 May: USD 16.22, GBP 12.55 & EUR 14.88 per ounce

08 May: USD 16.38, GBP 12.64 & EUR 14.96 per ounce

05 May: USD 16.27, GBP 12.58 & EUR 14.85 per ounce

04 May: USD 16.50, GBP 12.80 & EUR 15.09 per ounce

03 May: USD 16.85, GBP 13.04 & EUR 15.44 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.