Strength in Gold and Silver Mining Stocks and Its Implications

Commodities / Gold and Silver 2017 Jun 21, 2017 - 12:07 PM GMTBy: P_Radomski_CFA

Yesterday’s session was not like the previous ones – in the previous days, the precious metals sector moved lower together and mining stocks were leading the way. Yesterday, gold and silver declined, but miners were barely affected. Does this strength indicate a likely turnaround?

Yesterday’s session was not like the previous ones – in the previous days, the precious metals sector moved lower together and mining stocks were leading the way. Yesterday, gold and silver declined, but miners were barely affected. Does this strength indicate a likely turnaround?

Miner’s Outperformance

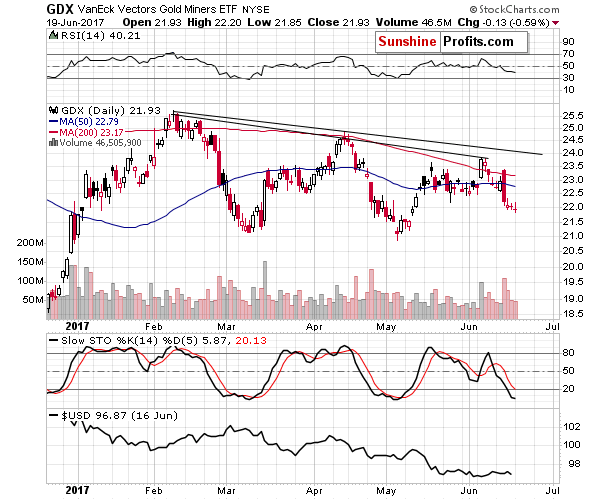

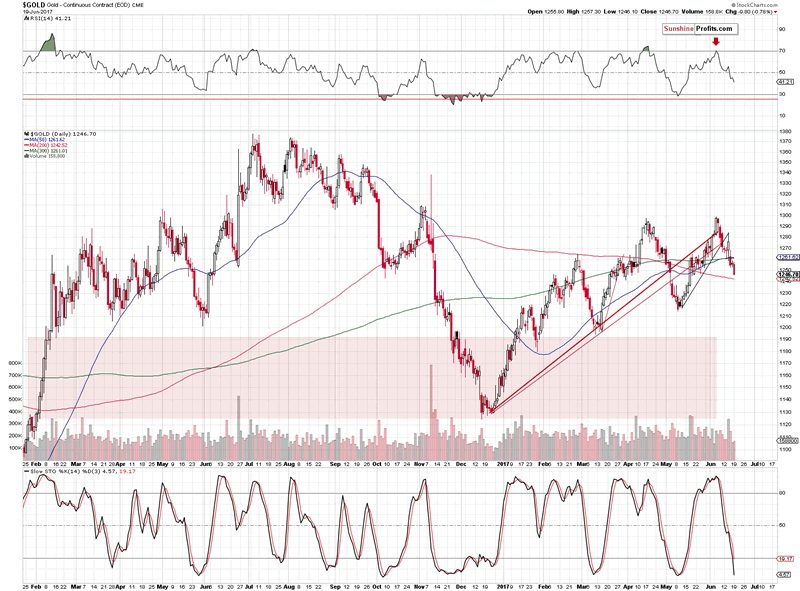

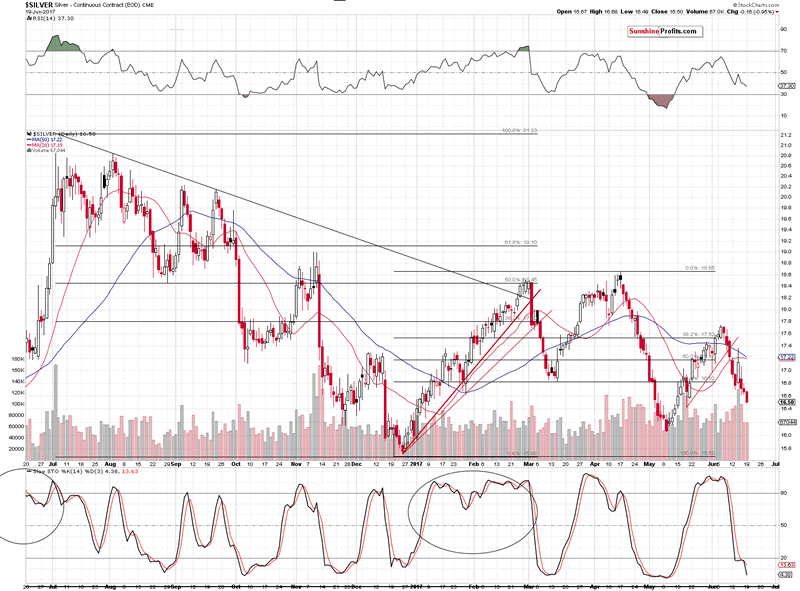

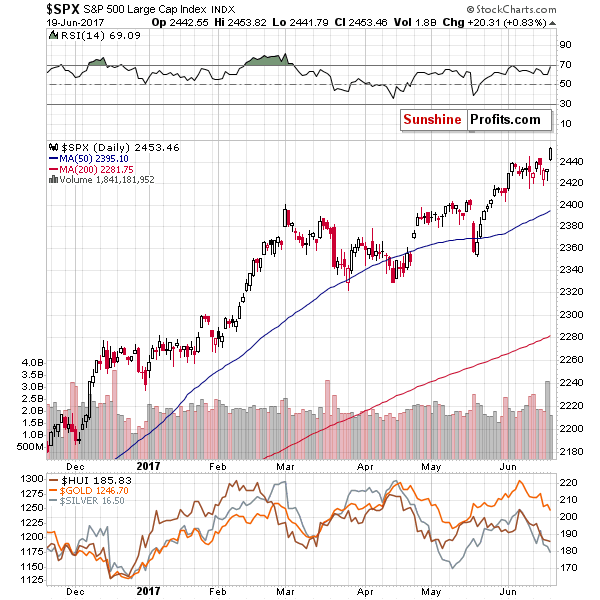

In short, that’s not likely. Miners had a very good reason to rally. The general stock market soared yesterday and mining stocks, being stocks themselves were positively affected by this development. This is something that happens quite often, but let’s keep in mind that this effect is usually temporary. Ultimately, the gold stocks’ profits depend on the price of gold and thus this is the key driver of the miners’ prices. Let’s see exactly how much the mentioned markets moved (chart courtesy of http://stockcharts.com).

The GDX ETF was down by 13 cents which is next to nothing. The volume was rather average and the entire session was yet another day of a post-decline pause.

Gold and silver both declined quite visibly, so the pause in mining stocks is no longer neutral by itself – it might appear bullish as the miners’ lack of decline despite gold and silver’s declines means that the former outperformed.

Likely Reason Behind Miners’ Strength

The action in the S&P 500 Index, however, makes the action in mining stocks neutral once again. The broad market moved sharply higher to new highs, which is both: important and very visible. Consequently, it’s no wonder that this tide lifted also the boat with mining stocks and the miners’ “strength” is therefore not a true sign of strength. This, in turn, means that there are generally no bullish implications of the mining stocks’ lack of decline, despite it might look so at first sight.

Summing up, the lack of decline in mining stocks doesn’t seem to have any bullish implications as miners had a very good reason for it in the form or a rallying stock market – the lack of decline in the former is therefore not a sign of strength and not a bullish development.

If you enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our gold newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up now.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.