Warning: The Fed Is Preparing to Crash the Financial System Again

Stock-Markets / Financial Crash Jul 21, 2017 - 04:46 PM GMTBy: Graham_Summers

Very few investors caught on to it, but a few weeks ago the Fed made its single largest announcement in eight years.

Very few investors caught on to it, but a few weeks ago the Fed made its single largest announcement in eight years.

First let me provide some context.

For eight years now, the Fed has propped up the stock market. In terms of formal monetary policy the Fed has:

· Kept interest rates at ZERO for seven years making money virtually free and forcing investors into stocks and junk bonds in search of yield.

· Engaged in over $3.5 TRILLION in Quantitative Easing or QE, providing an amount of liquidity to the US financial system that is greater than the GDP of Germany.

In terms of informal monetary policy, the Fed has consistently engaged in verbal intervention any time stocks came in danger of breaking down.

For eight years, ANY time stocks began to break through a critical level of support a Fed official appeared to issue a statement about future stimulus or maintaining its accommodative monetary policies.

Put simply, the Fed has invested tremendous capital (both literal and metaphoric) in maintaining the bull market in stocks. Indeed, at various points, both former Fed Chair Ben Bernanke and current Fed Chair Janet Yellen have pointed to elevated stock levels as indicating the “success” of Fed policy.

With that in mind, on June 27th 2017 the Fed sent a clear and coordinated signal that it is ready for the stock market to fall.

The signal was coordinated in that THREE senior Fed officials (Fed Chair Janet Yellen, Fed Vice-Chair Stanley Fischer and San Francisco Fed President John Williams) made formal statements on the very same day.

The signal was clear in that all three official referenced elevated stock levels/the fact that the stock market is ripe for a correction.

First was Fed Vice Chair Stanley Fisher who pointed our EXPLICITLY that stocks are extremely richly valued at current valuations.

Prices of risky assets have increased in most major asset markets in recent months even as risk-free rates also rose. In equity markets, price-to-earnings ratios now stand in the top quintiles of their historical distributions, while corporate bond spreads are near their post-crisis lows.

~Fed Vice-Chair Stanley Fisher

Source: Federal Reserve website.

This is an astonishing admission by the second most powerful official at the Fed. Fisher is literally admitting the market is richly valued based on earnings (fundamentals).

Then came San Francisco Federal Reserve Bank President John Williams (Janet Yellen’s most trusted advisor) who stated the following:

“The stock market seems to be running pretty much on fumes,” San Francisco Federal Reserve Bank President John Williams said in an interview carried on Sydney’s ABC News affiliate and available on the internet on Tuesday. “It’s something that clearly is a risk to the U.S. economy, some correction there — it’s something we have to be prepared for to respond to if it does happen.”

~ San Francisco Federal Reserve Bank President John Williams

Source: Reuters.

Yes, a senior Fed official, and one who has a direct line to Fed Chair Janet Yellen, stated that the stock market is running on “fumes.” This degree of bearishness from ANY Fed official is incredible. But for Williams to make a statement like this on the very same day that the Fed Vice-Chair pointed out that stocks are overvalued is like a six sigma event.

This is a CLEAR signal that the Fed is ready to let stocks fall from their lofty levels. But before anyone panicked, Fed Chair Janet Yellen appeared to assure us that the Fed stands ready to halt any financial crisis from occurring when the drop comes.

Fed Chair Janet Yellen said Tuesday that banks are “very much stronger” and another financial crisis is unlikely anytime soon…

She also made a bold prediction: that another financial crisis the likes of the one that exploded in 2008 was not likely “in our lifetime.” The crisis, which erupted in September 2008 with the implosion of Lehman Brothers but had been stewing for years, would have been “worse than the Great Depression” without the Fed’s intervention, Yellen said.

~Fed Chair Janet Yellen

Source: CNBC

If you wanted the Fed to provide the “all clear” that it is ready for stocks to fall, this is it. Yellen is openly stating that not only does she not expect a financial crisis in the near future… she doesn’t expect one to occur “in our lifetime.”

And bear in mind… all three of these speeches were given on the very same day.

This is a clear and coordinated campaign by the Fed to signal to the markets that it wants to deflate the stock market. It marks the first time in EIGHT years the Fed has been openly and publicly bearish on stocks.

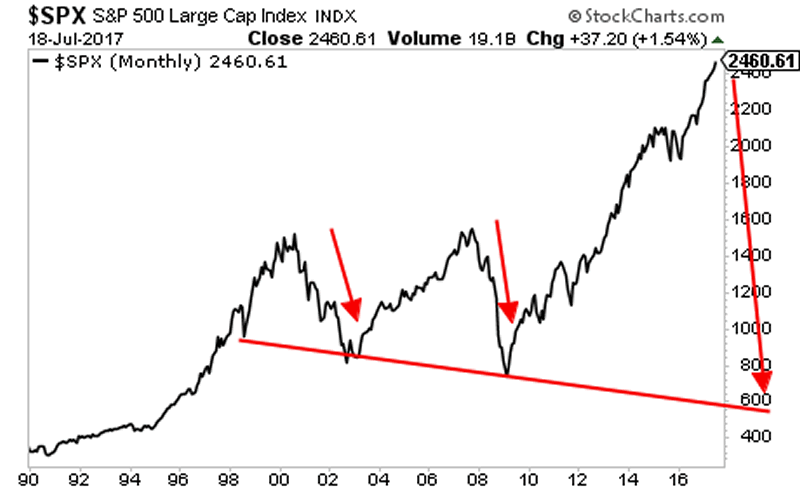

With that in mind, I believe the market rig that has been used to prop the markets up will be ending very soon. What’s next won’t be pretty.

A Crash is coming…

And smart investors will use it to make literal fortunes.

We offer a FREE investment report outlining when the market will collapse as well as what investments will pay out massive returns to investors when this happens. It’s called Stock Market Crash Survival Guide.

We extended our final offer on this report by 24 hours. But this is it. No more extensions.

Today is the last day this report will be available to the public.

To pick up one of the last remaining copies…

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2017 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.