Diversify Into Gold On U.S. “Political Instability” Advise Blackrock

Commodities / Gold and Silver 2017 Aug 28, 2017 - 08:34 PM GMTBy: GoldCore

– Gold set to shine as Washington stumbles

– Gold set to shine as Washington stumbles

– “Bet on gold’s diversifying properties rather than political stability”

– World’s largest asset manager believes Trump and political drama in the U.S. means gold likely to rise

– Real rates flattening out and rising political instability – Blackrock’s Koesterich

– “For now my bias would be to stick with gold” – Blackrock

– U.S. debt ceiling issue to be fractious as bankrupt U.S. hits $20 trillion debt

– Investors will again turn to gold in coming political strife

“For now I would prefer to bet on gold’s diversifying properties rather than political stability” – Russ Koesterich, Blackrock.

Not for the first time this year, Blackrock’s Koesterich has spoken about his faith in gold during times of both financial and political instability.

Those times are now, the world’s largest money manager believes. Since the beginning of the year Koestrich has been adding to the gold position of the $39bn Global Allocation Fund. Gold is now the fund’s second-largest position.

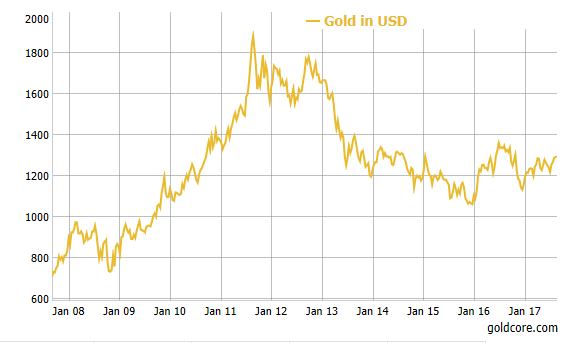

Gold’s performance, up 12% year-to-date, is particularly interesting. A hard-to-define asset, gold is often thought to perform best when either inflation and/or volatility is rising. This year has been notable for both falling inflation and record low volatility, raising the question: What is powering gold’s ascent and can it continue? Two trends stand out:

Real rates have flattened out

Political uncertainty has risen

Real rates – plateauing and boosting gold

Gold is most correlated with real interest rates (in other words, the interest rate after inflation), not nominal rates or inflation. While real rates rose sharply during the back half of 2016, the trend came to an abrupt halt in early 2017. U.S.10-year real rates ended July exactly where they began the year, at 0.47%. The plateauing in real yields has taken pressure off of gold, which struggled in the post-election euphoria.

Heightened political uncertainty

Koesterich said earlier this month that

“There has been a Pavlovian response by investors to disregard any piece of bad news or any spike in volatility, and that has been a very profitable strategy but we do think that there are risks in the world that are not being priced in.”

Currently there is heightened geopolitical risk across the world, with a focus on how the US will manage. Investors will no doubt be looking to reduce their risk exposure as events unfold between the US and North Korea as well as Venezuela’s chaos which shows no sign of dissipating.

The VIX index is often referred to as the ‘Fear Index’. Many believe this is a misnomer and does not portray what is really going on. The index has been trading at historically low levels. Apparently investors continue to bet that the index will remain low if money keeps pouring into markets and the global economy carries on improving.

Koesterich doesn’t think this will be the case. For him political risk has not yet been reflected in the markets.

Although market volatility has remained muted, albeit less so the past week, policy uncertainty has risen post-election (see the accompanying chart, above). This is important. Using the past 20 years of monthly data, policy uncertainty, as measured by the U.S. Economic Policy Uncertainty Index, has had a more statistically significant relationship with gold prices than financial market volatility. In fact, even after accounting for market volatility, policy uncertainty tends to drive gold prices.

To a large extent, both trends are related. Investors came into 2017 expecting a boost from Washington in the form of tax cuts and potentially infrastructure spending—resulting in the so-called “reflation” trade. Thus far neither has materialized. While economists can reasonably debate whether either is actually needed, lower odds for tax reform and stimulus have resulted in a modest drop in economic expectations. This, in turn, has caused a reversal in many reflation trades, a development that has allowed gold to rebound.

Going forward, gold’s performance may be most closely linked with what happens in D.C. Absent fiscal stimulus, the U.S. economy appears to be in a state of equilibrium: modest but stable growth. In this environment, gold should continue to be supported by historically low real rates and continued political uncertainty. Alternatively, if Congress does manage to enact a tax cut or other stimulus, we are likely to see some, albeit temporary, reassessment of growth and a corresponding backup in real rates, a scenario almost certainly negative for gold.

Conclusion – No crystal ball but stick with gold

Koesterich does not claim to ‘have any special insight into the Greek drama that is modern day Washington.’ But he is clear in his conviction that a ‘bet on gold’s diversifying properties rather than political stability’ is the way to trade right now.

Whilst Koesterich’s blog has made headlines and been featured on a range of sites, there should really be no surprise over his comments. All he is saying is that gold will continue to perform well thanks to a series of unknowns in the political and economic sphere.

It will act as a form of financial insurance and safe haven. This is no real news given history has demonstrated this as has the performance of gold in the last 10 years and as a hedge in the long term.

Most importantly the money manager is saying that he has little faith in the performance and abilities of the US government. In turn this means he is concerned for the strength of their currency and economy.

Individual savers and investors should take note – gold’s safe haven properties will be coming into their own as Washington continues to bicker and stumble.

Gold Prices (LBMA AM)

28 Aug: No LBMA prices today as UK holiday

25 Aug: USD 1,287.05, GBP 1,003.90 & EUR 1,090.90 per ounce

24 Aug: USD 1,285.90, GBP 1,003.26 & EUR 1,090.44 per ounce

23 Aug: USD 1,286.45, GBP 1,004.33 & EUR 1,091.68 per ounce

22 Aug: USD 1,285.10, GBP 1,000.71 & EUR 1,091.95 per ounce

21 Aug: USD 1,287.60, GBP 999.82 & EUR 1,096.52 per ounce

18 Aug: USD 1,295.25, GBP 1,004.34 & EUR 1,102.65 per ounce

Silver Prices (LBMA)

28 Aug: No LBMA prices today as UK holiday

25 Aug: USD 17.02, GBP 13.26 & EUR 14.40 per ounce

24 Aug: USD 16.93, GBP 13.20 & EUR 14.36 per ounce

23 Aug: USD 17.06, GBP 13.32 & EUR 14.48 per ounce

22 Aug: USD 17.02, GBP 13.27 & EUR 14.48 per ounce

21 Aug: USD 17.02, GBP 13.20 & EUR 14.48 per ounce

18 Aug: USD 17.15, GBP 13.30 & EUR 14.60 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.