Trump’s Path to IP Wars

Politics / Protectionism Sep 15, 2017 - 03:49 PM GMTBy: Dan_Steinbock

As the White House is about to escalate trade friction in intellectual property, it has opted for a flawed, partisan approach.

As the White House is about to escalate trade friction in intellectual property, it has opted for a flawed, partisan approach.

In mid-August, President Trump asked U.S. Trade Representative Robert Lighthizer, a veteran Reagan administration trade hawk, to open an investigation into China's intellectual property (IP) practices.

The first public hearing about Chinese trade conduct is scheduled for October 10 in Washington.

The White House IP narrative

As Lighthizer initiated the investigation, he seized the notorious Section 301 of the Trade Act of 1974, which in the 1980s was used against the rise of Japan and which Japan and the EU regarded as a violation of the rules of the World Trade Organization (WTO). Instead of free trade, it represents “aggressive unilateralism” and authorizes retaliatory tariffs.

Lighthizer draws from the highly partisan US Commission on the Theft of American Intellectual Property, which was mobilized in the early 2010s - amid the rise of China's indigenous innovation and foreign investment.

Relying on contested estimates, the Commission believes that IP theft amounts to $225-600 billion annually in counterfeit goods, pirated software, and theft of trade secrets. As a result, it advocates more aggressive policy enforcement “to protect American IP.”

Essentially, the US IP narrative claims that Chinese government forces US companies to relinquish its IP to China. The narrative is consistent with Trump’s “America First” stance and it has been quoted, referenced and echoed uncritically by media.

Nevertheless, it is deeply flawed.

The real IP narrative

While foreign companies in China are often warned not to part with “too much” in technology transfer and IP deals, they are not forced by the Chinese government or other interested parties into those deals.

Moreover, in contested legal cases, the Chinese government has often supported foreign companies. As the Wall Street Journal reported last year, when foreign companies sue in Chinese courts, they typically win. From 2006 through 2014, foreign plaintiffs won more than 80% of their patent-infringement suits against Chinese companies, virtually the same rate as domestic plaintiffs.

For years, foreign multinationals have effectively exchanged their technology expertise for market share in China. The rush of IP companies to China intensified a decade ago amid the global crisis, when the Silicon Valley giant Intel opened a $2.5 billion wafer fabrication foundry in Dalian, northeast China. As advanced economies struggled with stagnation, China continued to grow vigorously. So the bet proved very lucrative. At the time, Intel's chairman was Craig Barrett. Today Barrett is one of the five commissioners of the US IP Commission which portrays America as a victim of massive IP fraud.

Not surprisingly, some US observers see the Trump administration’s IP investigation as less a scrutiny of forced technology transfers than a negotiation ploy.

In reality, much of China’s IP progress can be attributed to past technology transfers and the government’s huge investment in science and technology. And as Chinese companies have moved up the value-added chain, they stress the need for IP protection, particularly patents.

Timing matters

Already in 2006, I noted in the prestigious US foreign policy journal The National Interest that emerging Chinese multinationals were “no longer satisfied with imitating. Instead, they seek to convert cost advantages to more sustainable competitive advantages—often through innovation.” At the time, few took the prediction seriously.

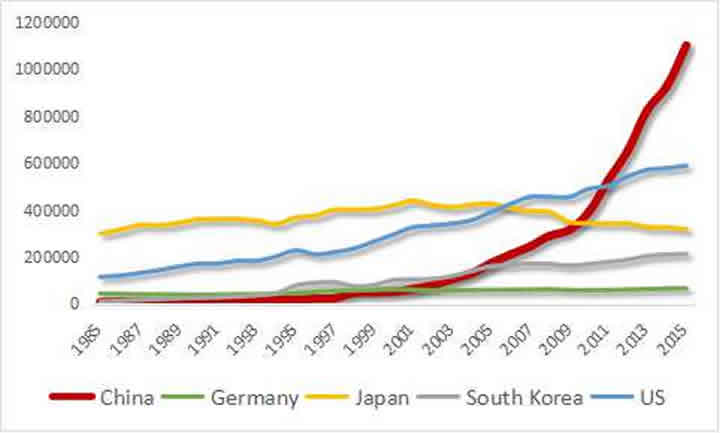

Typically, the Trump IP debacle is escalating as Chinese companies join the global rivalry for cutting-edge innovation. In terms of the number of total patent applications, China’s share has exploded. Two decades ago, it was far behind the US, Japan, South Korea and Germany; the world’s leading patent players. Now it is ahead of all of them (Figure 1).

Figure 1 Total patent applications, 1985-2014 (WIPO)

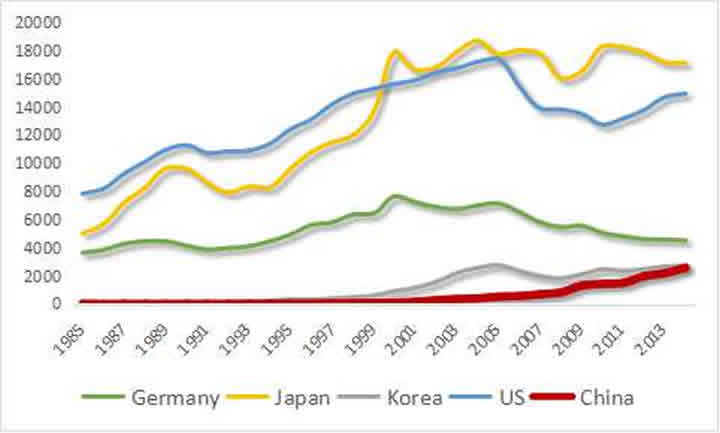

But in these rivalries, not all patents are of equal value. The so-called triadic patents, which are registered in the US, EU, and Japan to protect the same invention, tend to be the most valuable commercially and globally.

In triadic patents, too, China’s patent power has increased dramatically and will surpass that of Korea and Germany soon. The patents of Japan and the US peaked around 2005-6. Despite some progress, US patents are still 15% below their peak, whereas those of China have increased more than sixfold in the past decade (Figure 2).

Figure 2 Triadic Patent Families, 1985-2014 (OECD)

Since patent competition is accumulative, catch-up requires time. But here’s the thing: If, for instance, US and Chinese triadic patents would increase in the future as they have in the past five years, China could surpass the US by the late 2020s. And perhaps that’s why Trump is targeting China’s IP today.

However, neither innovation nor intellectual property are an exclusive privilege of the West.

Dr Steinbock is the founder of the Difference Group and has served as the research director at the India, China, and America Institute (USA) and a visiting fellow at the Shanghai Institutes for International Studies (China) and the EU Center (Singapore). For more information, see http://www.differencegroup.net/

© 2017 Copyright Dan Steinbock - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.