Gold’s “Bearish Bulls” Addressed, Now What?

Commodities / Gold and Silver 2017 Jun 10, 2017 - 05:49 AM GMTBy: Gary_Tanashian

An NFTRH subscriber named Joe, who is a former fund guy and current chart cranking, idea generating maniac (←said with admiration) came up with the term “bearish bulls” recently, by which he meant that a whole lot of people were looking down in the gold sector, especially heading into this week as the dreaded ‘GDXJ rebalance’ and then next week’s FOMC loomed.

An NFTRH subscriber named Joe, who is a former fund guy and current chart cranking, idea generating maniac (←said with admiration) came up with the term “bearish bulls” recently, by which he meant that a whole lot of people were looking down in the gold sector, especially heading into this week as the dreaded ‘GDXJ rebalance’ and then next week’s FOMC loomed.

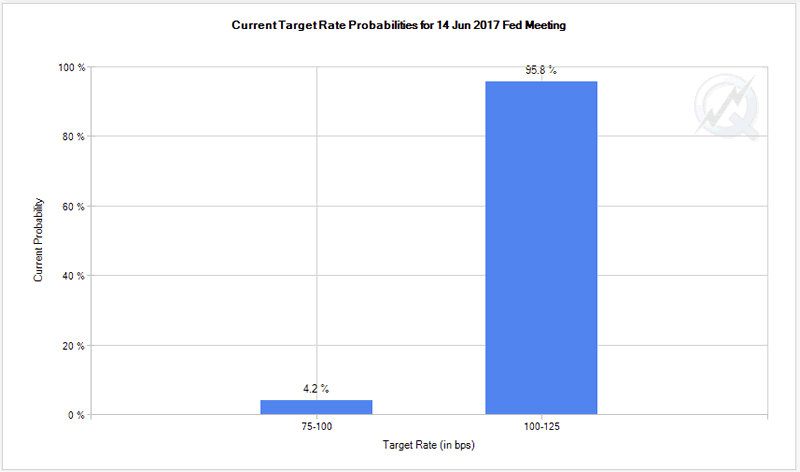

On the former, some bounce opportunities were created in oversold companies involved in the rebalance (with bearish bulls’ short covering providing the accelerant) and on the latter, I very much expect the Fed to raise the Funds Rate next week; and so does the futures market. From CME Group…

As to the “bearish bulls”, Joe felt that an awful lot of people who would just as soon be bullish on gold (many being former zealots recovering from the damage inflicted by unquestioning faith in the sector’s seedier element, the perma-pompoms) were set up bearish. In being short-term bearish but by nature (a nature I happen to share) believing in gold’s importance as a financial asset, the “bearish bulls” were by definition, weak hands from the short side.

The big bounce on Wednesday probably got the majority of those expecting a trap door plunge into the GDXJ/FOMC window to cover their shorts. But is the sector ready for prime time? Well, we have been tracking positive divergences in the technical condition of some individual stocks (NFTRH currently tracks a list of 24 individual miner and royalty charts, with more coming) and an improving macro fundamental element, in gold’s constructive state vs. commodities, but have also noted that the main index technicals (we use HUI) remain in bear chains and the sector’s fundamentals are not nearly all in place yet.

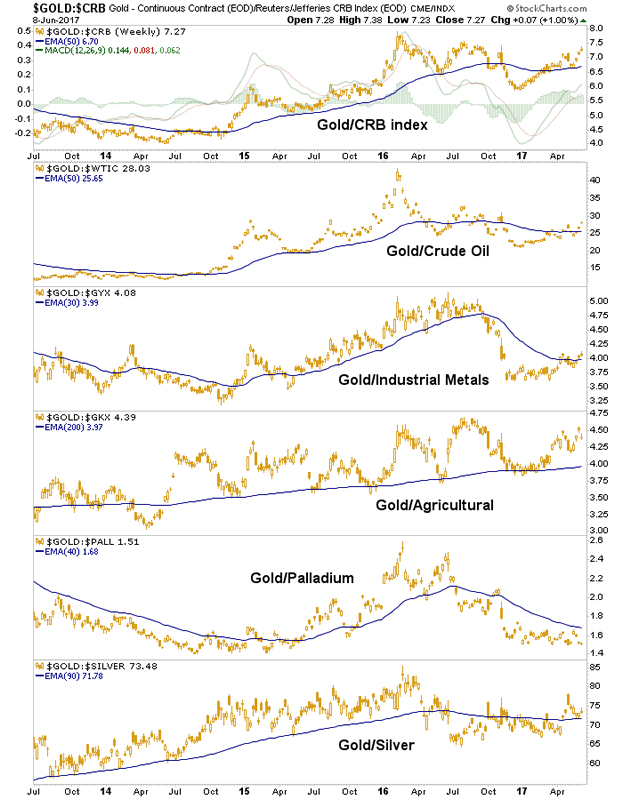

Gold vs. Commodities is however, coming along. A couple observations here; gold vs. oil and industrial metals look like a bottom may be in, while Gold/Palladium is still saying ‘a-okay’ as a positive economic cycle indicator (a negative for the counter-cyclical gold sector) and gold vs. silver looks constructive, which can at various times mean pain for the gold sector, the broad markets and/or both at the same time. Our view is that the US dollar index will find support in the mid-90s and that along with the Gold/Silver ratio would saddle up the 2 Horsemen of the Apocalypse. The question is against whom will they ride?

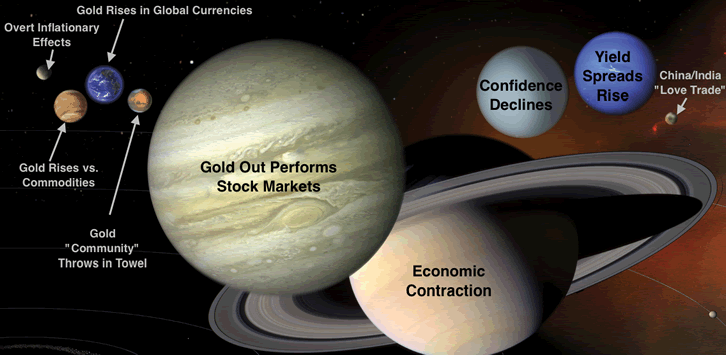

Our Macrocosm imagery (below) purposely made “China/India Love Trade” its smallest planet back in 2015 when I created this metaphor, and this “love trade” garbage should be tuned out right along with the ‘fear trade’ in gold. Come on guys, what is it, a love trade or a fear trade? The love and fear in these instances are provided by gold luminaries Frank Holmes and Eric Sprott. India’s weddings, China’s lovemaking and an “Ebola Armageddon” have nothing to do with gold as a financial asset. Nothing.

Needless to say, from a macro standpoint, the gold sector continues to await the proper alignment of the largest planets; gold vs. stocks, a waning of economic viability and by association, a decline in confidence. Let’s not belabor the point; these elements are not yet in place.

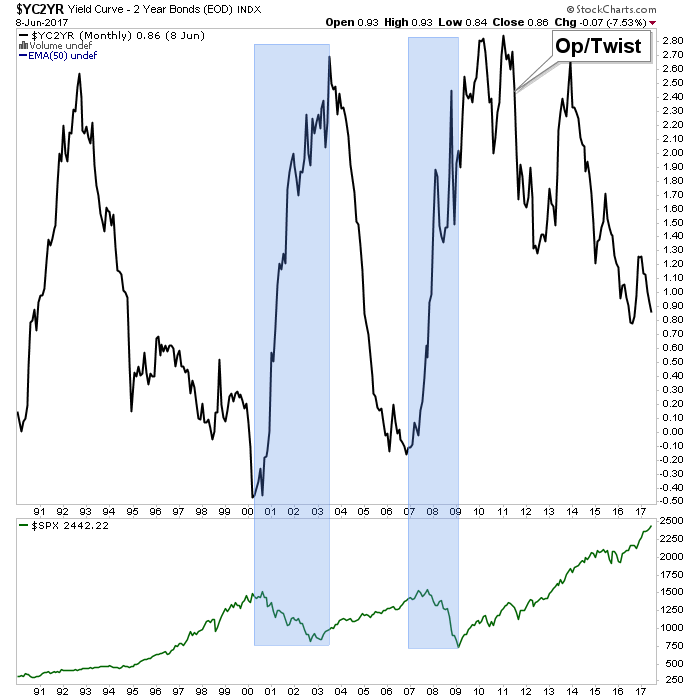

Neither is the next planet, yield spreads. Operation Twist sanitized inflation right out of the picture and it’s a good thing that the picture above shows “overt inflationary effects” as a very minor aspect of gold’s Macrososm, eh? The problem is that most gold bugs think in a progression of inflation>gold>silver>commodities>get rich owning gold miners, but the sector will only be ready when the curve turns up, implying either inflationary pressure or market [lack of] liquidity pressure.

Meanwhile, you see the thing in the bottom panel of the chart above? It is a picture of the US stock market thriving on a declining yield curve that implies no systemic stress (yet) and no inflation (yet). I’ll continue to maintain that in this environment, the inflation created to date by central banks since Op/Twist, has gone directly into stocks.

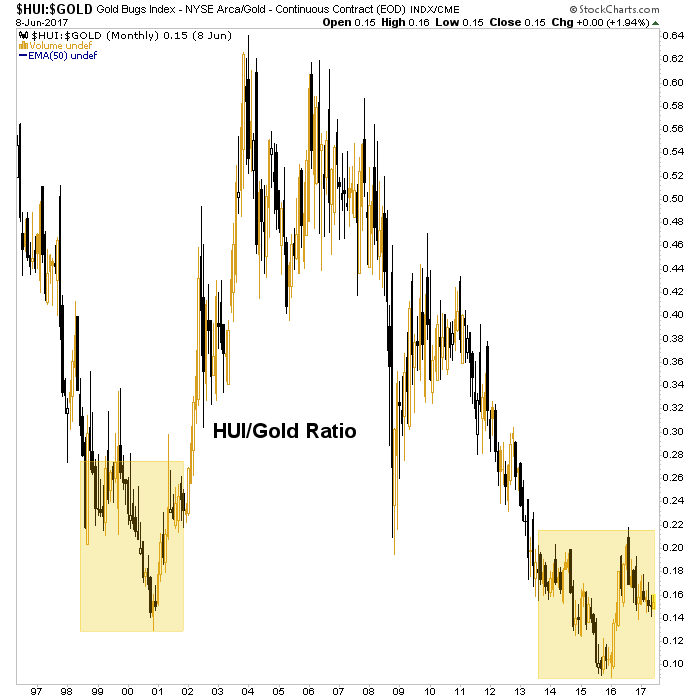

The above are some of the elements that must play out sooner or later to go with a bullish gold sector. I admit that I have to temper myself when I see some of the bullish miner charts out there and also big picture items like this monthly view – introduced in NFTRH 450 last week – of the HUI/Gold ratio (who’s to say today’s pattern will not resolve in a surprise upside burst like the one that birthed the last big bull?).

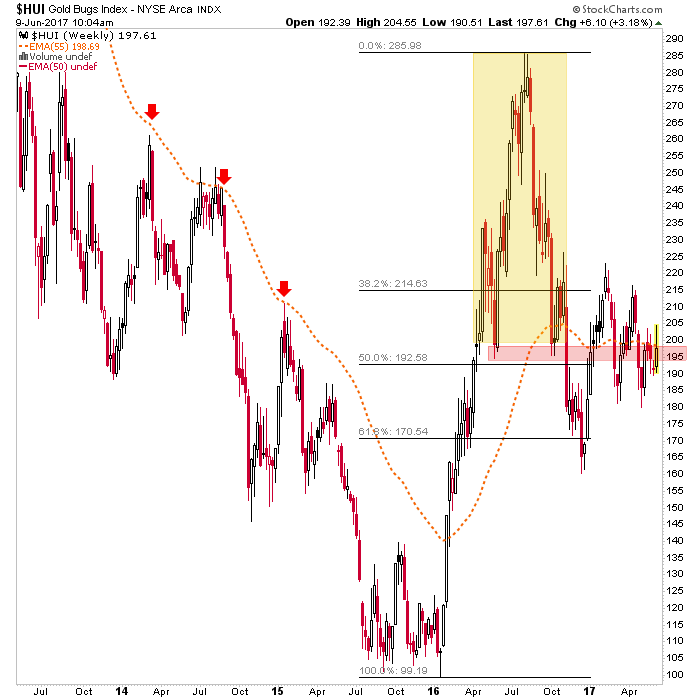

But until nominal HUI takes out the EMA 55 and the bear pattern’s neckline on this weekly chart and other parameters (like the April and February highs) noted in a post on June 3, the sector itself is not ready and continues to ride the Whipsaw Express.

Another issue is that the Whipsaw activity (actually a consolidation) is going to end in a chosen direction and the move will likely be big. I see the relatively bullish charts of some miners and royalties and think, hmmm… positive indicator. But I also see the stable economy, still-booming stock market and a yield curve dropping like a stone. These are negatives for gold and gold stocks.

The opportunity is coming, but acting with conviction now means you know the future. But you don’t.

You might want to stick with the idea that if the coming move is bullish the confirming parameters are not far above and there would be plenty of time to catch the big bull move (in terms of price and time) that would follow. If the move is bearish – and HUI is after all, still below its important resistance parameters – golden babies would be getting thrown out with the bath water. That’s the best time for fundamentally engaged players to buy this sector; on the washouts.

Patience… and parameters my friends. Breakout or washout upcoming. But for now, it’s a whipsaw and it is advisable for gold bugs to have a list of quality items at the ready.

Subscribe to NFTRH Premium for your 40-55 page weekly report, interim updates and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com. Also, you can follow via Twitter ;@BiiwiiNFTRH, StockTwits, RSS or sign up to receive posts directly by email (right sidebar).

By Gary Tanashian

© 2017 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.