Money Is Money, Wherever It Comes From

Currencies / Fiat Currency Jul 26, 2017 - 05:14 PM GMTBy: Raul_I_Meijer

One of the crucial things to understand about today’s world is that money is fungible. Whether it’s created in Japan, Europe, China or the US, once it’s tossed by a central bank into one or another part of the global economy, it eventually finds its way to a common pool of liquidity.

One of the crucial things to understand about today’s world is that money is fungible. Whether it’s created in Japan, Europe, China or the US, once it’s tossed by a central bank into one or another part of the global economy, it eventually finds its way to a common pool of liquidity.

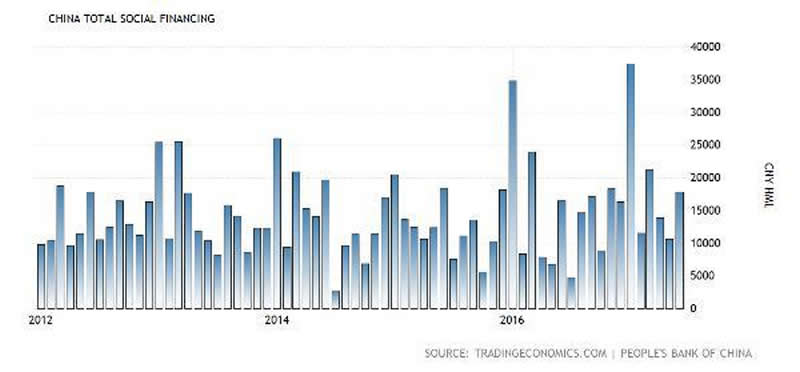

So the modest US tightening of the past year (100 basis point increase in the Fed Funds rate, slight decrease in Fed balance sheet) has to be seen in a global context. And that context is still insanely easy. Here, for instance, is China’s “social financing” – their term for total new debt:

This chart is in Chinese yuan, so it’s not immediately clear just how much borrowing is taking place. But converting to dollars yields a monthly average of about $250 billion, or $3 trillion per year. That’s a ton of new debt, much of which generates demand for raw materials from other countries, thus exporting Chinese inflation to the rest of the world.

The European Central Bank is, if anything, even easier. Here’s a brief excerpt from Doug Noland’s latest Credit Bubble Bulletin – which as usual should be read in its entirety by anyone who wants to understand today’s monetary insanity.

ECB chair Mario Draghi: “Inflation is not where we want it to be, and where it should be. We are still confident that it will gradually get there, but it isn’t there yet, and that’s why the Governing Council reiterated that the present very substantial monetary accommodation is still necessary…Now, the last thing that the Governing Council may want is actually an unwanted tightening of the financing conditions that either slows down this process or may even jeopardise it; and that’s why we retain the second bias, or let’s call it, reaction function. ‘If the outlook becomes less favourable or if financial conditions become inconsistent with further progress towards a sustained adjustment in the path of inflation, we stand ready to increase our asset purchase programme in terms of size and/or duration.’ And I think the Governing Council has given enough evidence that when flexibility is needed to achieve its objectives, it has been very able to find all that was needed. So that’s why we keep this bias.”

If central banks have become so keen to protect markets from risk aversion, why shouldn’t the cost of market “insurance” remain extraordinarily low. Why wouldn’t speculators gravitate to products fashioned to profit from providing myriad forms of market risk mitigation (hawking flood insurance during a drought)? And, importantly, as Bubble risks escalate, why would sovereign yields around the globe not discount the high probability that central banks will at some point be called upon to make good on their New Mandate – i.e. respond to faltering Bubbles with aggressive new QE programs with enormous quantities of bonds/securities to purchase?

Meanwhile, in Japan, a couple of central bank governors who are reportedly skeptical of hyper-easy money resigned and were replaced by people who were the opposite of skeptical:

Bank of Japan newcomers back 2% price goal

(Globe and Mail) – The two new members of the Bank of Japan’s policy board said on Tuesday that the central bank should continue efforts to achieve its 2 per cent inflation goal and it was premature to debate an exit from its massive monetary stimulus.Goushi Kataoka, a 44-year-old former economist at Mitsubishi UFJ Research and Consulting and an advocate of massive money printing, said he wants to see the price goal achieved quickly although he cannot say when that can be.

The other new board member, Hitoshi Suzuki, a 63-year-old former deputy president of Bank of Tokyo-Mitsubishi UFJ, who is well-versed with financial markets, said it was “dangerous” to markets to debate an exit from the stimulus now.

“There’s a considerable distance from the 2 per cent target. From my own experience of dealing with markets for 20 years, starting a debate on exit now would be dangerous to markets,” Suzuki told a joint news conference.

He added that the price target was a high goal but he wants to achieve it by any means.

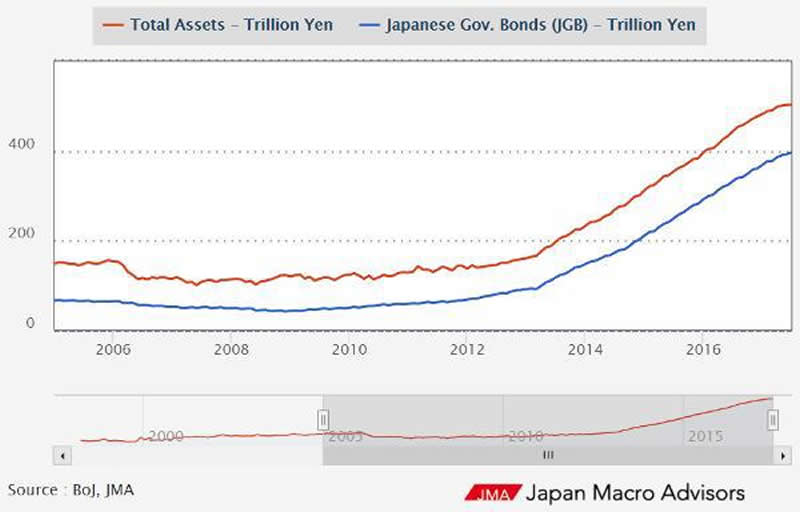

Here’s the recent increase in the BoJ’s balance sheet – which is another way of saying the amount of money the bank has created and released. Note that it has more than doubled in three years:

So what does all this mean? Here’s Noland’s conclusion:

There is no doubt that central bank liquidity backstops have promoted speculation, securities leveraging and derivatives market excess/distortions. I also believe they have been instrumental in bolstering passive/index investing at the expense of active managers. Who needs a manager when being attentive to risk only hurts relative performance? And the greater the risk associated with these Bubbles – in leveraged speculation, derivatives and passive trend-following – the more central bankers are compelled to stick with ultra-loose policies and liquidity backstops.

After all, who will be on the other side of the trade when all this unwinds? Who will buy when The Crowd moves to hedge/short bursting Bubbles? This is a huge problem. Central bankers have become trapped in policies that promote risk-taking, leveraging and hedging at this precarious late-stage of an historic Global Bubble. These days, central bankers cannot tolerate a “tightening of financial conditions,” and they will have a difficult time convincing speculative markets otherwise.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2017 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.