Another Stock Market "Minsky Moment" or Will the Markets Calm Down?

Stock-Markets / Stock Market 2017 May 18, 2017 - 03:06 PM GMT Good Morning!

Good Morning!

The chart show the best interpretation of yesterday’s decline. The SPX futures declined another 13 points before bouncing early this morning. It has regained about half of the overnight loss. As it stands, this would be an irregular correction, where Wave [c] does not meet the top of Wave [a]. Although unlikely, it is still possible that SPX could bounce back to the 50-day Moving Average at 2369.62.

ZeroHedge reports, “European and Asian stocks slumped on Thursday following the worst one-day drop in US stocks in 8 months, while S&P futures tumbled to session lows, down 0.3% to 2,350 after initially posting a modest rebound, following a new Reuters report alleging that Trump campaign members communication with Russians on at least 18 occasions, and which prompted today's risk off mood sending the USDJPY crashing by 100 pips from overnight highs of 111.40.

As stocks fells, yields dropped to the lowest in a month, while volatility, artificially subdued for the past month, exploded higher. Should vol continue to rise rapidly, there is a threat that vol-neutral and directional systematic funds such as CTAs and risk-parity will be forced to liquidate positions, as explained yesterday.”

VIX futures are higher. Whether they have crossed the Cycle Top resistance at 15.96 is in question.

ZeroHedge observes, “Today's sudden 'Minsky Moment' in markets has pushed US equity risk perceptions to their highest relative to Europe since August 2015, back to old 'norms'.

As Bloomberg notes, U.S. politics are taking center stage as risks recede in Europe following the French presidential election. With Donald Trump facing the deepest crisis of his presidency, the CBOE Volatility Index surged on Wednesday, while Europe’s VStoxx Index rose less than 5 percent.”

Bloomberg reports, “It finally happened.

After months of speculation over when the lull in U.S. equity volatility would snap, investors got their answer Wednesday. A bombshell report on President Donald Trump’s interactions with former FBI director James Comey sent the VIX up the most in almost a year.

For anyone on the wrong end of the trade, it was a painful lesson.

Investors who had been minting money since Election Day by selling volatility, taking a short wager on equity-market turbulence, got a reminder of how fast the bet can turn. Stuck for weeks at its lowest levels in a decade, the CBOE Volatility Index surged by almost half in a matter of hours.”

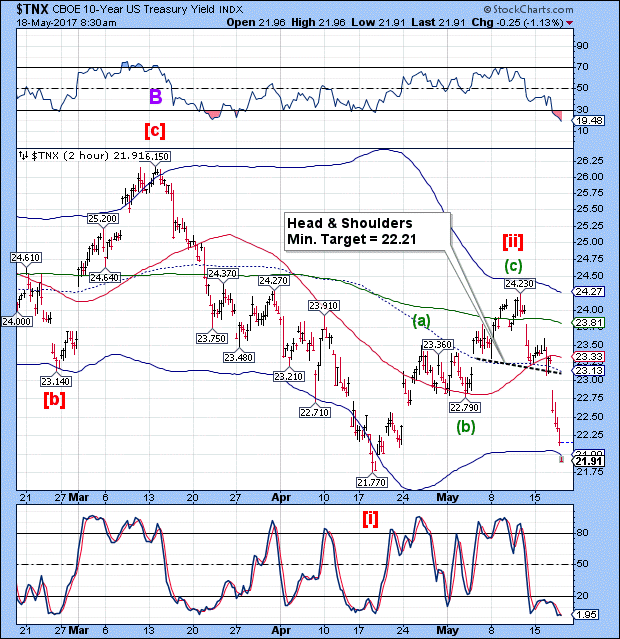

TNX overshot its Head & Shoulders target and its Cycle Bottom at 21.99 this morning. A breakdown beneath the April low could lead to more selling.

The next Master Cycle low is due next week, so there is little incentive to bounce until the low is in.

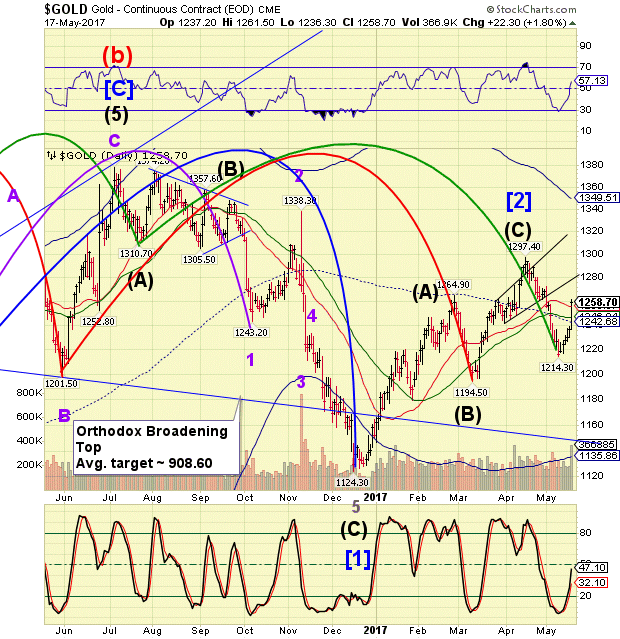

Gold may be headed for a turn today as it is a Pivot day. Gold futures appear to have peaked at 1264.75, a 60.7% retracement, early this morning and has been declining since.

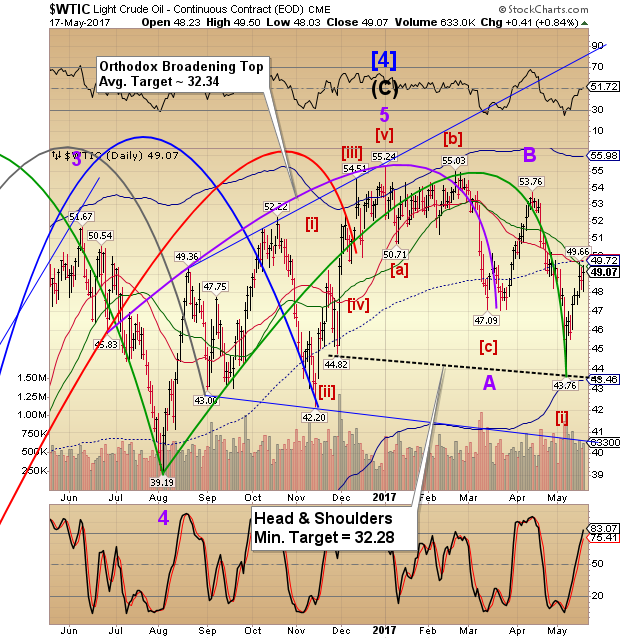

Crude appears to be making an “inside” consolidation, neither making a new high nor a new low. As I mentioned yesterday, there is a distinct probability of a marginal new high before Crude resumes its decline.

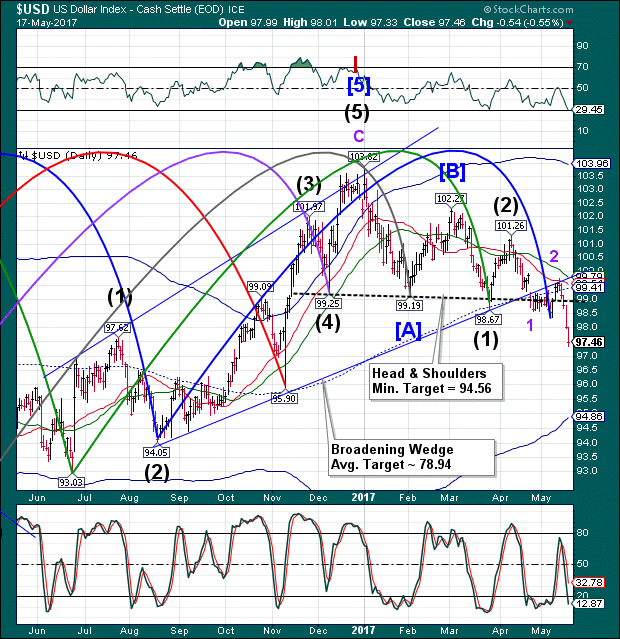

USD futures are bouncing, but it does not appear to be significant at this time. Of course, there is a possibility of a bounce to the Head & Shoulders neckline, so we may monitor it for any sudden moves.

The next pivot days on my Cycles Model come between May 26 and June 2.

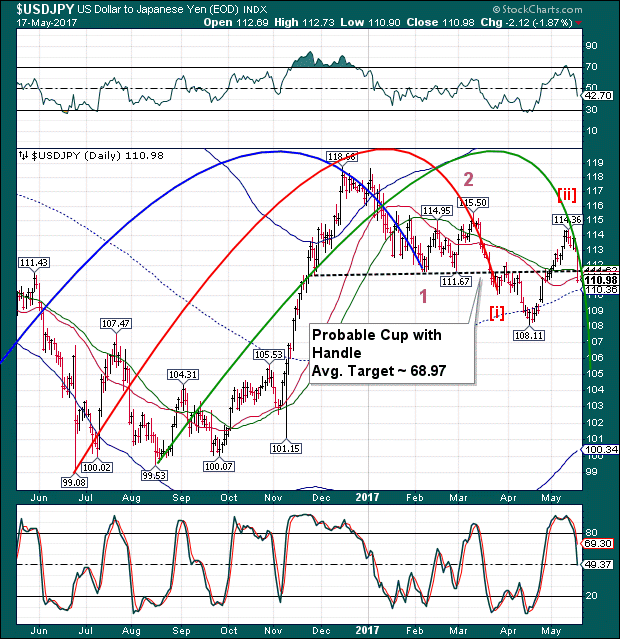

USD/JPY futures appear to have made a new overnight low at 110.24, challenging its mid-Cycle support at 110.36. It has bounced since then, but may be limited by the 50-day Moving average and Cup with Handle trendline, both at 111.62. We may see liquidity being squeezed as long as USD/JPY stays beneath that level.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.