The Koyaanisqatsi Economy

Economics / Economic Theory Sep 28, 2017 - 05:05 PM GMTBy: Raul_I_Meijer

The film Koyaanisqatsi was released in 1982. The title means ‘life out of balance’ in the language of the Hopi, a Native American tribe who live(d) mainly in what is now north-east Arizona. It is directed by Godfrey Reggio with music by Philip Glass and cinematography by Ron Fricke. There are no actors, and no dialogue. Philip Glass’s music underlies a series of film fragments that contrast the beauty of American nature with the noise and pollution mankind has added to it. Wikipedia:

The film Koyaanisqatsi was released in 1982. The title means ‘life out of balance’ in the language of the Hopi, a Native American tribe who live(d) mainly in what is now north-east Arizona. It is directed by Godfrey Reggio with music by Philip Glass and cinematography by Ron Fricke. There are no actors, and no dialogue. Philip Glass’s music underlies a series of film fragments that contrast the beauty of American nature with the noise and pollution mankind has added to it. Wikipedia:

The film consists primarily of slow motion and time-lapse footage of cities and many natural landscapes across the United States. The visual tone poem contains neither dialogue nor a vocalized narration: its tone is set by the juxtaposition of images and music. Reggio explained the lack of dialogue by stating “it’s not for lack of love of the language that these films have no words. It’s because, from my point of view, our language is in a state of vast humiliation. It no longer describes the world in which we live.”

Due to its initial success, Reggio and Glass made two sequels to the film, Powaqqatsi (1988), meaning “parasitic way of life” or “life in transition”, and Naqoyqatsi (2002) which means “life as war”, “civilized violence” and “a life of killing each other”. If you haven’t seen them, they come highly recommended.

Koyaanisqatsi is an fitting term to describe not only our world in general, but also our economies. They are severely out of balance, and getting more so every day. But economies, like nature, need at least a minimum in balance. If that disappears, this lack of balance will tip them over. It is somewhat strange that this is not being recognized, and not even discussed.

It’s as if people think that when almost all wealth goes to a select very few, an economy can still continue to function. It can’t. The rich getting continually richer means the poor getting poorer (as overall growth is slow or non-existent), until the latter reach a point where they can no longer afford even basic necessities. That’s when parts of an economy will start dying, in the same vein that parts of a living body, an organism, die off when the supply of blood, nutrients and oxygen is cut off.

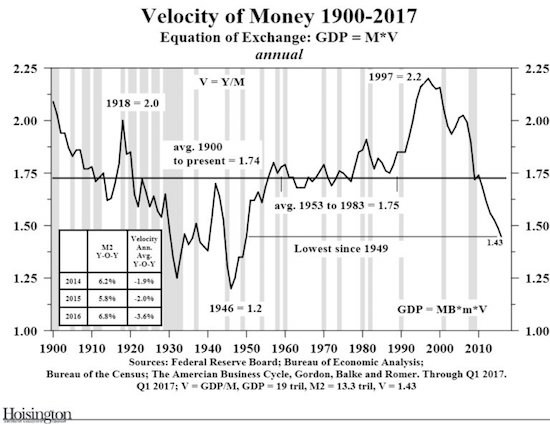

For an economy to function, it needs money to flow through it the same way a body needs blood to flow. If all the money gets increasingly concentrated in just a small area, the economy stagnates. We measure the flow of money as velocity:

If that graph would describe a human body, it would be in an ambulance on the way to ER. The only times velocity of money have been as low as today was during a Great Depression and a World War.

The ever richer rich cannot spend enough to keep things moving. They can buy stocks and bonds and houses, but they can’t buy all the groceries and clothing that the poor and middle class no longer can. But it’s those things that keep the economy humming along.

An economy as unbalanced as the one we presently have is bound to perish. The rich are killing their own economies by trying to get richer all the time. And they have no idea that’s what happens. It’s sort of baked into their understanding of what capitalism is. Or neo-liberalism if you want.

We should look upon, and handle, our economies and societies as living, and vibrant, systems, but we’re miles away from any such understanding. Our education systems are gross failures when it comes to this, and our media, owned by the rich, support anything that will make them richer. Even though that is suicidal for everyone involved. We are a tragic species in many more ways than one.

This has nothing to do with political views, with socialism or communism or any ism, it’s a simple empirical observation. It’s not about ‘everyone deserves their fair share’, but about if they don’t get their share, no economy will be left to hand out any shares even to the rich. If the rich want to get richer, they will need a functioning economy to get there.

In other words, someone will have to call a halt, or at least a pause, to the pace at which they’re getting richer, or their quest for riches will become self-defeating. Literally every single human being can grasp this, but hardly anyone even considers it. At their peril.

Here’s just a small example from CNBC, there are thousands just like it:

The Top 1% Of Americans Now Control 38% Of The Wealth

America’s top 1% now control 38.6% of the nation’s wealth, a historic high, according to a new Federal Reserve Report. The Federal Reserve’s Surveys of Consumer Finance shows that Americans throughout the income and wealth ladder posted gains between 2013 and 2016. But the wealthy gained the most, driven largely by gains in the stock market and asset values. The top 1% saw their share of wealth rise to 38.6% in 2016 from 36.3% in 2013.

The next highest 9% of families fell slightly, and the share of wealth held by the bottom 90% of Americans has been falling steadily for 25 years, hitting 22.8% in 2016 from 33.2% in 1989. The top income earners also saw the biggest gains. The top 1% saw their share of income rise to a new high of 23.8% from 20.3% in 2013. The income shares of the bottom 90% fell to 49.7% in 2016.

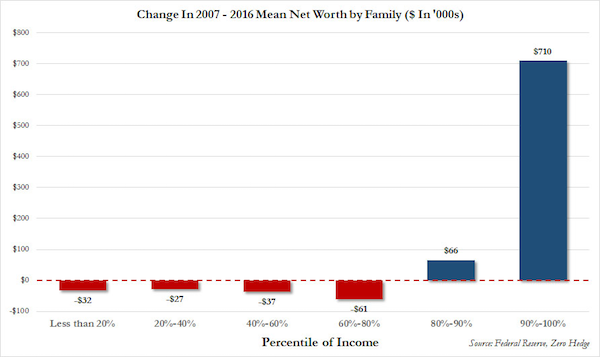

Now, you may think: 38%, how bad is that?, and you may be forgiven for thinking that way. After all, you’re in a majority there. To understand the severity of what’s happening, you need to look at the trends:

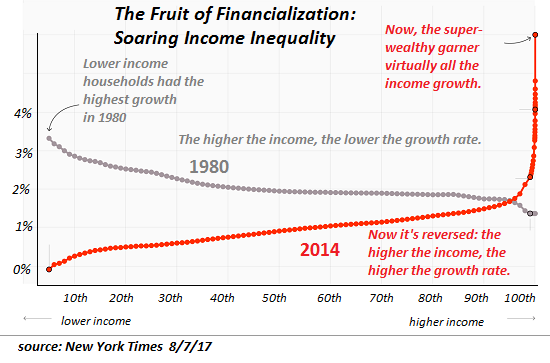

This one from the New York Times, annotated by Charles Hugh Smith, is very revealing too. What happens is that just as we find ourselves in a stagnating/shrinking economy, the rich get richer fast. They can do that because central banks are releasing trillions of dollars in QE, but also because the system is geared towards eviscerating the poor, and increasingly the middle class as well:

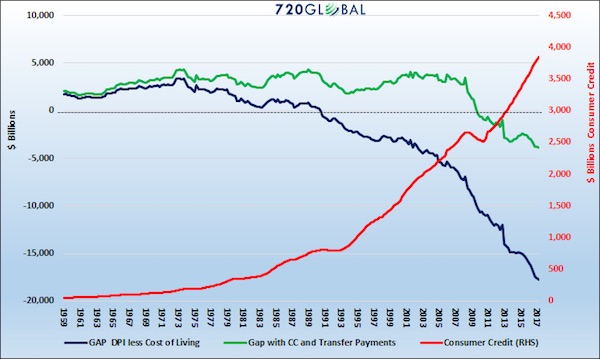

And this is amplified by the ultra-low rates policies central banks have been pushing over the past decade. They allow for the ever poorer to keep up appearances of wealth by plunging into debt ever deeper, but they don’t allow for their living conditions, their jobs, their savings, their pensions, to recover. They do the exact opposite. As this graph from Mike Lebowitz, one of many to show the same trendline, goes to show:

This is not an American phenomenon, though it’s more pronounced stateside. And Trump’s tax reform plans promise to only make it worse. It looks like Bernie Sanders might be the only politician in the US to stop it, but what are the odds of that? We live in a system that is warranting economic suicide for everyone including its own proponents, and we’re blindly following it like so many lemmings.

The Koyaanisqatsi film doesn’t have a happy Hollywood ending, and it makes no pretense of it. Our Koyaanisqatsi economy will not end with ‘they lived happily ever after’ either. The protagonists wouldn’t know how to achieve that. They don’t understand what makes an economy run, and keeps it running.

And they don’t want to understand, because they think it’ll make them less rich. Nobody gives balance a second’s thought. Presumably because they think the system, like nature, will eventually balance itself. And they’re right in that. They just haven’t considered what that balancing act might mean for them personally.

if you’re rich, good on you. But don’t forget what made it possible for you to gather your riches, or you’ll lose them, and probably a lot more too.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2017 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.