Stock Market Top - Are We There Yet?

Stock-Markets / Stock Market 2017 May 25, 2017 - 03:22 PM GMT Good Morning!

Good Morning!

SPX futures are at new highs this morning. This appears to be Wave (v) of [v] of 5…the final push.

Potential targets are as follows:

Wave 5 equals Wave 1 at 2408.83.

Wave [v] equals Wave [i] at 2413.85.

The 2-hour Cycle Top is at 2411.05.

SPX has already achieved the first target, so it may be possible that it will go to one of the higher targets.

Time-wise, We are fast approaching the 17.2-year Cycle Pivot, which may occur at any time in the next two weeks. In addition, tomorrow appears to be a Trading Cycle pivot day and SPX will have consumed 60 hours in the current Cycle by mid-morning tomorrow. It may be an appropriate time for a Super Cycle Pivot High.

ZeroHedge reports, “It has been a session of violent, volatile gaps, starting with sharp gap up in S&P futures on Wednesday night, just around 10pm, which saw ES spike and rally to new all time highs on no news...

... which in turn helped generate a sea of green in Asian stock markets, with the Kospi rising after the Bank of Korea left rates on hold, while China's H shares surged 1.5% higher and the SHCOMP eventually closing up 1.4%; more interesting is that just an hour after the sudden jerk in S&P futures, there was a similar gap higher in both the on and offshore Chinese Yuan, with the CNY surging 0.25% within a 5-minute span...

VIX futures have been spiking up and down in the overnight session. There’s no telling how it may open, as it is currently back to its 9-handle.

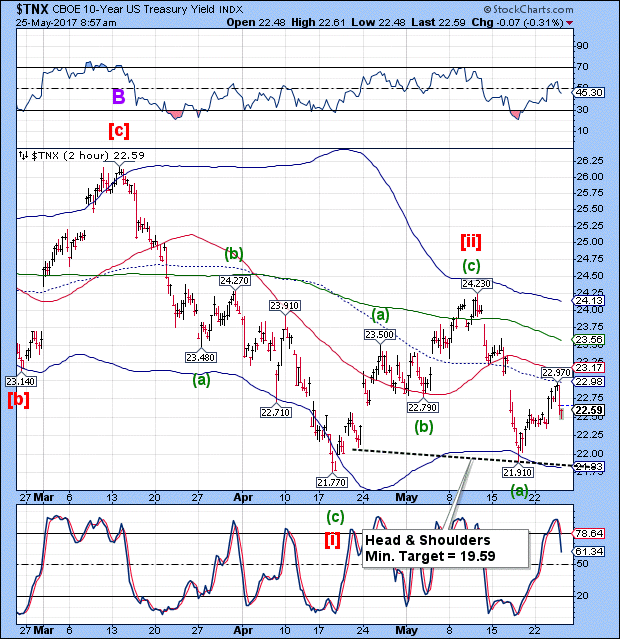

TNX is down, suggesting treasuries are well-bid this morning.

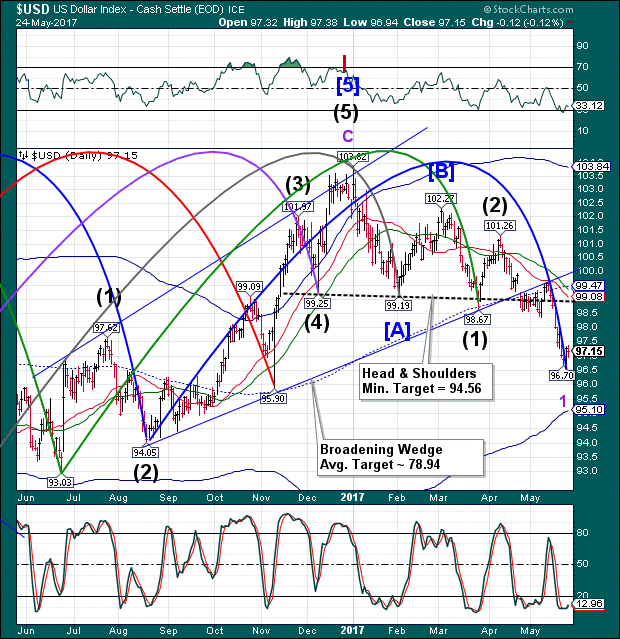

USD futures are higher. It is also due for a possible inverted Trading Cycle high on Friday or early next week. As mentioned earlier, the Head & Shoulders neckline is a probable target for the bounce.

Crude Oil futures are starting to come down, hitting a low of 50.09 this morning. We may see a new Master Cycle low in the next two weeks.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.