Gold Price and the Fed’s Shrinking Balance Sheet

Commodities / Gold and Silver 2017 May 27, 2017 - 10:52 AM GMTBy: Arkadiusz_Sieron

The latest FOMC minutes suggest that the Fed may start decreasing its balance sheet later this year. There are many unknowns about this process, so we invite you to read our today’s article about the unwinding of the Fed’s balance sheet and find out how it could affect the gold market.

The latest FOMC minutes suggest that the Fed may start decreasing its balance sheet later this year. There are many unknowns about this process, so we invite you to read our today’s article about the unwinding of the Fed’s balance sheet and find out how it could affect the gold market.

As we wrote in the Gold News Monitor, the latest FOMC minutes suggest that the Fed may start decreasing its balance sheet later this year. There are many unknowns about this process, so we will closely watch the U.S. central bank’s comments and actions in this context. But let’s dig into the subject with the information we have.

Timing. In December’s statement, the FOMC members declared that the shrinking the central bank’s balance sheet will not start until normalization of the level of the federal funds rate is well under way. It means that rate increases come first, balance sheet reductions come later. Some of the Fed officials suggested that a funds rate target at 1 percent would enable the U.S. central bank to begin the reduction of its balance sheet. This is why most participants of the FOMC March meeting “judged that a change to the Committee's reinvestment policy would likely be appropriate later this year.” However, according to the March survey of primary dealers by the New York Fed, the median dealer expects the FOMC to allow the balance sheet to begin shrinking in the second quarter of 2018, when the federal funds rate is believed to reach target range of 150-175 basis points.

Method and Pace. The Fed will shrink its balance sheet in a conservative and passive way. It means that the U.S. central bank will not actively sell assets, but it will stop replacing or rolling over maturing assets. In discussions as to whether to cease at once or phase out, the former option was seen as an easier step for the Fed to communicate, while the latter as less likely to trigger volatility in the market. Given the Fed’s care about the U.S. stock market, we bet on its phasing out, until the balance sheet reaches the desired size.

Scale. This is perhaps the biggest unknown about the balance sheet normalization process. The current size of the Fed’s assets is about $4.5 trillion, a huge change from about $0.9 trillion at the end of 2007. However, the U.S. central bank’s balance sheet will not return to the pre-crisis level. Given the growth of the economy and the public’s demand for currency, as well as changes in the monetary policy that occurred since 2007, the level of the Fed’s assets is not likely to shrink below $2.5 trillion (according to the Fed’s own projections, this would be the optimal size of the balance sheet in the long-term). Actually, the median primary dealer expects that the U.S. central bank’s balance sheet will amount to $3.5-4.0 trillion at the end of 2019.

What does it all mean for the gold market? Well, quite a lot. The standard narrative is that the ballooning of the Fed’s balance sheet was positive for the stock market, so its shrinking has to lead to the correction. As a result, gold will flourish. However, it’s not so simple, as the unwinding of the Fed’s balance sheet will not entail exactly opposite consequences to quantitative easing. The reason is that the Fed will not actively sell its assets. Instead, the whole process will be passive, gradual and well communicated to the market. And the size of the balance sheet will not return to the pre-crisis level. Hence, the impact of the balance sheet normalization on the markets, including the precious metals market, should be limited. The current hiking cycle may be an example. Despite many doom scenarios, three interest rate hikes have not disturbed financial markets so far. And do not forget that the process of shrinking the Fed’s balance sheet may be already priced in.

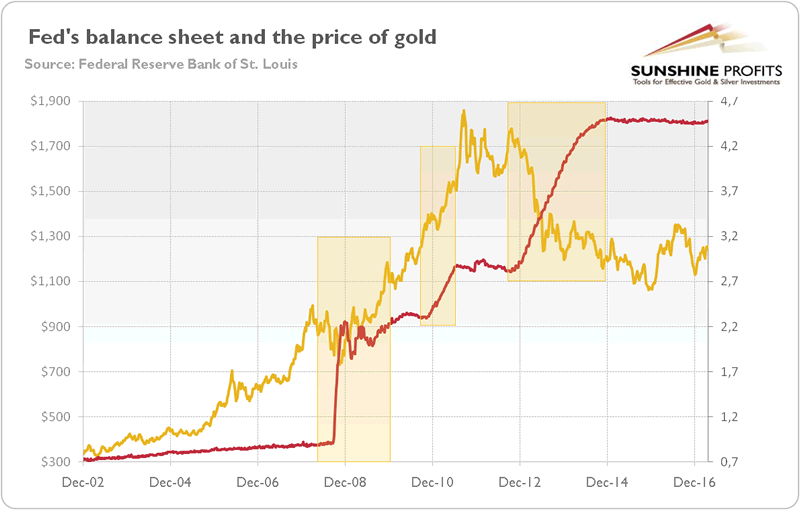

Let’s look at the chart below. As you can see, the relationship between the Fed’s balance sheet and gold prices is far from being linear.

Chart 1: The Fed balance sheet (red line, right axis, in trillions of dollars) and the price of gold (yellow line, left axis, London P.M. Fix) from December 2002 to April 2017.

It is true that the first two rounds of quantitative easing were positive for the gold market. However, the third one was a disaster for the yellow metal, as the confidence in the U.S. economy came back and the safe-haven demand for gold declined. Therefore, the impact of the unwinding of the Fed’s balance sheet on the gold market is not easy to determine – a lot will depend on the broad macroeconomic picture. On the one hand, the Fed’s shrinking balance sheet would imply rising long-term real interest rates, which would be negative for gold prices. On the other hand, there may be some turmoil in the financial markets, which would support the gold market. Moreover, it may be the case that the U.S. dollar rally which started in 2014 was caused by the rising expectations about the Fed’s upcoming tightening. If this is true and investors really bought the rumor and sell the fact, then the greenback may start depreciating, which would likely send the price of gold higher. Gold’s response to the current Fed’s tightening cycle suggests that it is not impossible scenario. However, the whole process is likely to be conducted in a very conservative and cautious way to minimize market volatility and disruption. Hence, investors should not bet on doom scenarios and expect that the price of gold will necessarily skyrocket.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.