Platinum and Palladium Investment Potential

Commodities / Platinum Jul 28, 2017 - 03:29 PM GMTBy: Arkadiusz_Sieron

In the previous sections of this edition of the Market Overview, we presented the demand and supply outlook for platinum and palladium. In that part, we would like to analyze the potential benefits of adding these precious metals into investment portfolio.

In the previous sections of this edition of the Market Overview, we presented the demand and supply outlook for platinum and palladium. In that part, we would like to analyze the potential benefits of adding these precious metals into investment portfolio.

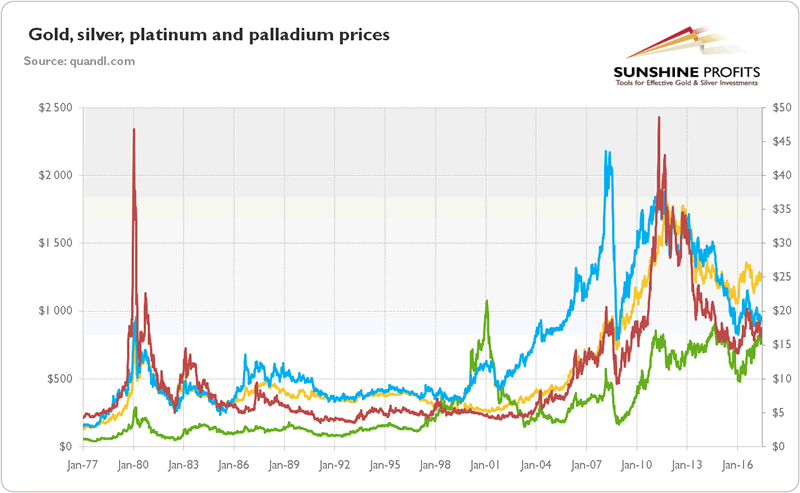

On the surface, platinum and palladium behave similarly to the yellow metal. Indeed, as the chart below shows, there is an important positive correlation between prices of these metals and gold. It should not be surprising as all four main precious metals – gold, silver, platinum, and palladium – are considered as currency, with an appropriate ISO 4217 code.

Chart 1: The price of gold (yellow line, Comex future price, weekly average), the price of silver (red line, right axis, Comex future price, weekly average), the price of platinum (blue line, Nymex future price, weekly average), and the price of palladium (green line, Nymex future price, weekly average).

Based on the 1977 – 2016 data, the correlation coefficient for gold and platinum is 0.87, while for the yellow metal and palladium it is 0.75 (for silver these coefficients are, respectively, 0.81 and 0.65). It implies a strong relationship between both these metals and gold. Interestingly, it’s stronger than the link between them, as the correlation coefficient for platinum and palladium is 0.72 (we use weekly averages here due to availability of consistent and comparable data, but the coefficients are similar for daily prices). Why should we add them to the gold portfolio, if they are not negatively correlated with the yellow metal?

First of all, since both platinum and palladium are industrial commodities – which are sensitive to the level of business activity (auto sales) and industrial demand – they can play an important and beneficial role in portfolio diversification (their prices are more correlated with the U.S. industrial production than gold). In particular, thanks to its industrial use, both white metals serve as a long-run inflation hedge. In good times, they should outperform gold, which behaves like a safe haven, shining during periods of uncertainty and turmoil. And it’s worth pointing out that the correlation between these two platinum-group metals and gold are still smaller than between gold and silver, which is above 0.9, hence investors could consider replacing part of their silver holdings with platinum-group metals. Indeed, it turns out that silver has significantly lower risk-adjusted return than platinum and especially palladium.

Moreover, both white metals are more volatile than gold, as has been perfectly seen in 2008 when platinum reached its peak, only to drop like a stone a few months later. Their relatively high volatility is the other side of the ability to diversify portfolios. However, investors should remember that one of the reasons of unpredictability is lower liquidity of white metals compared to gold.

To make it clear, we do not recommend abandoning gold and investing money in platinum and palladium instead. Quite to the contrary, we believe that the majority of precious metals portfolio should be allocated to gold – especially by investors who would like to minimize risk, as it was found in this paper – as gold is the best hedge against the stock market (according to this paper, platinum can help diversify a stock portfolio in the long-term, but not as well as gold, while palladium does not show such hedging ability). However, small additions of the platinum-group metals as portfolio diversifiers could enhance expected returns, being a smart move. There is no agreement what “small additions” exactly means, but most analysts would agree that platinum and palladium should never be more than 5 percent of one’s investment portfolio, while gold should be at least 10 percent.

Indeed, when we analyzed the weekly returns (based on the prices presented on the chart above), it turned out that gold has the lowest volatility measured by the standard deviation. Platinum (and silver) has similar expected return (about 0.15 percent per week), while being significantly more volatile. Meanwhile, palladium yields higher gains (about 0.24 percent per week), but at the expense of greater risk (the standard deviation of 4.70 percent against 4.44 percent in the case of silver, 3.56 percent in the case of platinum and 2.72 percent in the case of gold). Thus, risk-adjusted returns for both gold and palladium, are almost the same, while platinum loses in this respect (and silver looks even worse). Still, let’s keep in mind that the data period that we analyzed starts at 1977 – if we take into account the current bull market only (starting at 2001), we see that silver outperformed both: platinum and palladium.

Moreover, palladium has a weaker correlation with gold. It suggests that investors debating about platinum versus palladium should prefer the latter metal – financial analysis confirms our previous conclusions on the fundamentals of both white metals. Given the retreat of diesel technology in the automotive sector, palladium should outperform platinum in the long-run. Surely diesel will not disappear, but its dusk is very likely after the Volkswagen scandal and given that burning diesel produces nitrogen dioxide, the main cause of smog – this is why more and more cities in the world (Paris is the great example) are implementing measures against diesel vehicles. Therefore, taking all this into consideration, the investment potential of palladium seems to be greater than in case of platinum, although the current level of prices may limit it.

Finally, please note that the above does not take into account the possible (and likely) impact of the growth of electric cars in the future, including the use thereof in self-driving cars. The above could disrupt the demand for both platinum and palladium. That’s not something that’s going to happen this month or next, but it is something that one needs to keep in mind.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.