Can The Dow Trade to 30K or is it Just Another Pipe Dream

Stock-Markets / Stock Market 2017 Jul 13, 2017 - 04:58 PM GMTBy: Sol_Palha

Insanity in individuals is something rare, but in groups, parties, nations, and epochs it is the rule. Friedrich Nietzsche

Insanity in individuals is something rare, but in groups, parties, nations, and epochs it is the rule. Friedrich Nietzsche

One group of experts state that the markets are ready to crash, another states the markets are ready to soar to new highs. Which group is one supposed to believe? For starters, the naysayers have the odds stacked against them as every so-called stock market crash has turned out to be a long-term buying opportunity. We view stock market crashes as once in a “lifetime buying opportunity” and frankly so should every self-respecting long term Contrarian investor. The smart money always swoops in and buys top quality stocks when there is blood on the streets, and the dumb money sells right at the bottom.

Therefore, our advice is that you should never listen to jackasses that continuously states that the market is going to crash, but instead the opposite comes to pass. Had you listened to almost all these experts, you would have been bankrupted several times over. What is even more disturbing is that stations like CNN continue to provide air time to these individuals despite their abysmal track record, clearly proving that you don’t have to know anything to be labelled a Financial Expert.

Here is a video of one expert who repeats the same theme year after year but fails to deliver

https://www.youtube.com/watch?v=PCJfbnyOrfw

Regardless of the Market, one needs to be cautious when so-called expert’s start issuing targets that seem to match the ravings of Ward 12 inhabitants. Now we have another expert who is stating that the Dow could trade to 30K; is this expert full of air too? Well, there are some notable differences. Schiller uses the word could and more importantly he has a track record to lean on:

It’s not very often that a Nobel Prize-winning economist who is known for his bearish calls turns extremely bullish. Last week, Professor Robert Shiller of Yale, who called the housing collapse ten years ago, proclaimed that stocks could rise another 50 percent in the next few years based on his latest research. Meaning Dow 30,000! That got the attention of many folks, especially the Wall Street analysts, many of whom don’t understand this market. Shiller accurately saw the housing bubble and predicted that it would end very badly, as it did. He also co-developed the S&P/Case-Shiller index, which is a benchmark for measuring housing prices around major US cities. What many may not know is that. Full Story

So what’s our take on this call?

Dow 30K could be a possibility and here’s why

The trend as per our trend indicator is still bullish and so higher prices are favoured

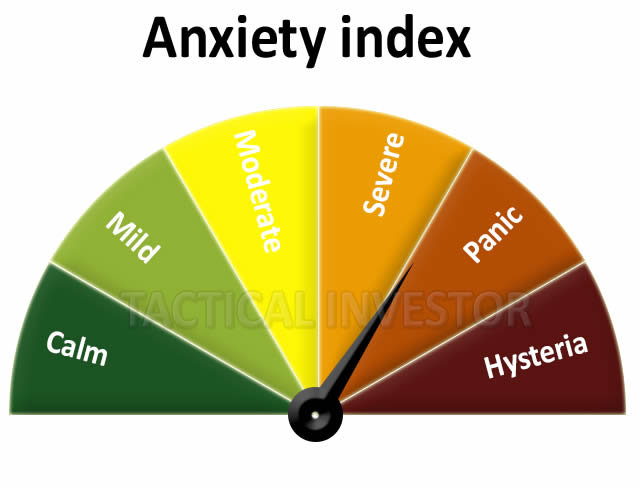

The masses based on our anxiety index and various other measures of market sentiment are still anxious. The Crowd has not embraced this bull market. Not once this year has the number of individuals in the bullish camp ever made it to the 60% mark. In fact, most individuals are opting for the neutral camp. No bull market has ever ended without the mass participation, and we don’t think this stock market bull will be any different. In fact, for the past several years we have gone on record to state that every major pullback should be viewed through a bullish lens.

The markets are extremely overbought and dying for a reason to let out a healthy dose of steam. We don’t think the Dow will trade to 30K without letting out a large dose of steam. We are not stating that the Dow will trade to 30K, but we have stated many times over the years that this bull market will trade to heights that would shock even the most ardent of bulls; that’s coming to pass as many bulls decided to throw the towel early in the year.

We tend to pay more attention to the SPX, and there is a case slowly building up for the SPX to trade to the 2900 -2950 ranges with a possible overshoot to the 3040 ranges. If the SPX moved to such levels, it could be comparable to the Dow trading to 30k. Keep in mind that no market trades in a straight line and the higher a market trends, the more volatile the ride becomes; expect a lot of volatility along the way up.

Having said that we need to state that our goal has never been to focus on absolute targets, instead, the focus is on the trend and market sentiment. If the trend is up, then we view strong pullbacks as buying opportunity and vice versa.

Every major bull market experiences at least one sharp to very strong correction, before topping out. This sharp correction provides astute players with an entry point for a spectacular rally that leads to the feeding frenzy stage; at this stage, the masses have finally decided it’s time to join the party, and then as they say the end is usually close at hand. After that, the market can experience a correction/crash ranging from 30%-50%.

A moment's insight is sometimes worth a life's experience.

Oliver Wendell Holmes

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2017 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.